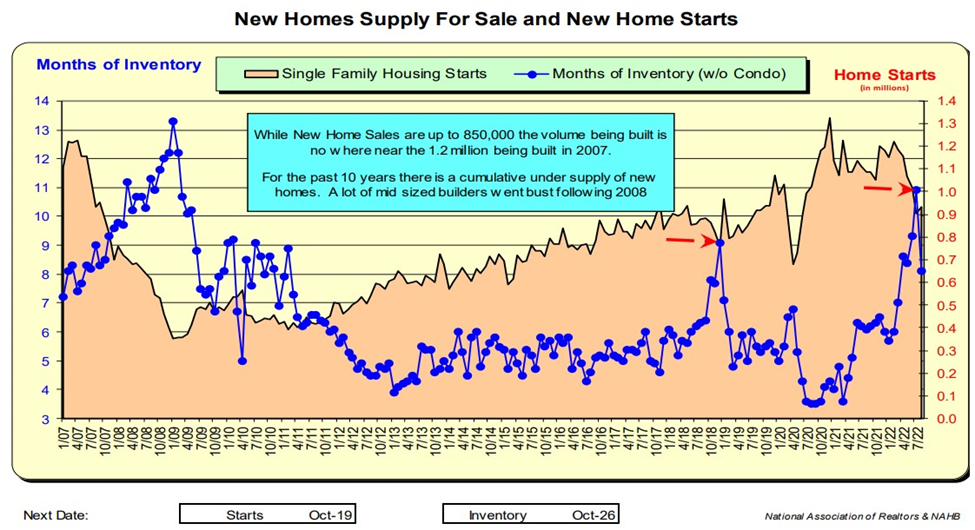

As new home sales spiked in August, months of inventory dropped. Speculation as to why the increase in buying New homes buyers could be anticipating mortgage rates will go even higher, so they are purchasing now before rates increase further.

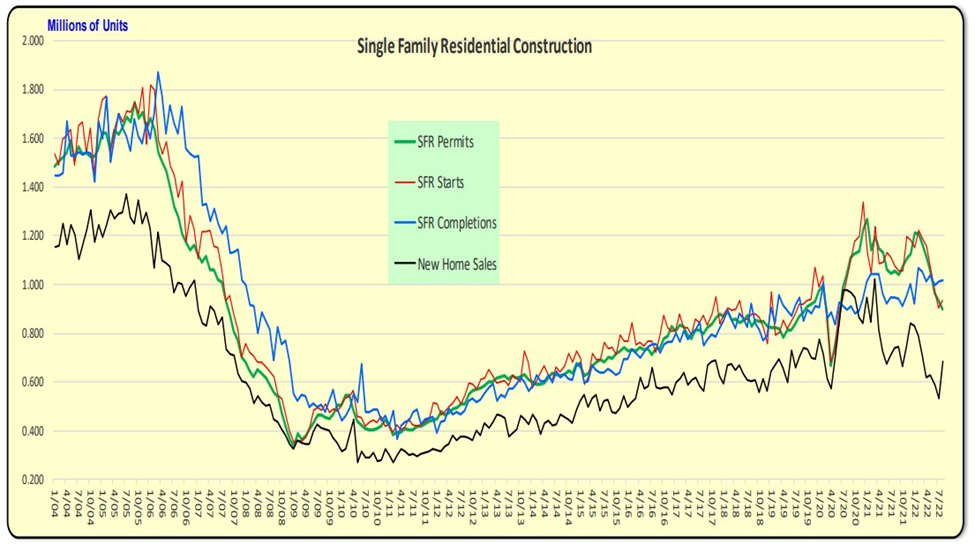

Builders have pulled back on permits and new construction starts, while they continue to build out inventory in their construction pipeline. Importantly there does not appear to be a build-up of newly constructed homes for sale.

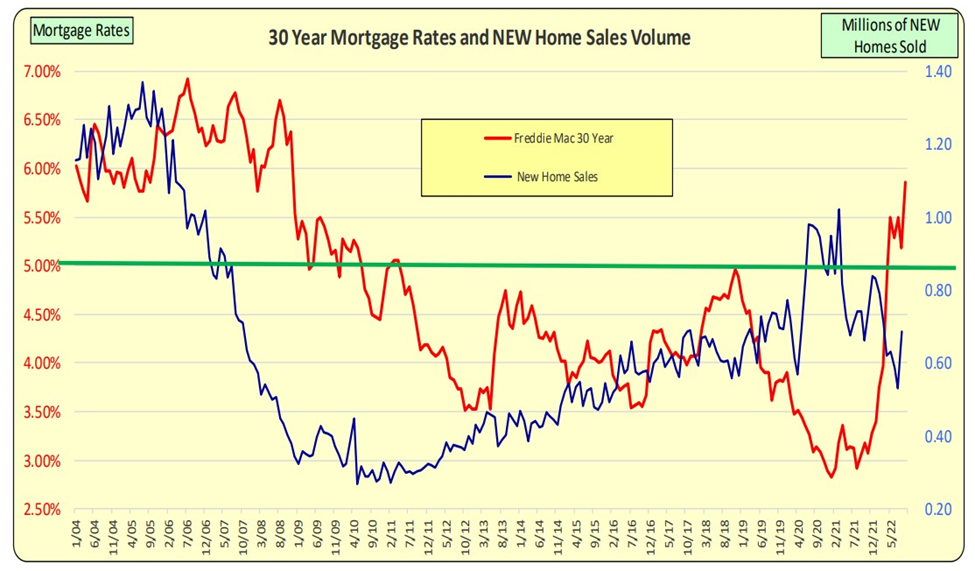

When Covid-19 began in March of 2020, Mortgage rates declined to record lows of 3.00% thru February of 2021. This brought forward buying demand. But when rates started to rise, the demand lessened. Like in November 2018 when mortgage rates reached 5.00% and NEW home sales materially decreased, in 2022 when mortgage rates breached 5.00% sales immediately declined. However, In Aug 2022 sales spiked 29% over the prior month, perhaps anticipating much higher mortgage rate increases.

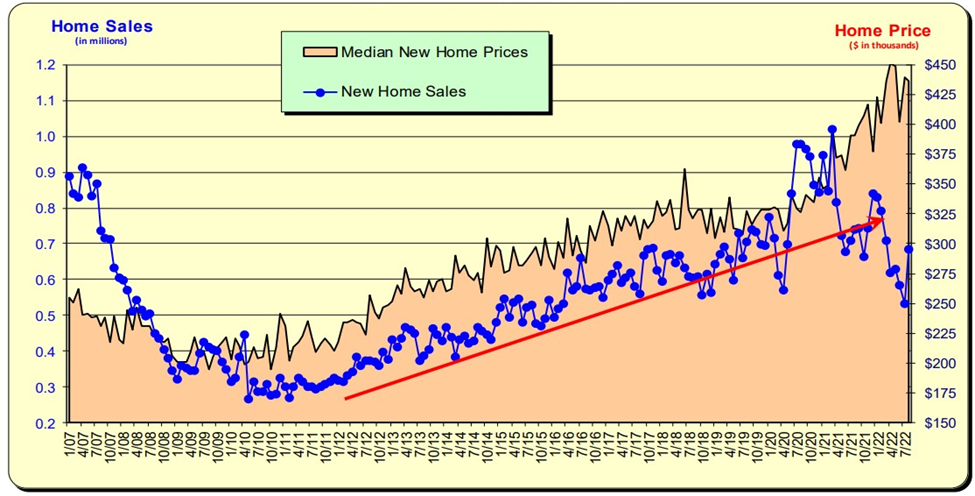

New Home Sales and Prices

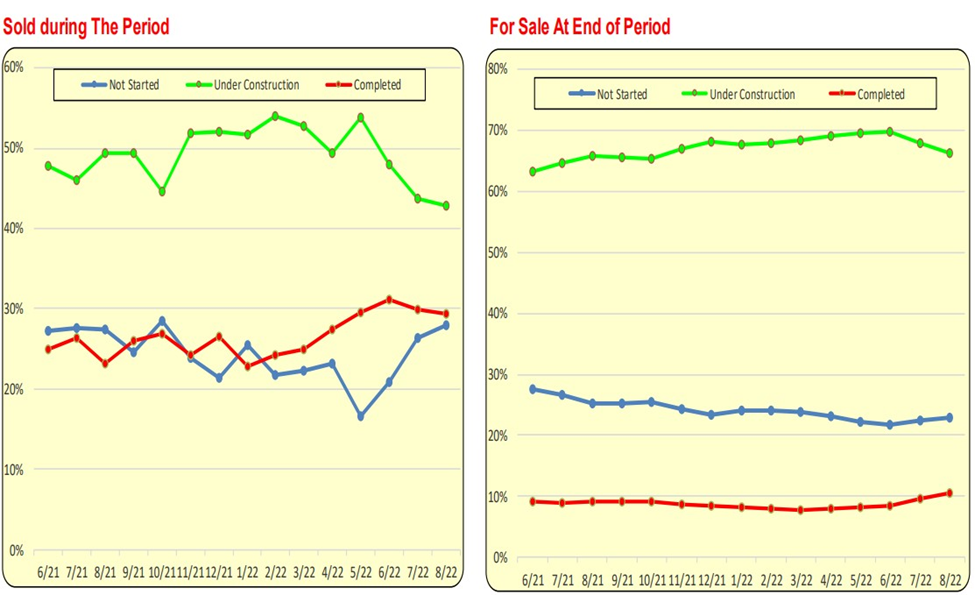

Over the past year, ~50% of the NEW homes sold were homes that were under construction, and <25% were completed homes. This implies there is not a lot of standing inventory available for sale. A key metric to monitor is the red line in the lower right corner. If that rises, it implies excess inventory is occurring.

In the past, when mortgage rates increased, sales of new homes have slowed causing the New Home Sale’s Months of Inventory to spike. Note the mortgage rate spikes in Nov 2018 and April 2022—which exceeded 5.00% this is a major price point for Millennials. The run-up in rates in 2022 is unprecedented and is headed to over 7.00%.

NEW home Permits, Starts, and Completions reveal how home builders have pulled back on and are completing homes under construction. The blue line will decrease in the future. Recent decreases in Permits and Starts will lead to future decreases in Completions. A key metric to watch is how fast will completions slow relative to sales. With fewer completions, sales will decrease.

When COVID first appeared in the US, new home sales initially dropped and then sharply rebounded as mortgage rates hit multi-generation lows of 3.00%. With a sudden surge in sales, months of inventory dropped (blue line). When mortgage rates rose in early 2021, sales pulled back and months of inventory returned to levels that prevailed prior to COVID It is important to note the large increase in Months of Inventory that occurred in November 2018. That is when Mortgage rates reached 5.00% and sales slumped. On April 14, 2022, rates exceeded 5.00%. Sales spiked in Aug 2022—rate buydowns? Fear of future rate hikes? Months of inventory dropped.

Bill Knudson, Research Analyst Landco ARESC