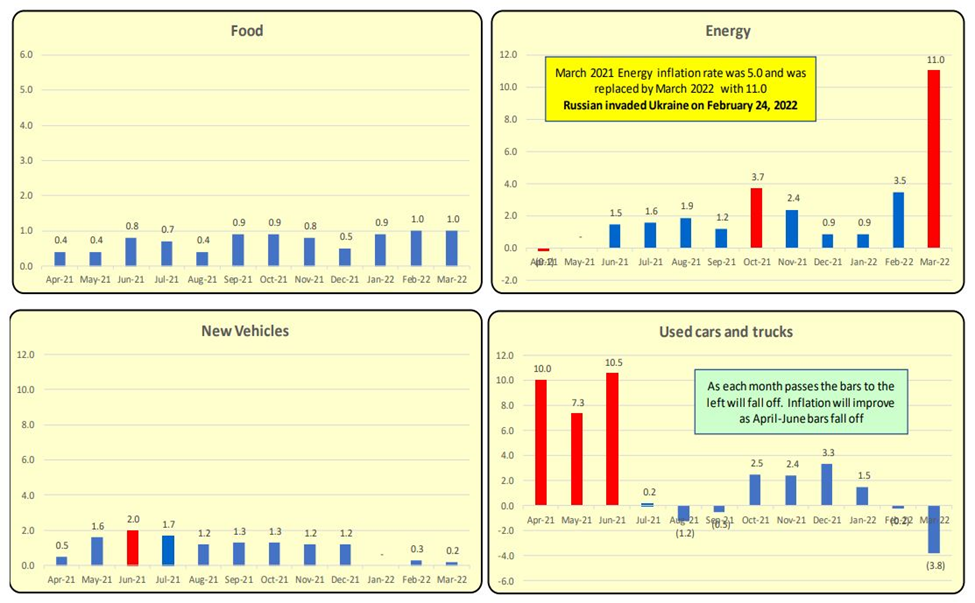

The Consumer Price Index (CPI) for March 2022 data was released on April 12th, 2022 and year-over-year levels came in at high’s last seen in 1981. The main driver of the increase in March was due to soaring energy costs due in part to Russia’s invasion of Ukraine which started on Feb 24th, 2022. The one month increase was 11% while the annual rate is 32%.

This 11% single month increase will remain in the CPI calculation for the next 12 months and won’t drop off until April 2023. It will give a continuing appearance that we have a high annual inflation rate due to this single month’s spike. As job growth continues to be robust and inflation is up, the Federal Reserve will likely continue with its announced future rate increases into the foreseeable future.

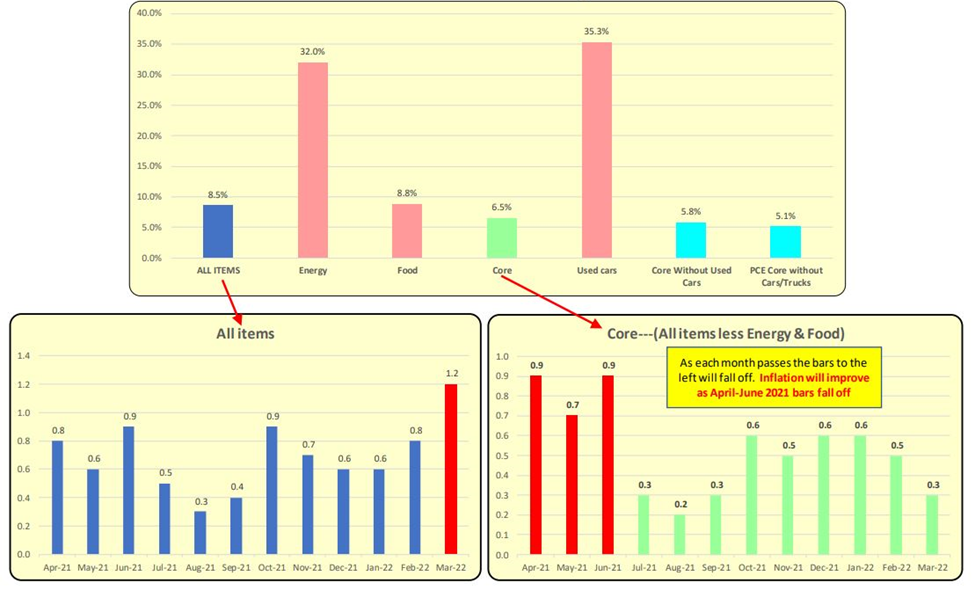

There is some good inflation news: Core inflation (less Energy and Food) came in at a 0.3% and the annual core was 6.5%.

The major item driving the Core inflation rate is Used Car Prices which spiked for a 3 month period of April thru June 2021. The annual used car inflation rate is 35%. These 3 months from 2021 will start dropping off next month and should lead to a decrease in the core inflation rate.

Inflation: 12 Month Period Ending: MARCH 2022

INFLATION: the 12-month CPI was 8.5% as of March 2022. Energy prices were up 32% and that is worldwide, while Used Car Prices were up 35%. If we exclude energy, food, and Used Cars, inflation was at 5.8%. The Federal Reserve sets interest rates based on the PCE which is 5.1%.

What are the Major Causes of Inflation?

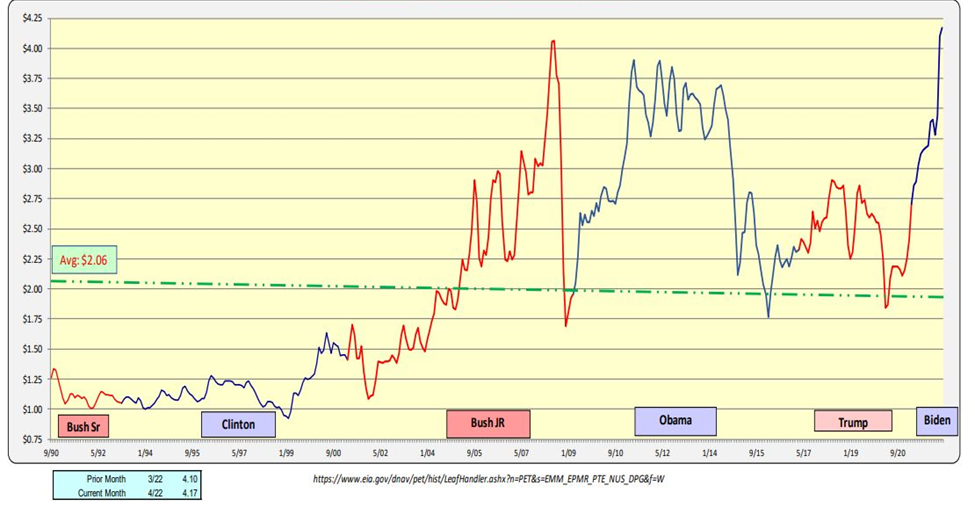

GAS PRICES are an international item that affects all countries. Putin invades Ukraine on February 24th, 2022. Note that gas prices pulled back slightly in April 2022. This will bode well for that month’s inflation data. The March 2022 spike will continue to be included in the annual CPI calculation for the next 12 months.

US Dept. of Energy: US Average Gas Prices (nominal)

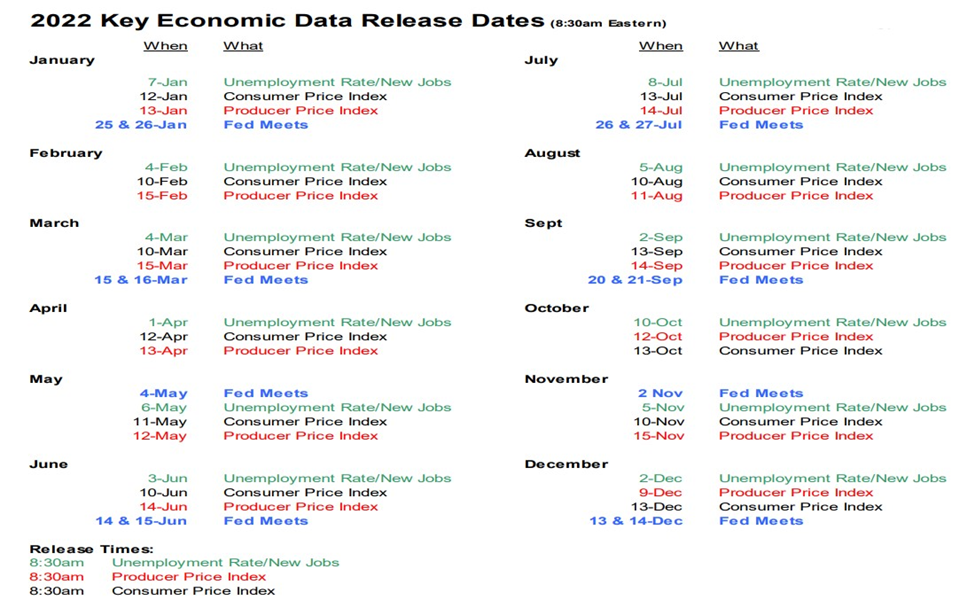

As we move forward in 2022 and as the impacts of COVID-19 subside, the economy will come into focus. Below are the publication dates of the CPI, PPI, and Net New Jobs. These items will be key factors during the Federal Reserve’s meetings which are also listed below.

Bill Knudson, Research Analyst Landco ARESC