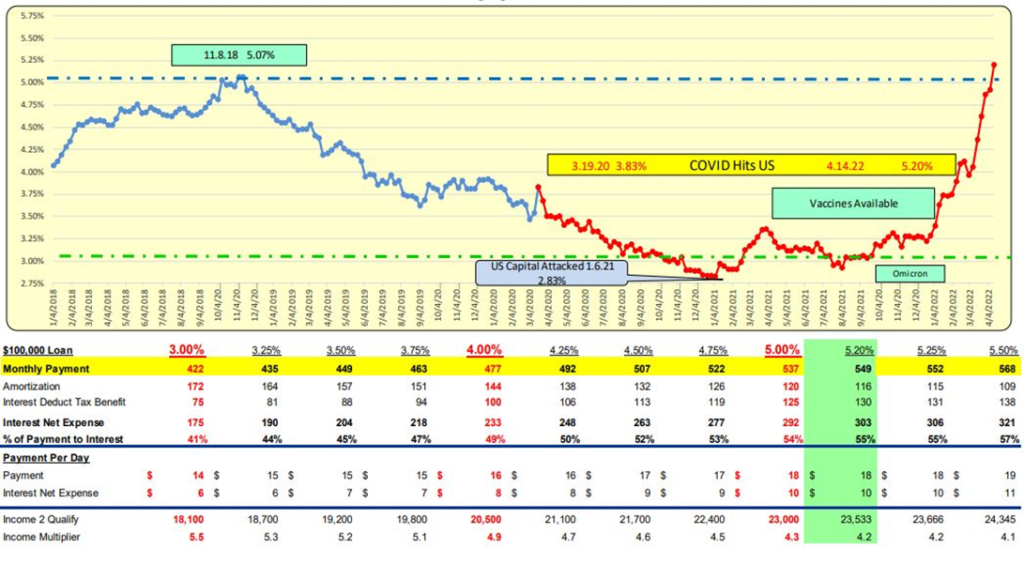

MORTGAGE RATES ARE NOW OVER 5.00% and increased 28 basis points to 5.20%. 28 bps was nearly a 3-sigma event that being 30 bps (in 51 years a 1% event). For a $100,000, loan the monthly payment increased by $17 to $549 which is equal to $0.57 a day. Mortgage rates of 5.00% to 5.50% by the end of April are very possible given the Fed’s announcement. Ten-year Treasuries were up 17 bps.

30 Year Mortgage Rates

The spread of Mortgage rates to 10-year US Treasury increased 11 bps and is now 69 bps above the historic norm. Things are moving VERY fast, and Mortgages are trying to keep out in front of Treasury rate movements.

- The profitability of mortgage loans in the pipeline is going to be hit.

- Pending home purchase loans are going to be pressured.

- Millennials have never been through changes like this and rates this high. How do people react to uncharted waters? The natural reaction will be to pull back on purchasing.

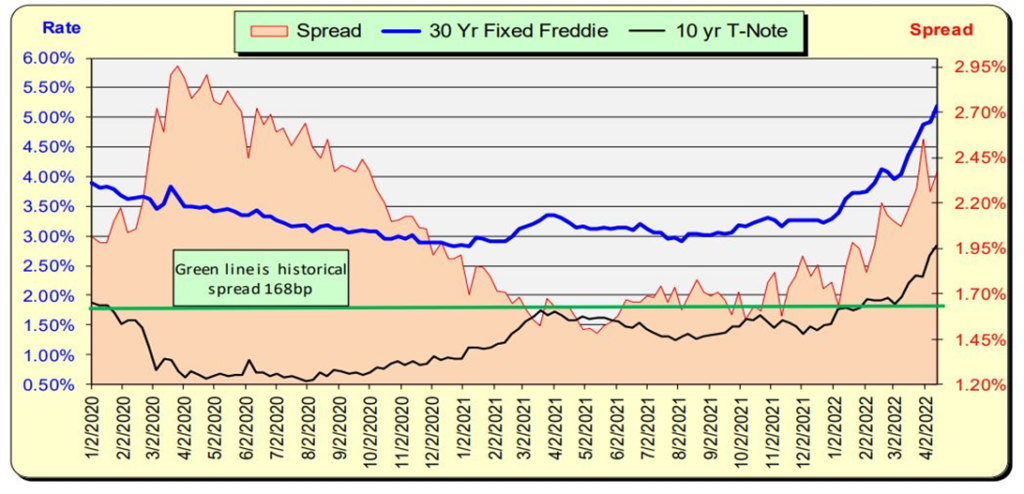

Rates Rocket Up and Feather Down

For now, and into the foreseeable future, rates will continue to increase. As 10 Year US Treasury rates declined in 2020 due to COVID-19, mortgage rates were slower to react, consequentially the spread between the two increased. Eventually, Mortgages decreased and the historic difference of 168 bps was attained (see green line). At the start of 2022 mortgage rates have increased FASTER than the 10-year Treasury, thus the spread has increased beyond their 168-spread level. This past week the 10 Year rose 17 bps while Mortgage rates increased more 28 bps thus their spread increased 11 to be 69 bps above the historical norm.

Bill Knudson, Research Analyst Landco ARESC