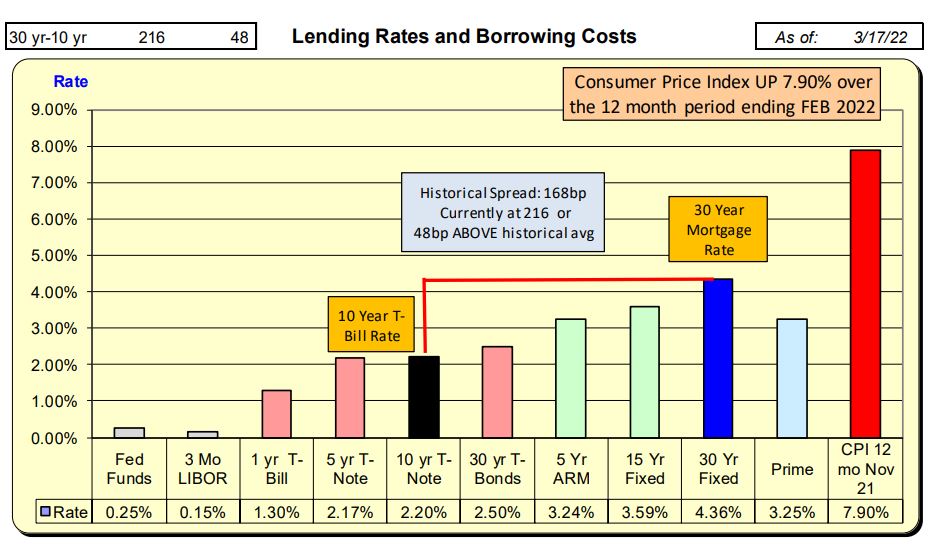

For the 7-day period ending March 17th, 2022, the 10-Year Treasury rates increased 22 bps while mortgage rates increased 31 bps. This caused the net spread between the two to increase 9 bps to 48 bps above the normal spread of 168 bps. It appears the mortgage market is positioned for an anticipated additional rate increase by the Fed.

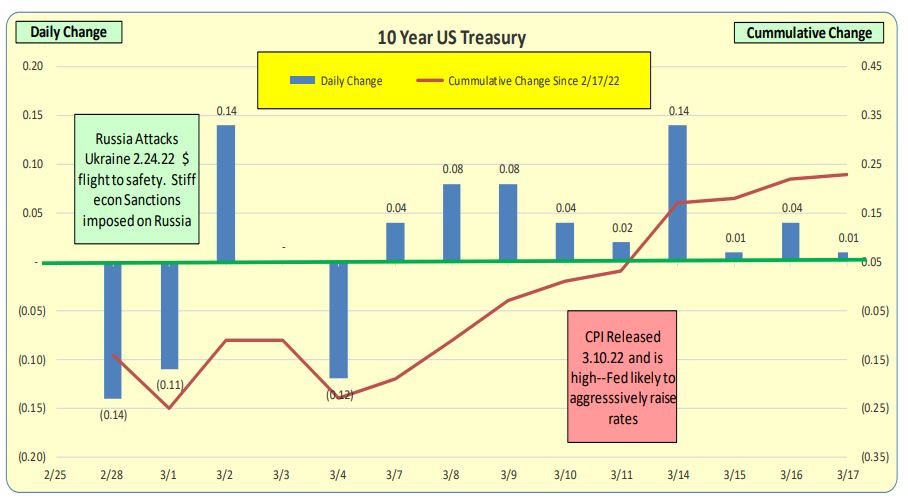

Daily changes in the U.S 10-Year Treasury rates are represented by the blue bars while the red line indicates the cumulative changes since February 25th, 2022. Cumulative changes over the past 14 trading periods resulted in a 23 bps increase. For the 30-year mortgage rate (represented by the blue bars) it is unusual to have changes of more than 0.10 in a single day and 0.20 is VERY usual.