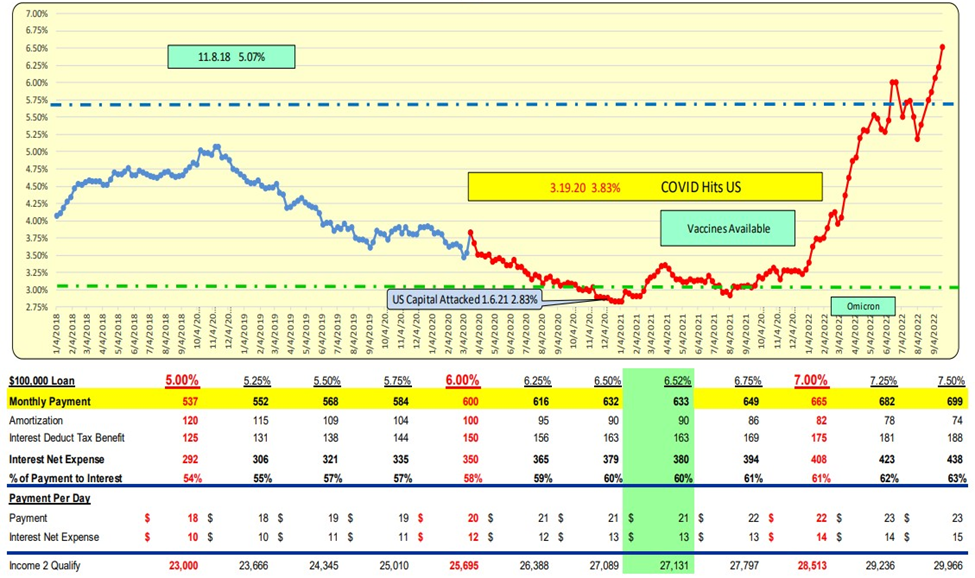

Mortgage rates are back on the rise today. Borrowers looking for a 30-year fixed-rate mortgage will find rates over 6.52%.

30-Year Mortgage Rates

Mortgage rates INCREASE 30 bps to 6.52% for the week ending September 22, 2022. To put that in context, for a $100,000 loan, the monthly payment INCREASED by $19 to $633/mo. or $0.64/day.

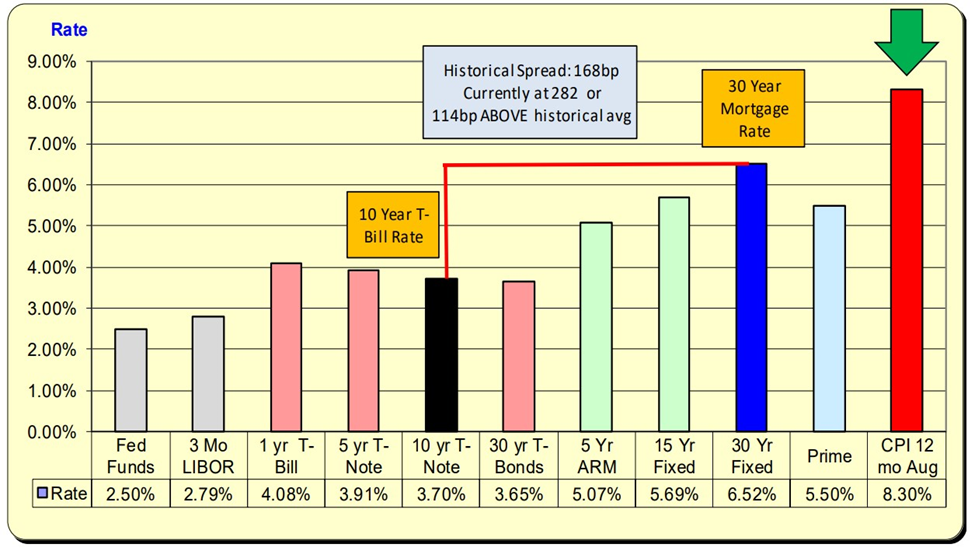

Lending Rates and Borrowing Costs

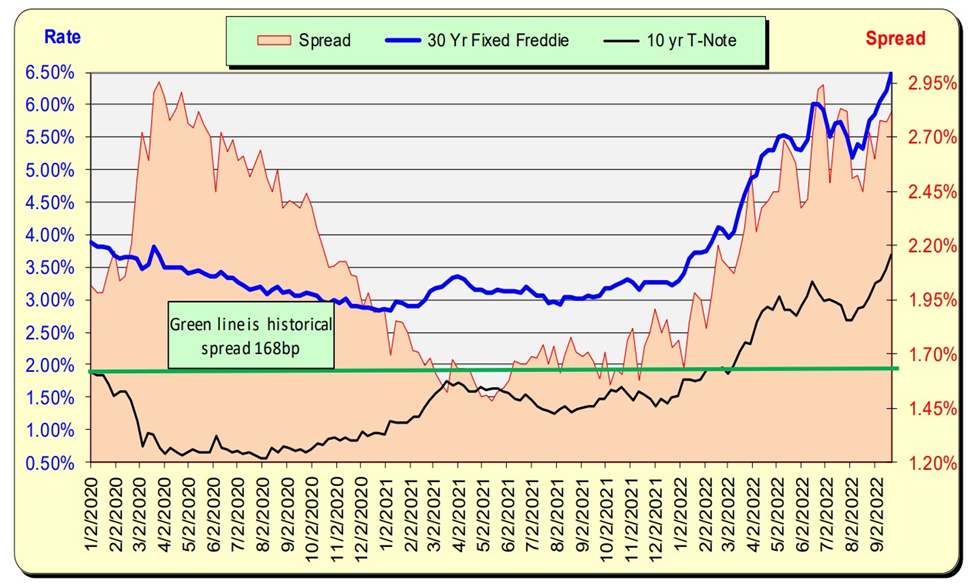

While mortgage rates INCREASED by 30 bps, both the 5-year and 10 Year Treasury rates also INCREASED by 25 bps. The net difference is a 5 bps decrease in a spread of 282 bps. With the historical spread being 168 bps, there now exists a “safety cushion” of 114 bps above the historical spread.

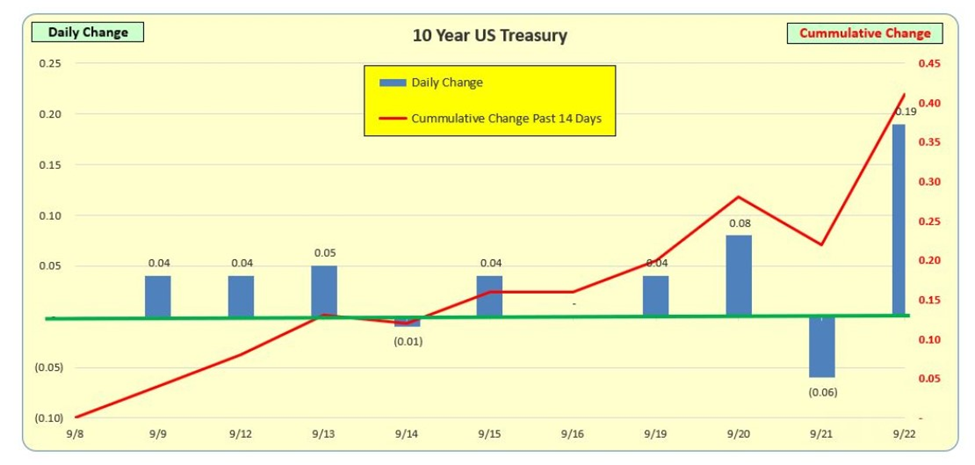

10 Year US Treasury

The 10-year Treasury Rate increased 19 bps on Thursday, September 22, 2022, alone. Freddie Mac rates had already been reported and thus do NOT include the impact of the September 22, 2022, change. Expect Freddie Mac rates to be up next Thursday, September 29, 2022, provided no other changes happen.

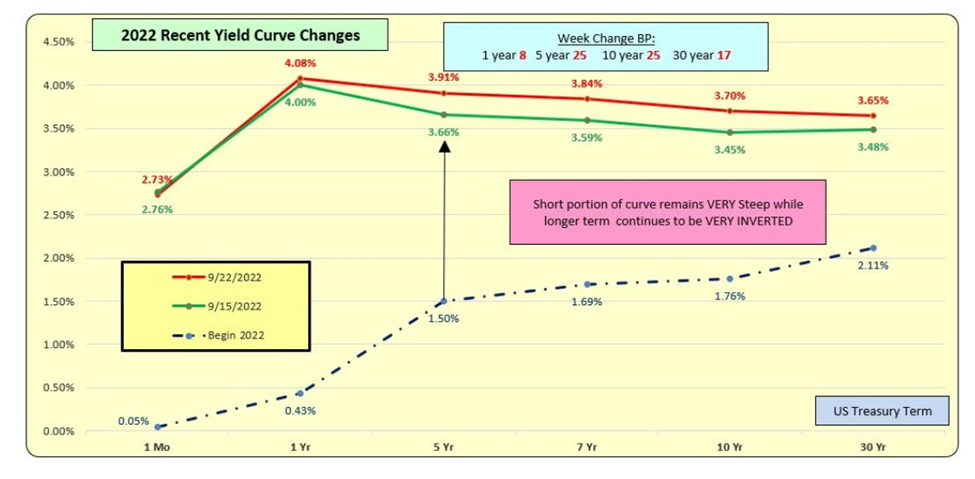

2022 Recent Yield Curve Changes

Note the short-term portion of the Yield Curve is steep, an increase in short-term rates will not necessarily result in the longer terms moving by a similar amount. Thus, the Fed increased their Fed Funds rates by 75 bps on September 21, 2022, that does NOT automatically mean that longer-term rates, hence mortgage rates, will not necessarily increase by an exact amount of 75 bps.

Spread

The historic spread between the 10 Year Treasury rates and Mortgage Rates is 168 bps (see the green line, right axis) and currently, there are 110 bps above the historical norm. For this spread to return to the historical norm, either mortgage rates will decrease, or 10 Year Treasury rates will increase. WEEKLY Mortgage rates are available each THURSDAY. Rates have been increasing as the Fed ramps up its efforts to address inflation concerns.

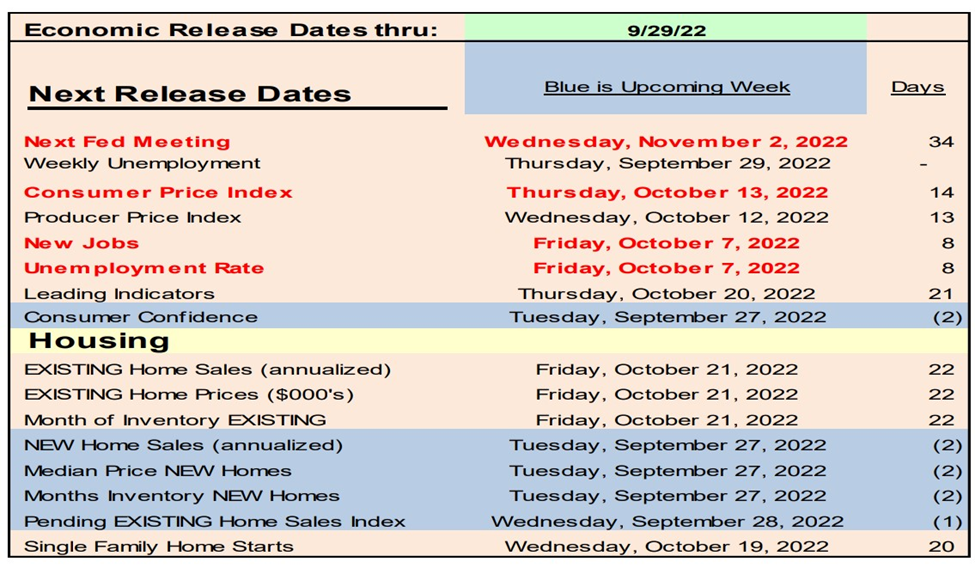

Upcoming Week’s Data

Upcoming Week’s Data that Could Impact Treasury and Mortgage Rates

• Monthly data updates in blue

• Weekly data on Unemployment Claims–Wednesday and Mortgage rates—Thursday

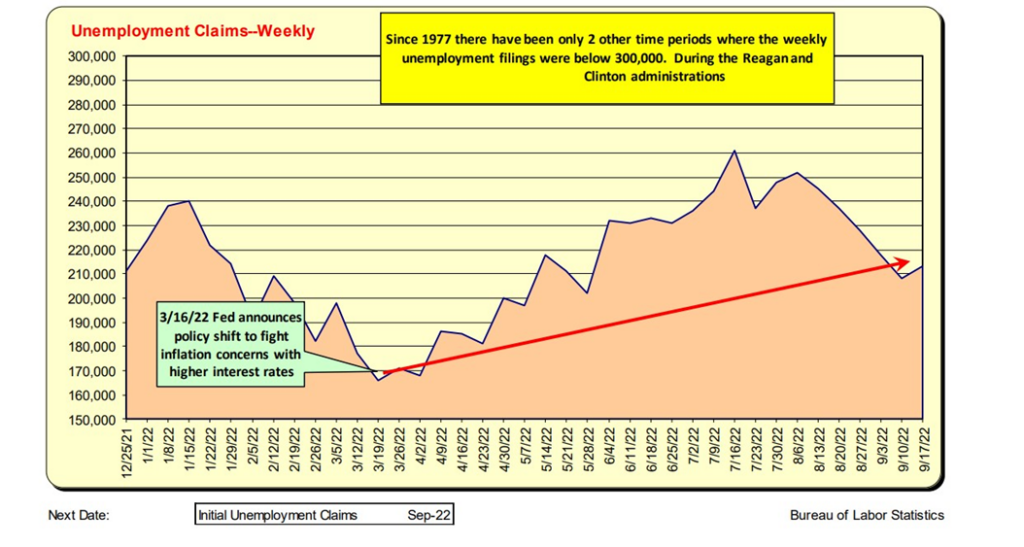

WEEKLY: Unemployment claims are available each WEDNESDAY. They have been increasing since the Fed announced its intention to increase interest rates to address inflation concerns. As the weekly claim filings increase, it will eventually slow the growth of the MONTHLY Net New Jobs total.

Weekly Initial Unemployment Claims

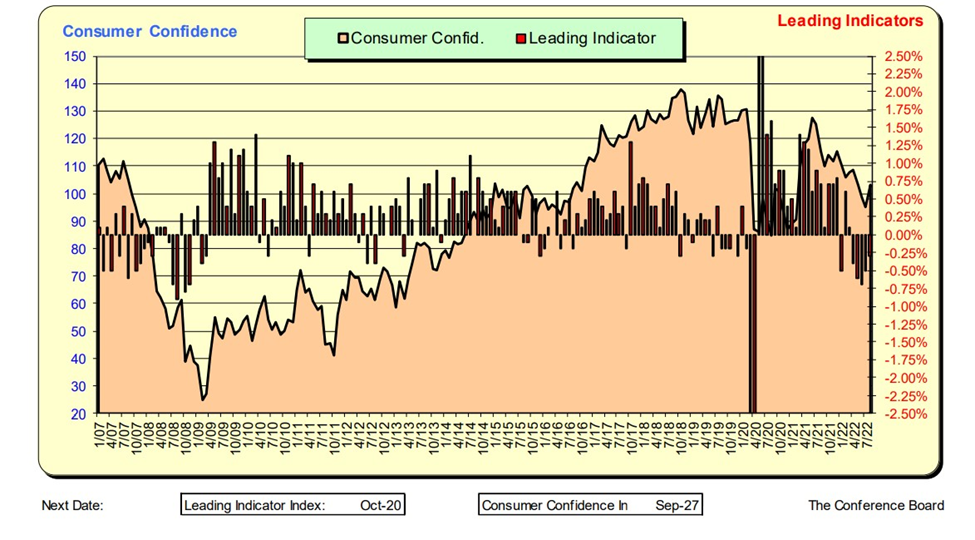

Leading Business Indicator and Consumer Confidence

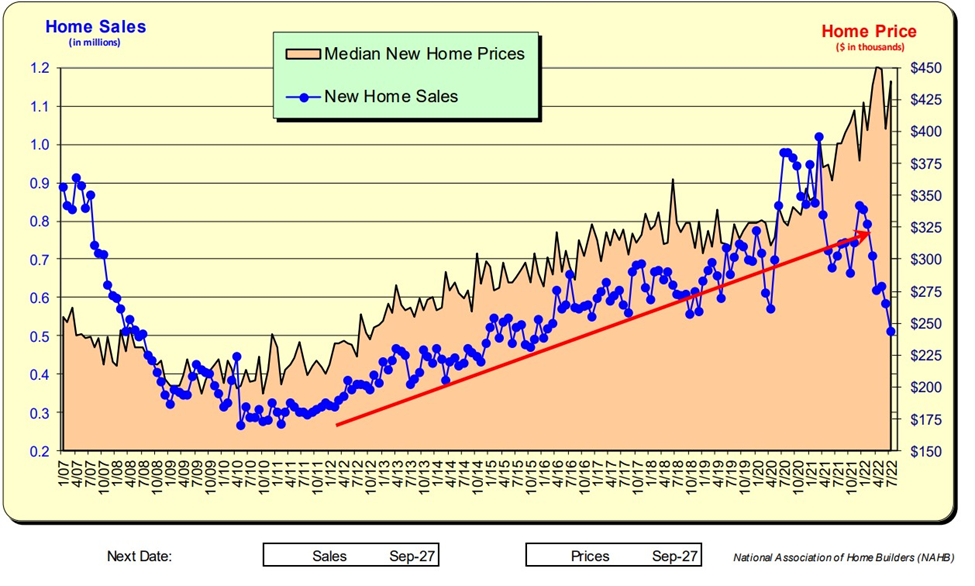

New Home Sales and Prices

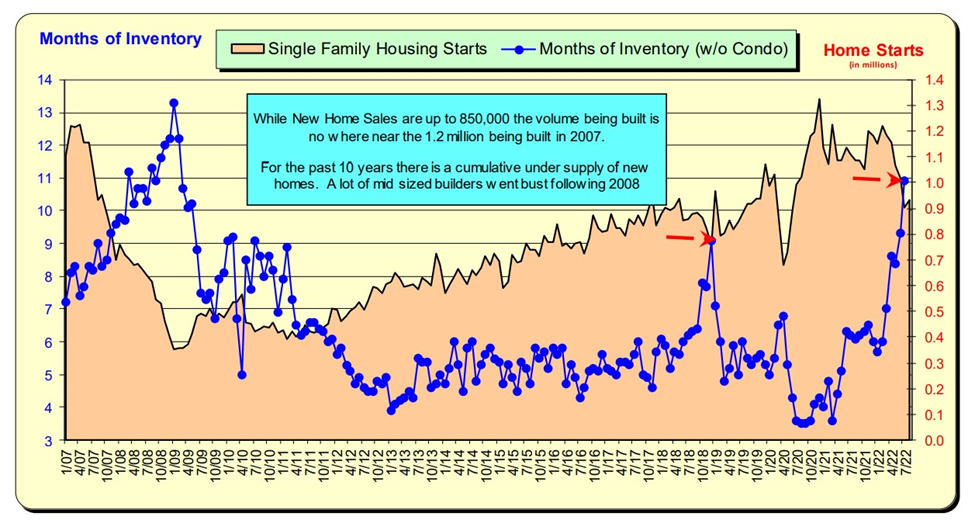

New Homes Supply For Sale and New Home Starts

While New Home Sales are up to 850,000 the volume being built is no where near the 1.2 million being built in 2007. For the past 10 years there is a cumulative under supply of new homes. A lot of mid sized builders went bust following 2008.

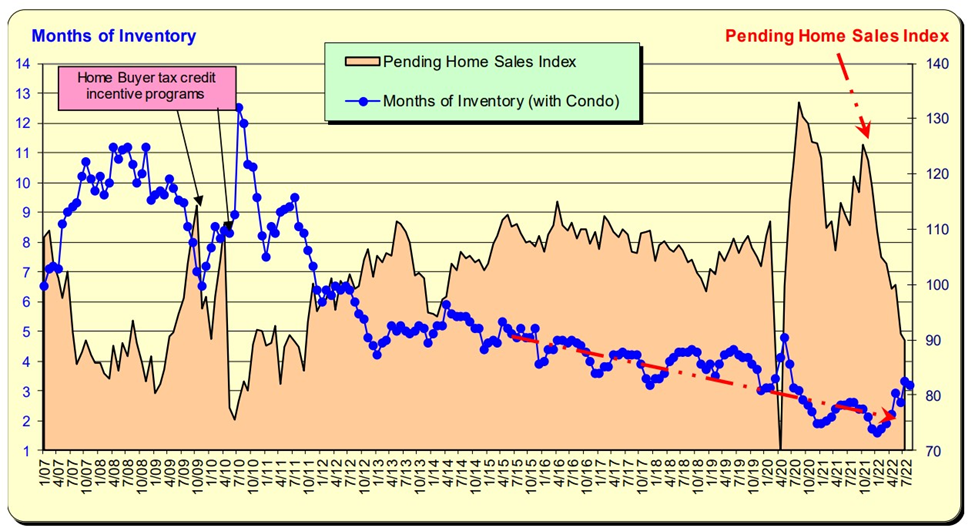

Existing Homes Supply For Sale and Pending Sale Index

Bill Knudson, Research Analyst Landco ARESC