The Federal Reserve’s next meeting is THIS Wednesday, July 27th. The debate amongst economists now is how much will the Feds raise rates: 75bp vs 100bp. With the unemployment rate remaining at 3.6%, and the Consumer Price Index (CPI) rising to 9.1%, it all but assures the Fed will raise rates by 75 bps, possibly 100 bps.

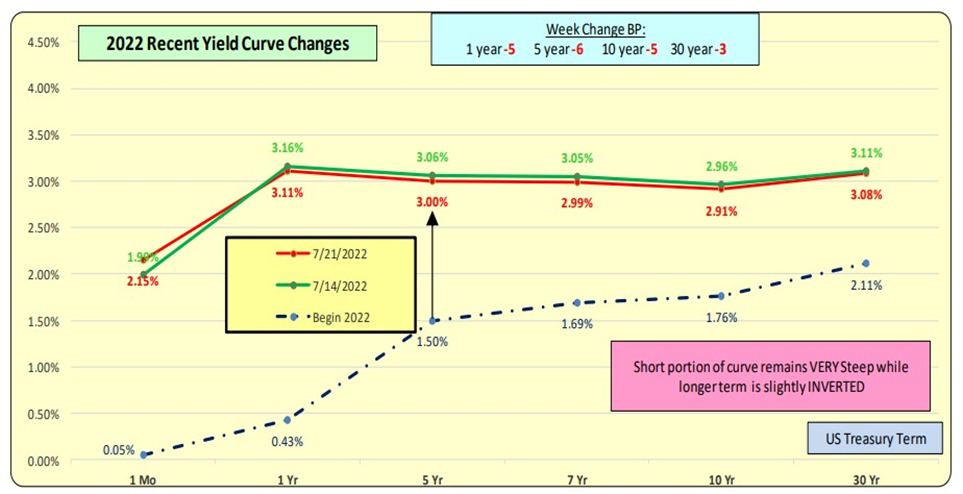

Short Term Rates

Short-term rates are up materially while recession concerns are still present with the inverted Yield Curve. In the past 2 weeks, 1-month rates increased from 1.55% to 2.15% which is a big increase. The Yield Curve for short-term rates is VERY steep while the longer term (5+ years) is inverted. Could we be in for a short-term period of stagflation (slow growth, rising prices, and high unemployment)? It will take at least 12 months for the Energy Prices to “fall” out of the CPI 12-month rolling calc. In the meantime, we can have a slowing economy with higher interest rates while the Fed fights inflation. This is what an inverted yield curve is pointing to.

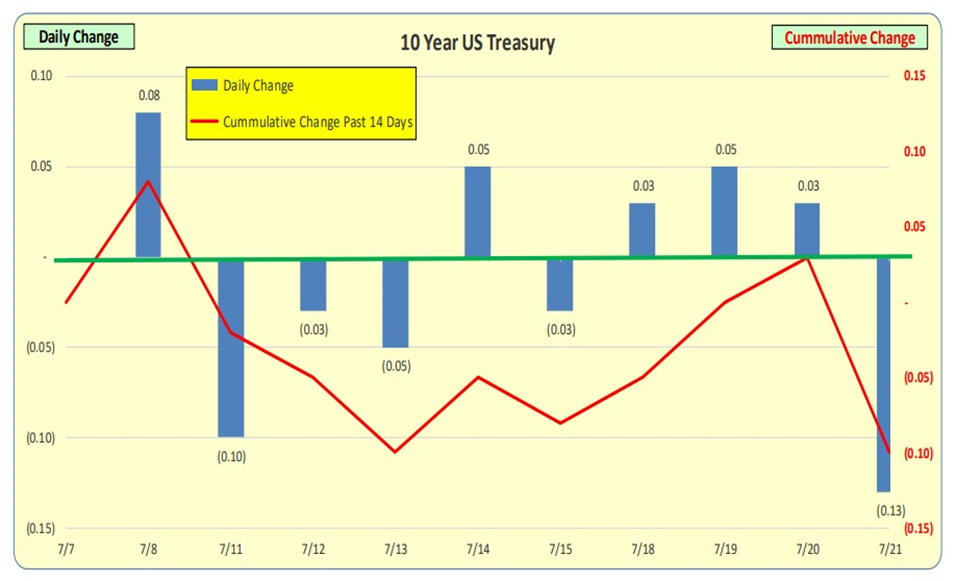

Daily changes in the US 10 Year Treasury rates are the blue bars while the red line is the 14-day cumulative change in rates: 10 bps decrease. Note the up & then down in rates—uncertain market. For the blue bars, it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

10 Year US Treasury

Bill Knudson – Research Analyst for Landco ARESC