10 Year US Treasury rates decreased 5 basis points for the week ending April 28th, 2022. There were no material changes to rates or yield curves.

The next Fed meeting will be on WEDNESDAY, May 4th, 2022. Perhaps after they meet, the short-term rates will be at 50 bps.

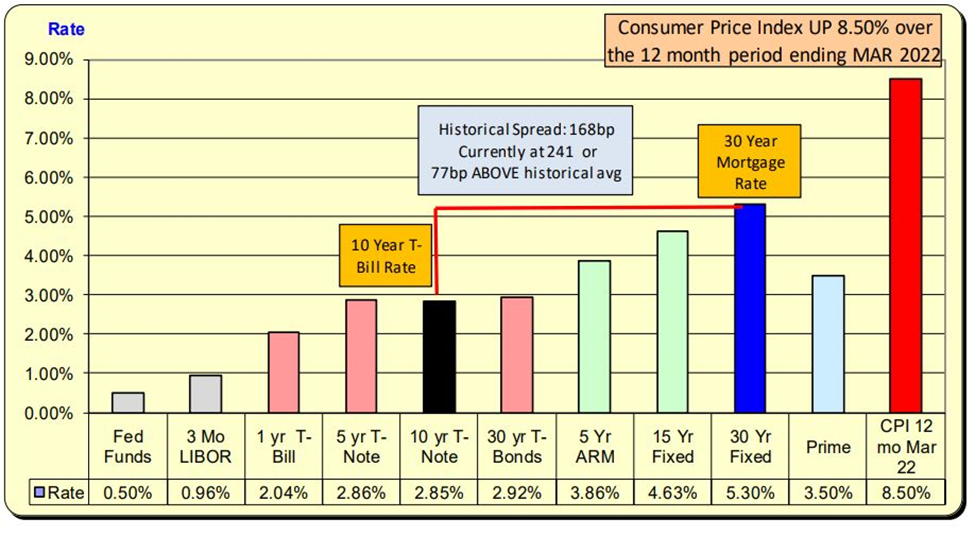

Lending Rates and Borrowing Costs

As I wrote in my previous article, (The Knudson File: MORTGAGE RATES ARE NOW 5.30%), for the 7-day period ending April 28th, 2022, 10 Year Treasury rates decreased 5 bps while mortgage rates were down 1 bps. This caused the net spread to Increase from 4bps to 77 bps ABOVE the normal spread of 168 bps.

10 Year US Treasury

Daily changes in the US 10 Year Treasury rates are the blue bars while the red line is the 14-day cumulative change in rates: 15 bps increase. For the blue bars, it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

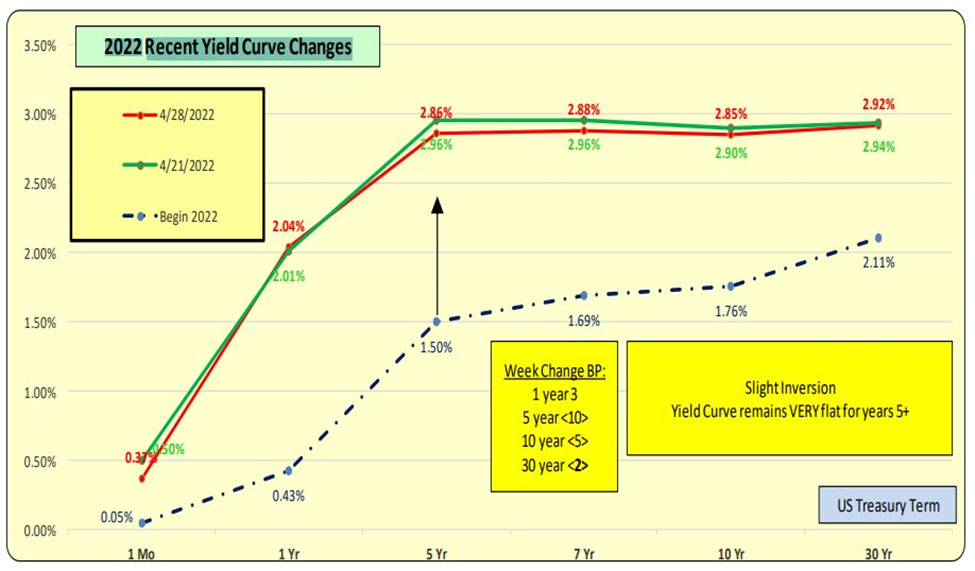

2022 Recent Yield Curve Changes

The Yield Curve has had slight changes this past week (the red line is current, and the green is last week). The Yield Curve is virtually flat for 5+ years and the inversion is BACK.

Bill Knudson, Research Analyst Landco ARESC