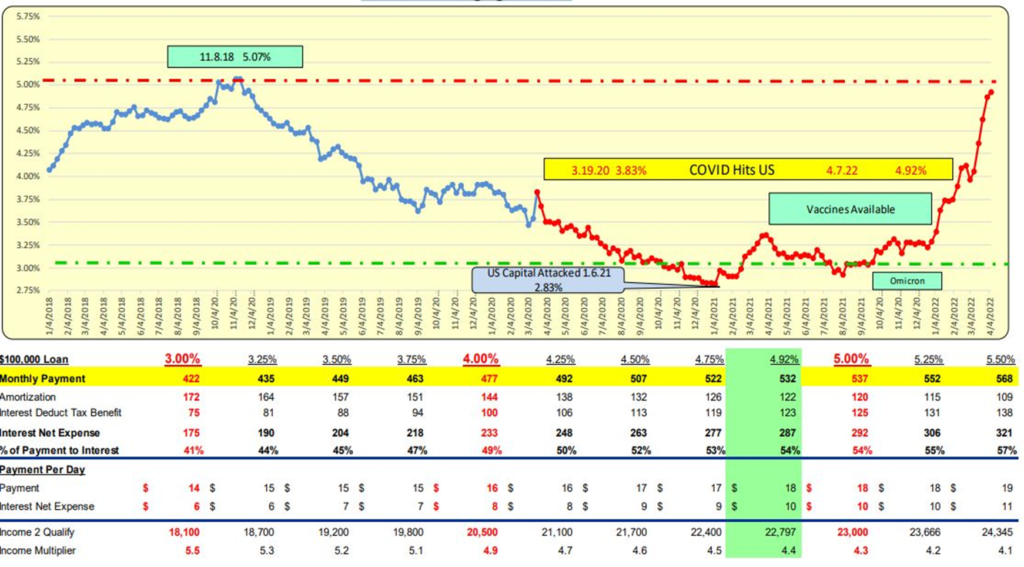

After a VERY UNUSUAL bout of 3 weeks of consecutive rate increases of 25+bps, mortgage rates increased 5 bps this past week ending 4.7.22 and now stand at 4.92%. (a review of mortgage rates since 1971 reveals a less than 1% chance of a series of increases of this size)

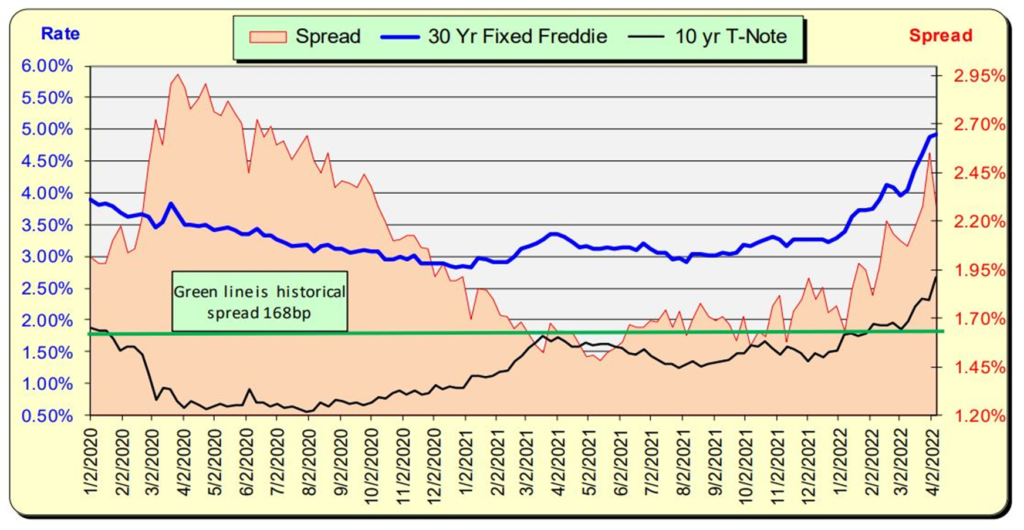

The benchmark US 10 Year Treasury rate rose 31 bps this past week —–thus the net spread between the two DECREASED by 26 bps and now stands at 226 which is 58 bps ABOVE the historic spread of 168 bps. The next Fed meeting is May 4th, 2022.

30 Year Mortgage Rates

This past week 4.7.22 Mortgage rates increased 5bp to 4.92%. The market is reacting to the Fed’s strong statement coming from their 3.16.22 FOMC meeting regarding increasing interest rates. For a $100,000 loan, the monthly payment increased by $3 to $529 which is equal to $0.10 a day. Mortgage rates of 5.00% to 5.50% by the end of April are very possible given the Fed’s announcement.

Rates Rocket Up and Feather Down

For now, and into the foreseeable future, they will continue to increase. As 10 Year US Treasury rates declined in 2020 due to COVID-19, mortgage rates were slower to react, as such the spread between the two increased. Eventually, Mortgages decreased, and the historic difference of 168 bps was attained (see green line) At the start of 2022 mortgage rates have increased FASTER than the 10 year Treasury, thus the spread has increased beyond their 168 spread level. This past week the 10 Year rose 31 bps while Mortgage rates increased only 5 bps thus their spread decreased 26.

note the 10-year and mortgage spread since Jan 2020. Historically, when the 10 Year decreases, the Mortgage rate lag and feather down. When the 10-Year rates are anticipated to increase, Mortgage rates will rocket up before that. (Rocket up, Feather down)

Bill Knudson, Research Analyst Landco ARESC