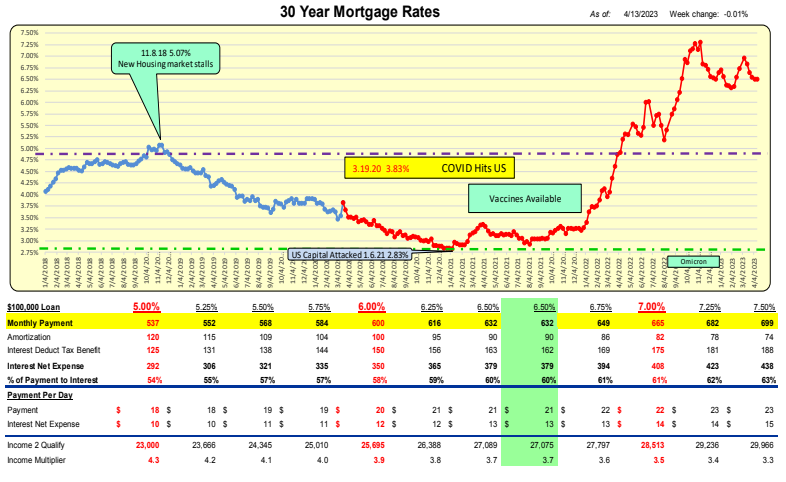

For the week ending 4.13.23, mortgage rates decreased 1bp to 6.50%. For a $100,000 loan, the monthly payment decreased by $1 to $632/month or $0.02/day.

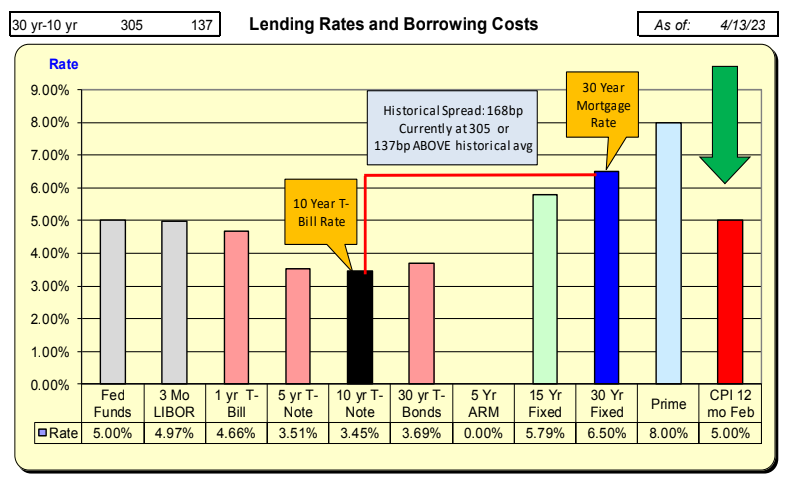

Mortgage rates decreased 1bp, and 10-year Treasury rates increased 15bp. The net difference resulted in a decrease of 16bp in the spread to 305bp. With the historical spread being 168, there now exists a ‘safety cushion’ of 137bp above the historical spread.

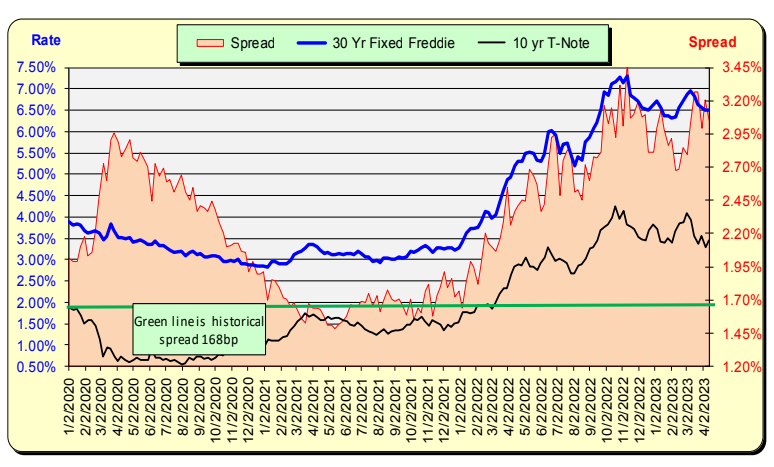

The historic spread between the 10-Year Treasury and mortgage rates is 168bp (see green line, right axis), and currently, there is 137bp above the historical norm. For this spread to return to the historical norm, either mortgage rates will need to decrease further or 10-Year Treasury rates will need to increase. The last time spreads were this large (Nov 10, 2022), mortgage rates decreased by 100bp over the following 12 weeks.

Bill Knudson, Research Analyst LANDCO ARESC