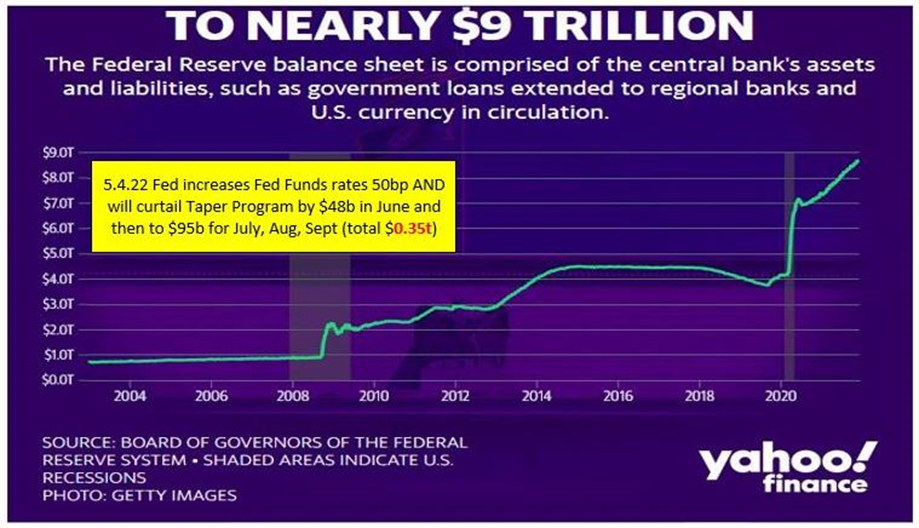

On May 4th the Feds increased the Fed Funds rate by 50 bps AND curtailed their Taper Program holdings of mortgage secured investments. This will put upward pressure on longer-term rates such as the 10 Year US Treasuries, hence home mortgage rates as well. 10 Year US Treasury rates increased 20 bps for the week ending May 5th, 2022.

The Fed’s announced on May 4th, that $0.350 Trillion of the Fed’s holdings of mortgage securities will mature and the Fed will NOT replace this with additional security purchases.

Given the Fed’s balance sheet is $9 trillion, the $0.350 Trillion represents 3% of their total this will occur over a 4-month period.

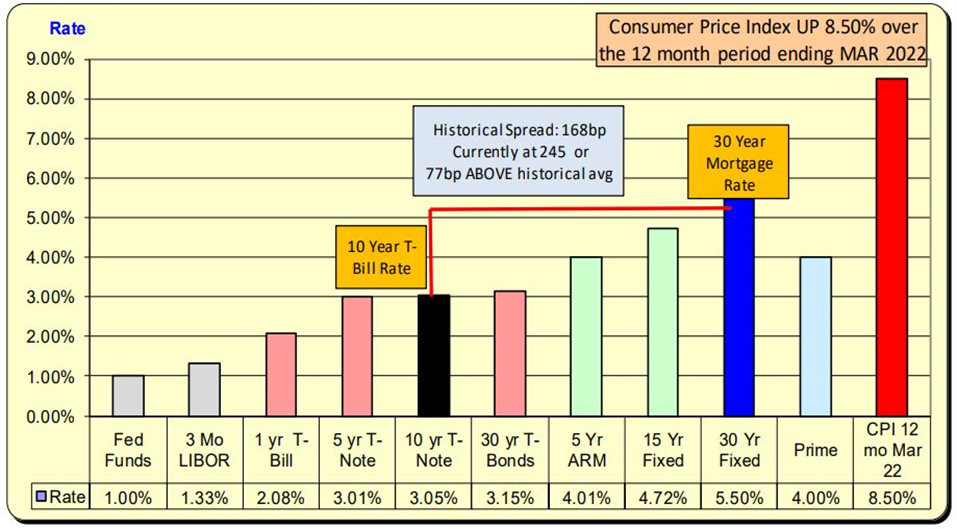

Lending Rates and Borrowing Costs

As MORTGAGE RATES ARE NOW at 5.50%, the 10 Year Treasury rates have increased 20 bps while mortgage rates are also up 20 bps. This has caused the net spread to remain at 77 bps ABOVE the normal spread of 168 bps.

10 Year US Treasury

Daily changes in the US 10 Year Treasury rates are indicated by the blue bars while the red line indicates the 14-day cumulative change in rates: a 15-bps increase. As you can see on the chart, the blue bars indicate an unusual change in rate. For rate changes, it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

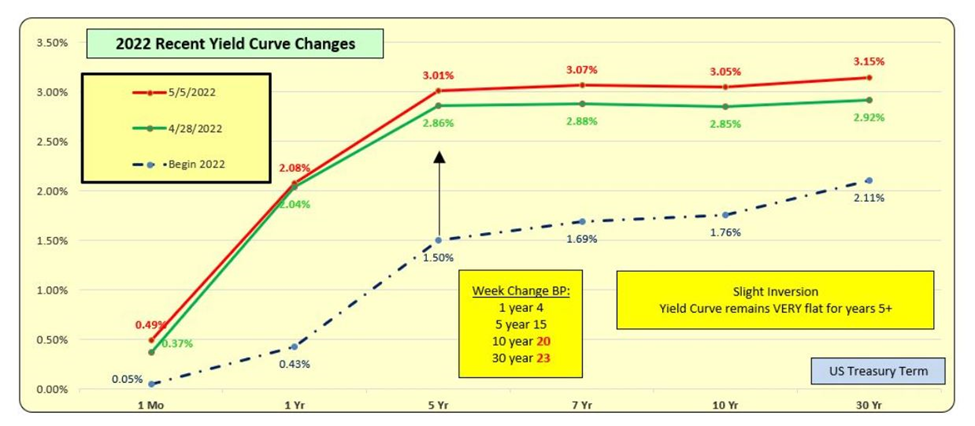

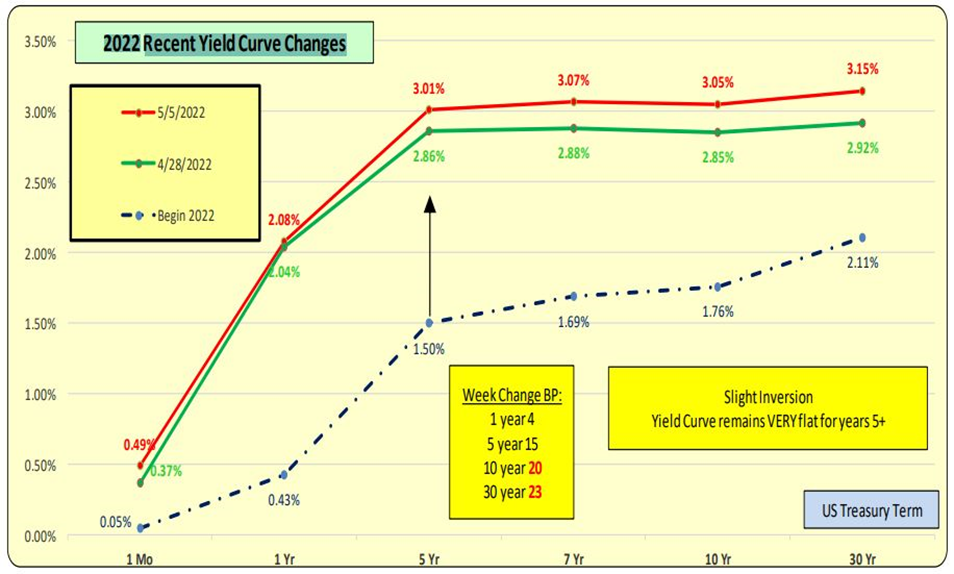

2022 Recent Yield Curve Changes

The Yield Curve rose for longer-term rates this past week (the red line is current; the green is last week). The Yield Curve remains virtually flat for 5+ years and the inversion is BACK.

Bill Knudson, Research Analyst Landco ARESC