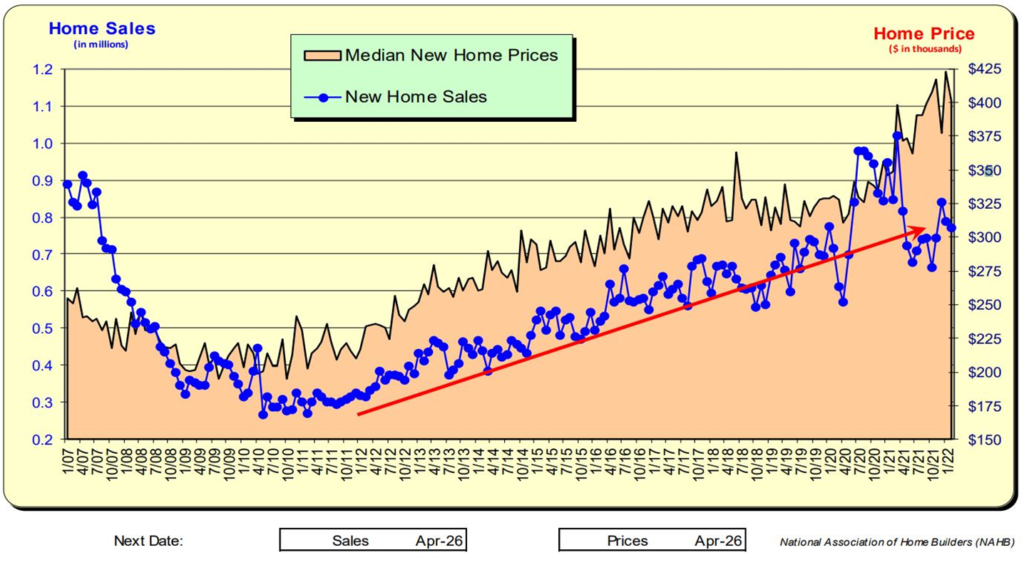

For every 1 new home sold in the United States, 9 existing homes are sold. This is due in part because new homes prices are 10% higher than existing home prices. New home sales tend to be more sensitive to interest rates than do existing home sales.

When COVID-19 first hit the US in March 2020 sales of NEW homes immediately stalled but quickly resumed as interest rates declined. With record-low mortgage rates, sales of NEW homes surged in late 2020 and into 2021. As mortgage rates increased sales slowed but appear to be at levels slightly below levels that prevailed prior to March 2020. The increased sales with multi-generational lows may have brought demand forward, thus giving the impression that NEW home sales have stalled.

It is noted that when mortgage rates hit 5.00% in November 2021, sales slowed, and months of inventory spiked for a couple of months. 5.00% mortgage rates may be a price point for NEW home sales are sensitive to.

New Home Sale Prices

In April/May 2021 new sales materially decreased even though interest rates were relatively stable at 3.25% COVID-19 first appeared in the US in March 2020 and Mortgage rates went below 3.00% between Oct-Feb 2021. While this may have brought forward demand and thus decreased sales in later months, sales have not returned to the elevated levels of 2020, but they may have returned to a trend that prevailed prior to COVID-19.

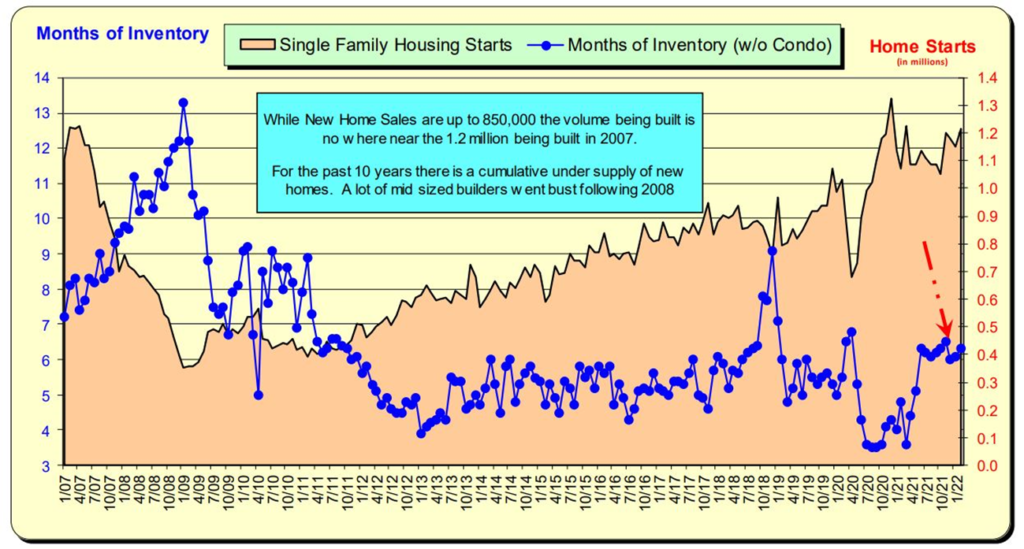

New Homes Supply For Sale and New Home Starts

When COVID-19 first appeared in the US, new home sales initially dropped and then sharply rebounded as mortgage rates hit multi-generation lows of 3.00%. With a sudden surge in sales, months of inventory dropped. When mortgage rates rose in early 2021, sales pulled back and months of inventory returned to levels that prevailed prior to COVID-19 It is important to note the large increase in Months of Inventory that occurred in November 2018. That is when Mortgage rates hit 5.00% and sales slumped.

Bill Knudson, Research Analyst Landco ARESC