Inflation data for the month of April had some encouraging results. As such the 10 Year US Treasury rates decreased 21bps for the week ending May, 12th 2022.

Lending Rates and Borrowing Costs

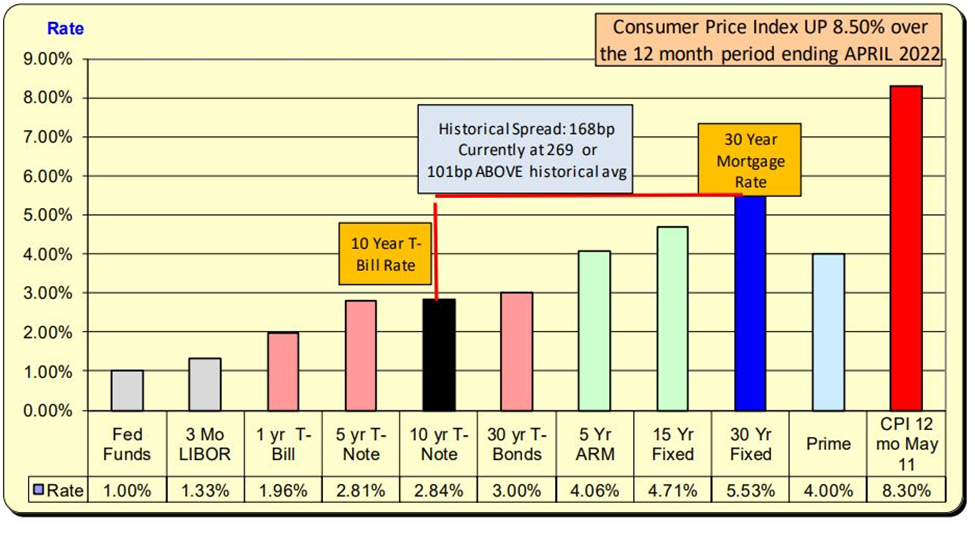

MORTGAGE RATES ARE NOW 5.53% For the 7-day period ending May 12th, 2022. 10- year Treasury rates DECREASED 21 bps while mortgage rates were up 3 bps. This caused the net spread to increase 24 bps to 101 bps ABOVE the normal spread of 168 bps.

10 Year US Treasury

Rates rocket up and feather down. The historic spread (aka difference) between the 10 Year Treasury and mortgage rates is 168 bps (see green the line). At the start of 2022, mortgage rates have increased FASTER than the 10-year Treasury rates. This past week the 10 Year treasuries decreased 21 bps while Mortgage rates increased 3 bps thus a 24 bps change in spread remains at 101 bps above the historical norm. That is a large spread but given how quickly rates have recently risen, pricing personnel is going to want to “hold onto this cushion” to be safe against unexpected rate increases.

Bill Knudson, Research Analyst Landco ARESC