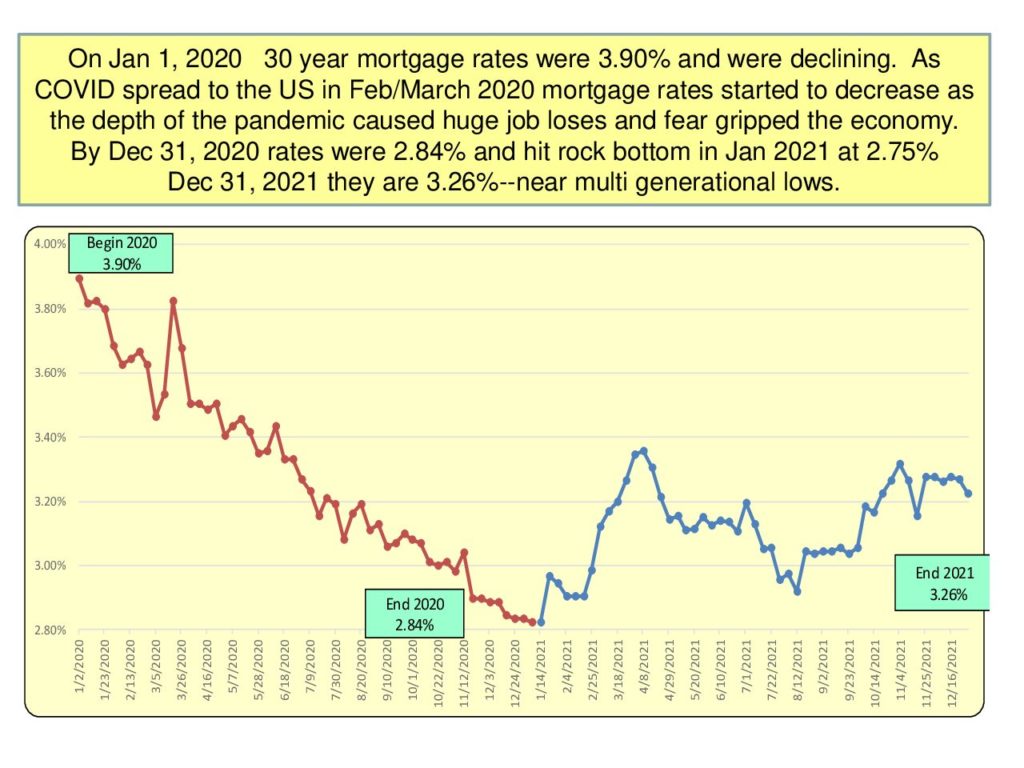

Covid-19 and Mortgage Rates

At the start of 2020, mortgage rates were trending downward, and the COVID-19 pandemic has only helped to accelerate that trend. Mortgage rates are at their lowest in a generation.

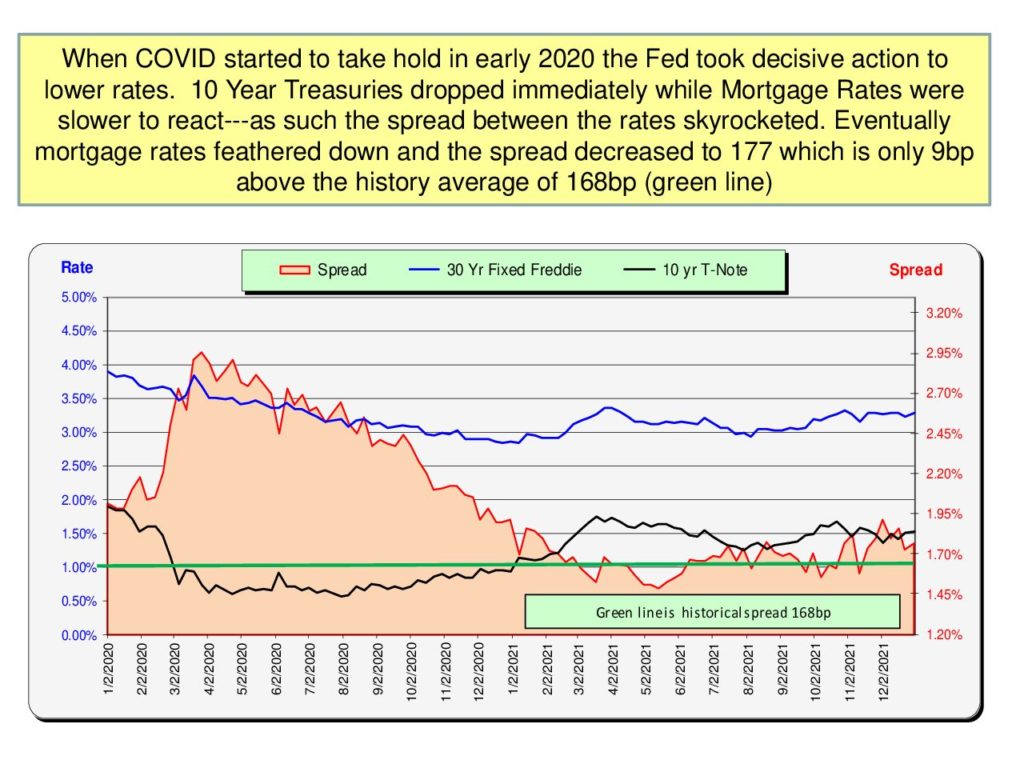

Mortgage Spread and US Treasuries

While the 10-year Treasury note traded under 1% for much of 2020, The interest rate spread between the 10-year treasury and conforming/conventional mortgages are now well within historic normal levels of 2%. Treasury rates started to decline and mortgage rates did not follow.

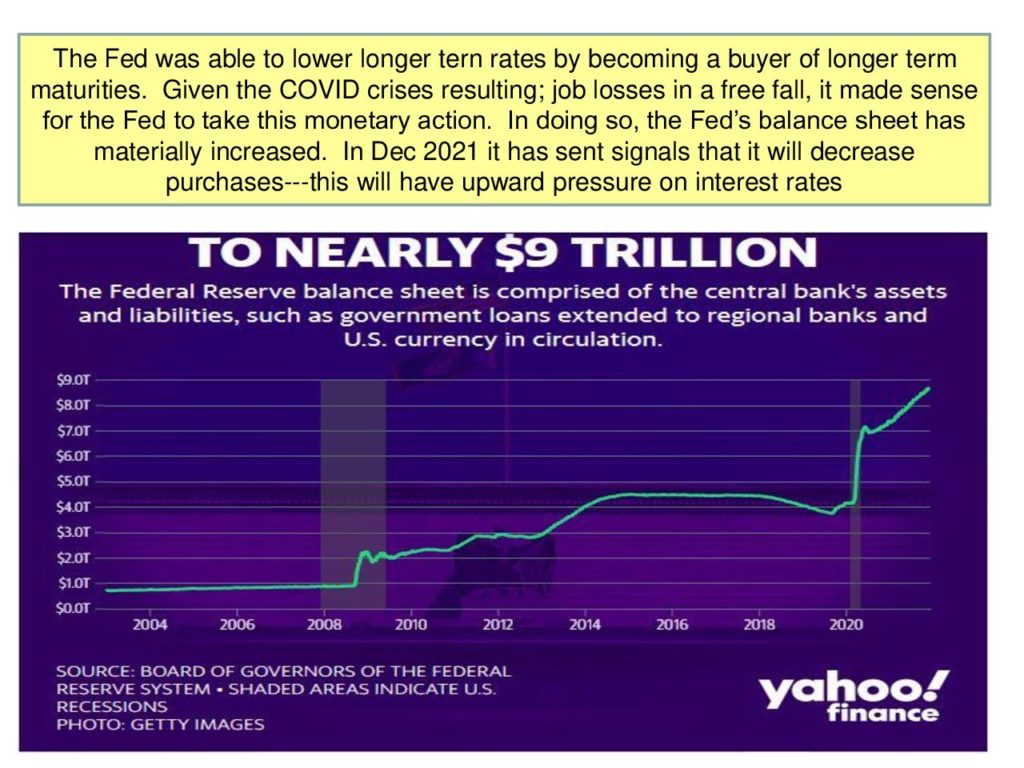

Job Loss and Federal Debt

The Feds responded to the Covid-19 crisis in two ways. First, by pushing the federal funds rate lower and by increasing its purchase of mortgage-backed securities, two moves that drove interest rates lower and freed up more money for lending. These actions were taken due to the unprecedented job losses the country was incurring during April – June of 2020. The Fed’s balance sheet holdings of debt surged and are at record levels.

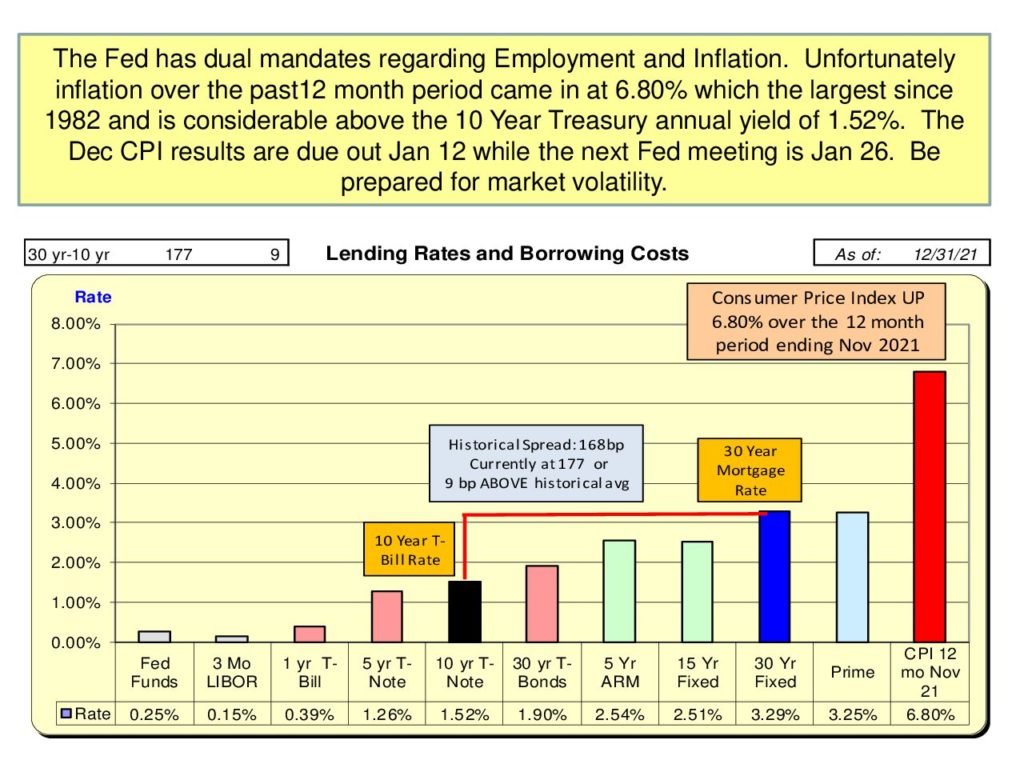

Spread vs. CPI

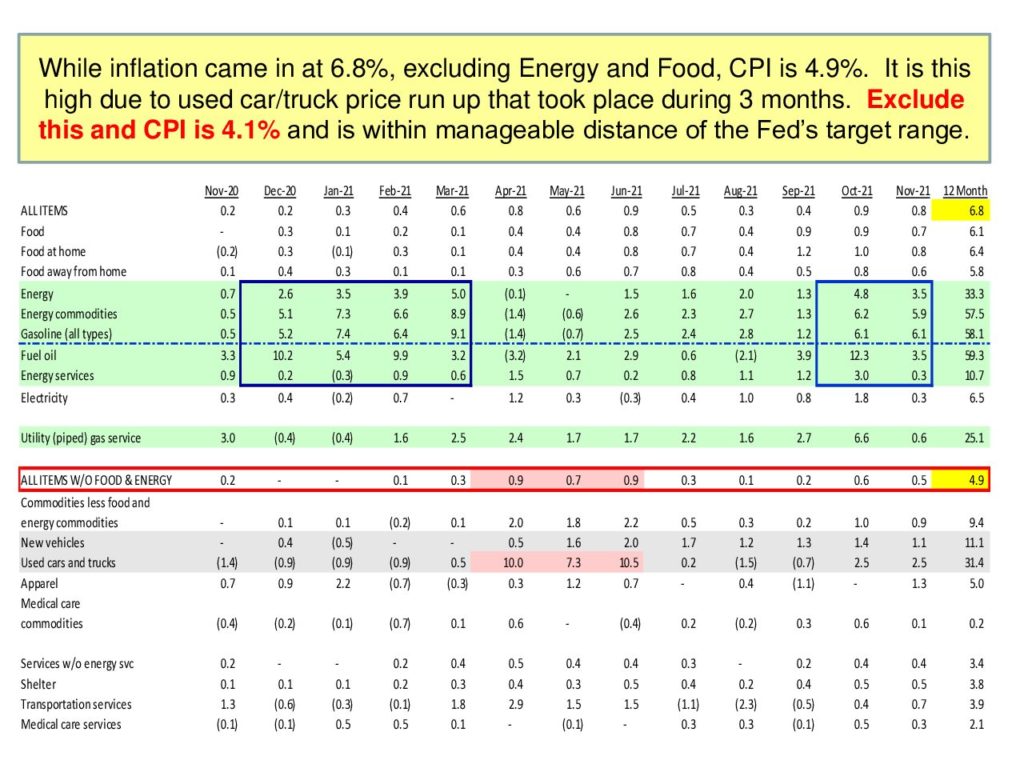

While the Treasury Inflation-Protected Securities (TIPS) spreads are normal, what has materially increased is inflation as measured by the consumer price index (CPI).

A review of the CPI reveals that a substantial portion of the inflation has been incurred in very specific sectors of the economy.

For the Fed so much is about expectations and anticipation of the future. With the job market improvements, the Fed will have more latitude to deal with inflation by decreasing their balance sheet which will put upward pressure on interest rates.

Inflation Fight and the Feds

The optics of the Federal Reserve in fighting inflation will be important. One way to do this is to increase the Fed Funds rates directly. By August 2022 the monthly non-recurring factors that are contributing to currently high CPI annual levels will have worked themselves through and as such, without additional inflation shocks, the annual CPI calc will decrease.