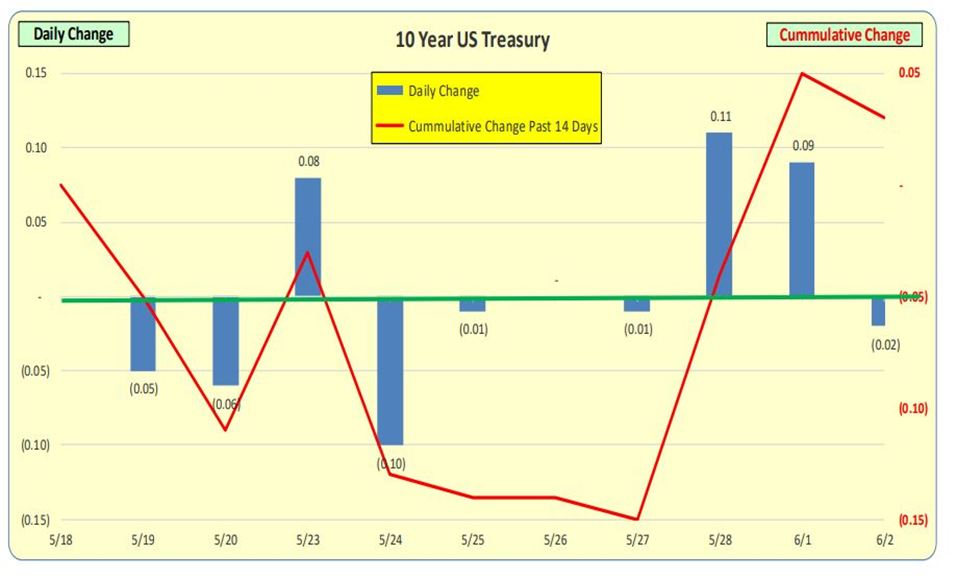

Mortgage rates increased 17 basis points while the 10 Year US Treasuries INCREASED 12 bps (in the prior week the 10-year Treasury increased 17 bps), thus spread increased by 4 bps to 242 bps or 74 bps ABOVE the 168-bps average.

This rise in Treasury rates will place upward pressure on mortgage rates during the upcoming week. I predict we will have mortgage rates at 5.60% by June 17th, 2022.

30-Year Mortgage Rates

For the week ending June 9th, 2022, Mortgage rates increased 17 bps to 5.46%. For a $100,000 loan, the monthly payment increased by $10 to $565 which is equal to $0.34 a day.

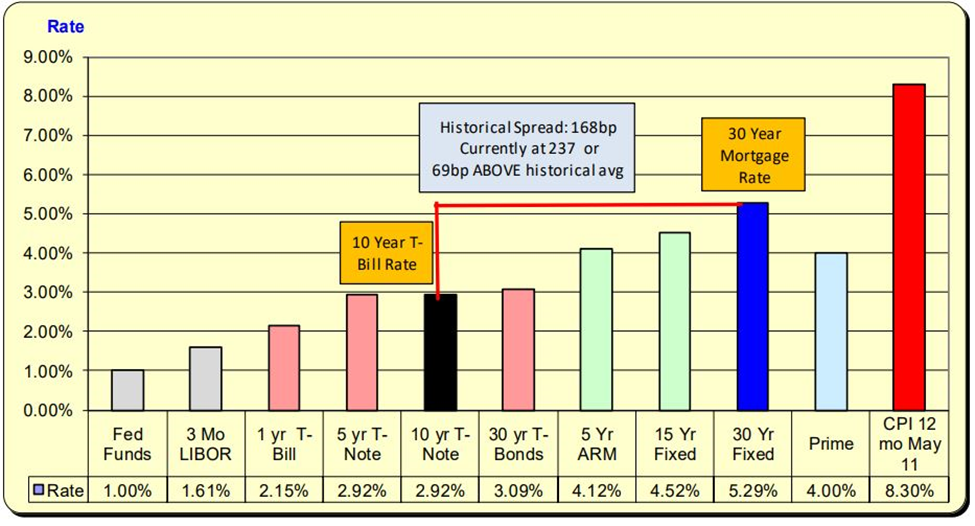

Rate VS Spread

The historic spread (aka difference) between the 10 Year Treasury and mortgage rates is 168 bps (see green line). At the start of 2022 mortgage rates have increased FASTER than the 10-year Treasury. This past week the 10 Year increased 12bp while Mortgage rates increased 17 bps thus a 5 bps increase in spread occurred and the spread is 74 bps above the historical norm. Given how quickly rates have recently risen, pricing personnel is going to want to “increase this cushion” to be safe against unexpected rate increases.

Bill Knudson, Research Analyst Landco ARESC