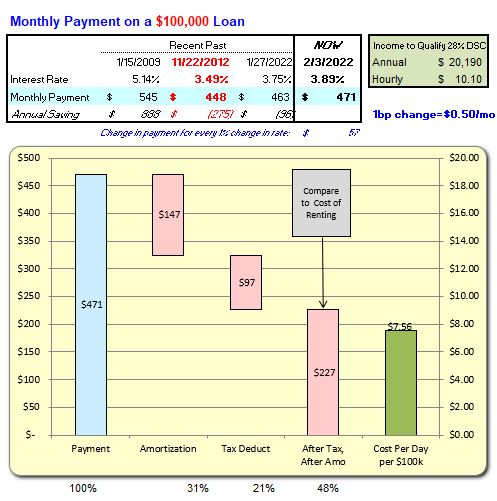

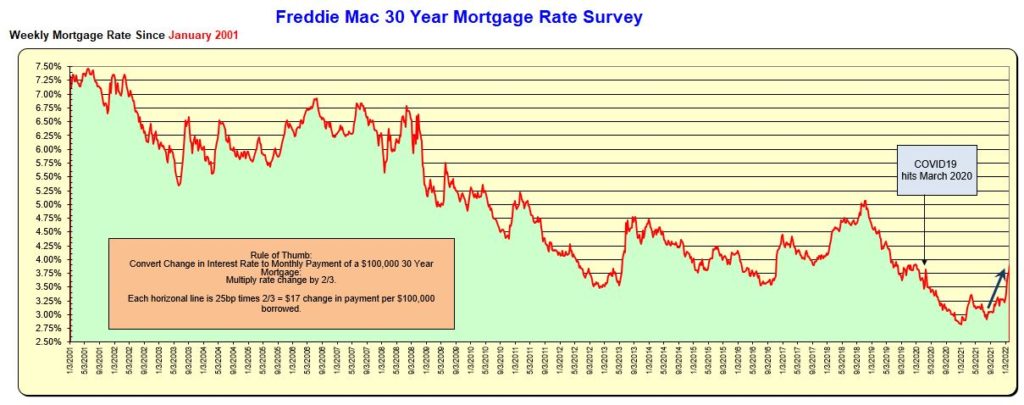

Following the rise in U.S Treasuries last week, 30-Year Mortgage rates increased 14 basis points (0.14%) to 3.89% for the week ending 2.11.22. For a $100,000 loan the payment increase went from $463 to $471. This was BEFORE the Consumer Price Index announcement of 2.10.22.

Mortgage rates are on an upward trajectory and at levels that prevailed before COVID-19’s impact on the country in March 2020.

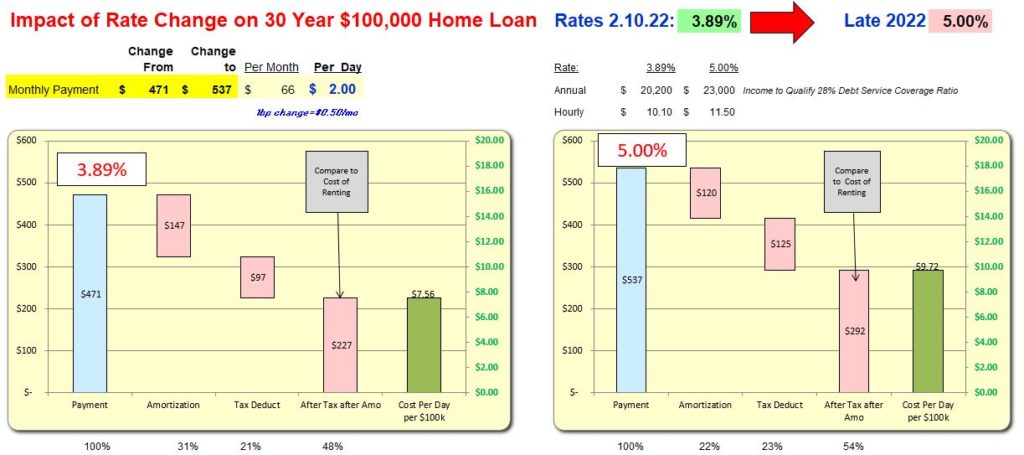

With unemployment at low levels and inflation on the rise, the Federal Exchange will likely begin increasing interest rates. The Fed’s next meeting is on March 15th. It’s possible that they may raise rates before then. Given current projections, mortgage rates may rise to 5% later this year.

This would cause payments to increase from $471 to $537 or about $2/day per $100k borrowed. The amount of the loan going to amortization would decrease from 30% to 22% of the payment. Note that the amount of income to qualify for a loan increased from $20,200 to $23,000. This will have a SEVERE impact on first-time home buyers. Loan balance to Income will decrease from a 5:1 ratio to ~4:1