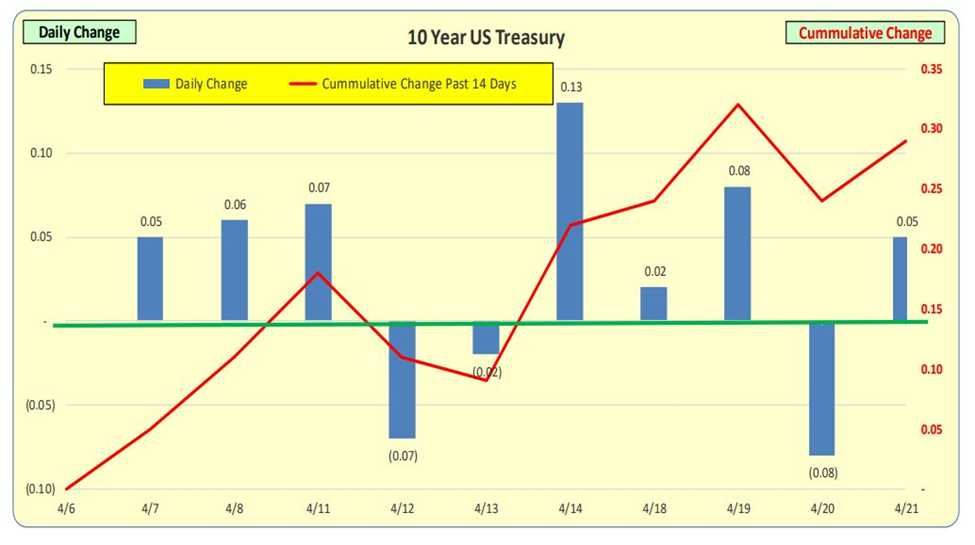

10 Year US Treasury rates increased 7 bps for the week ending April 14th, 2022.

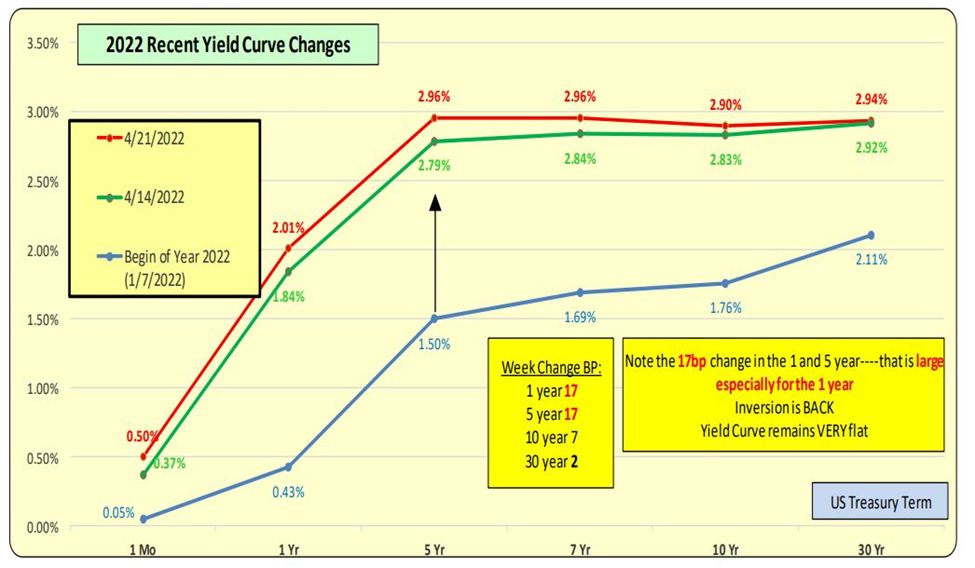

1 & 5 Year Treasuries were up a by a LARGE margin (17 bps). This slammed 15-year mortgages which spiked 19 bps to 4.58% .

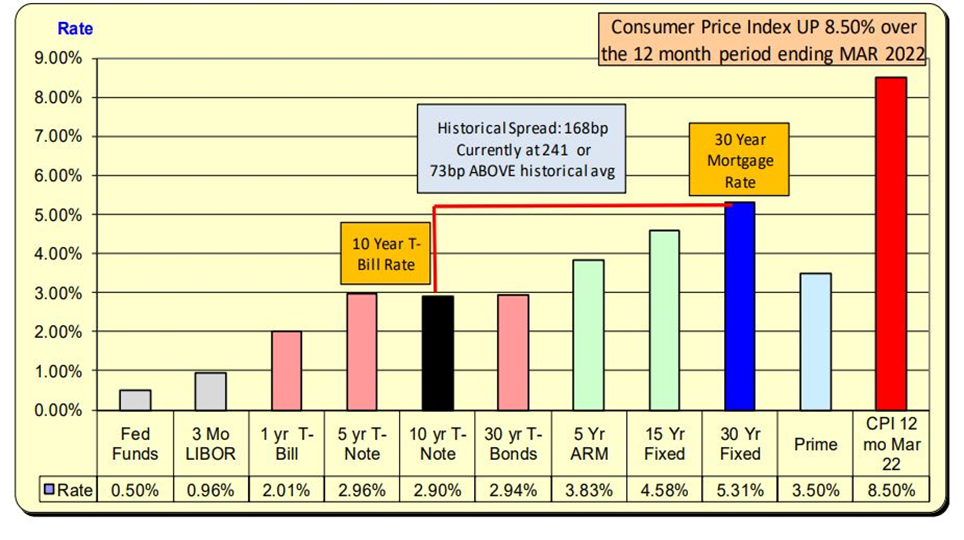

Lending Rates and Borrowing Costs

Mortgage rates are now at 5.31%. For the 7-day period ending April 21st, 2022, the 10-Year Treasury rates increased 7 bps while mortgage rates were up 11 bps. This caused the net spread to Increase 4 bps to 73 bps ABOVE normal spread of 168 bps.

10 Year US Treasury

In the chart about, daily changes in the US 10-Year Treasury rates are the blue bars while the red line is the 14-day cumulative change in rates which shows a 30 bps increase. 4 up days for every one down—rates are on the upward march. For the blue bars it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

The Yield Curve

The Yield Curve increased this past week (red line is current and green is last week). 15-year mortgages SKYROCKETED by 18 bps to 4.58% because it is benchmarked off shorter term US Treasuries while 30-year mortgages were up 11 bps The Yield Curve is virtually flat, and the inversion is BACK.

Bill Knudson, Research Analyst Landco ARESC