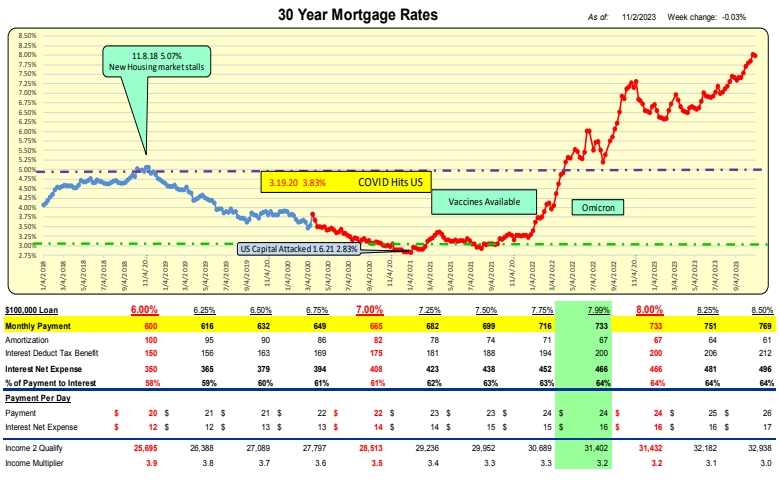

For the week ending 11.02.2023, mortgage rates decreased 3bp to 8.02%.

For a $100,000 loan, the monthly payment decreased $2 to $735/mo or $0.10/day.

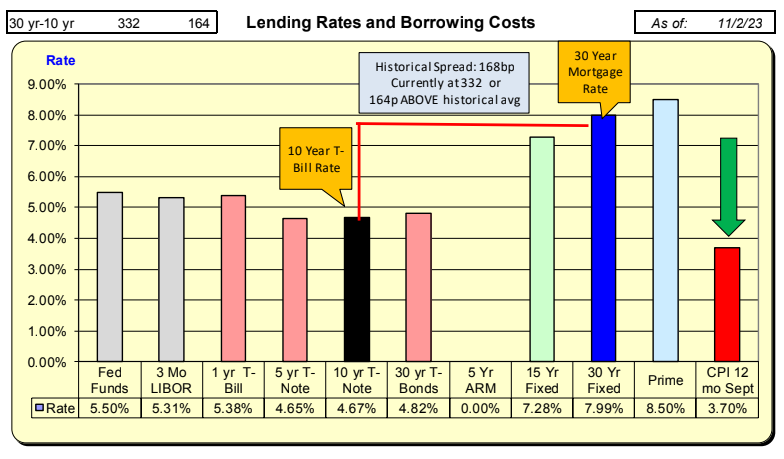

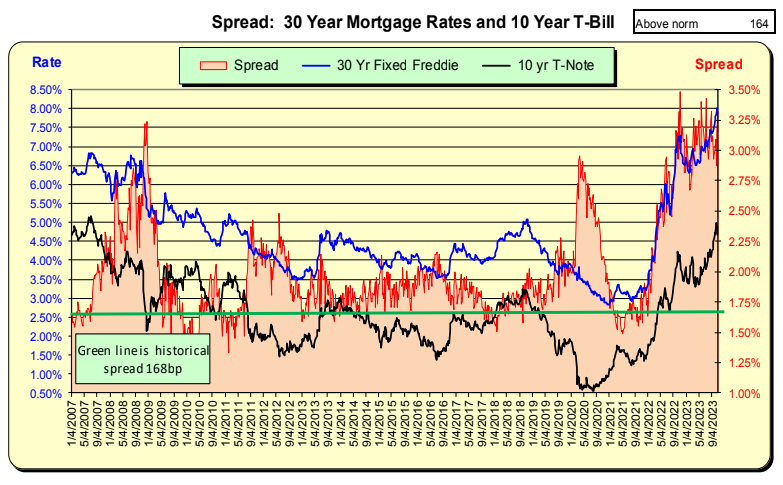

Mortgage rates decreased 3bp, while the 10-Year Treasury rates decreased 19bp for the week ending 11.02.23. The net difference resulted in a 16bp increased in the spread to 332bp. With the historical spread being 168bp, there now exists a ‘safety cushion’ of 164bp above the historical spread.

The historic spread between the 10-Year Treasury and mortgage rates is 168bp (see green line, right axis), and currently, it is 164bp above the historical norm.

Bill Knudson, Research Analyst LANDCO ARESC