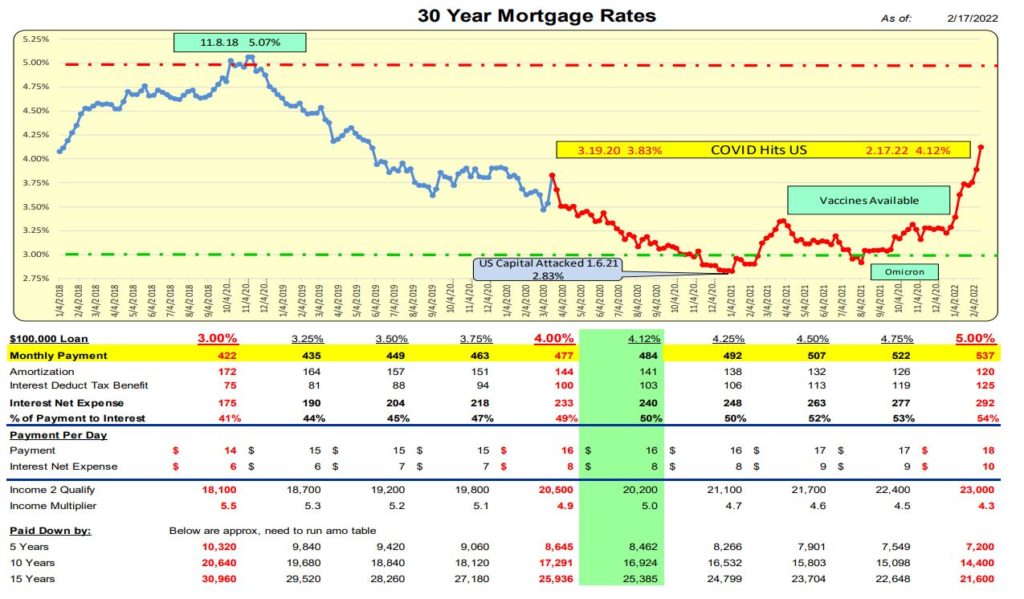

Mortgage rates increased 23 Basis Points this past week from 3.89% to 4.12%. While 4.00% is not a major price point, it will start catching the public’s attention. For a $100,000 loan, the monthly payment increased by $13 to $484 which is equal to $0.48 a day. Rates were below 3.00% for 14 weeks and it appears these rates are a thing of the past.

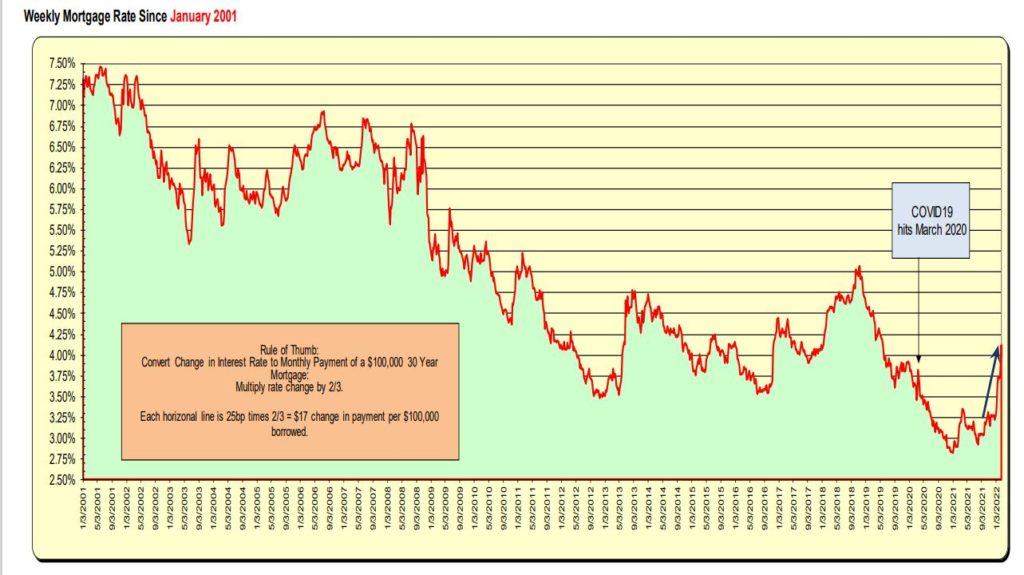

Rates rocket up and feather down and for now and into the foreseeable future, they will continue to increase. The Federal Reserve has not changed its Fed Funds rates which are short-term rates—their next meeting is 3.15.22. It appears longer-term rates are increasing in anticipation of an increase by the Federal Reserve. Viewed from a broader time frame, 4.12% are relatively low rates.

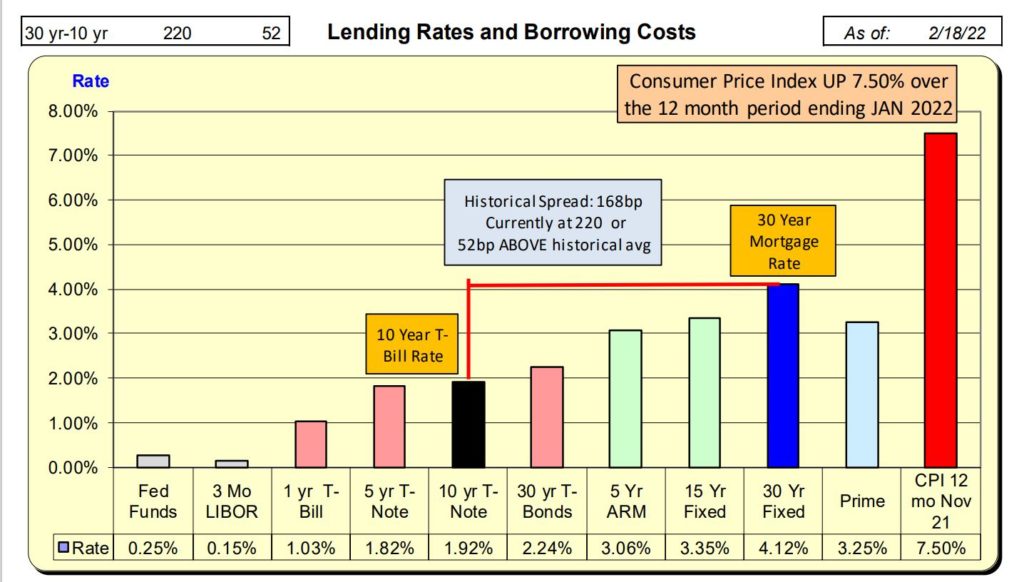

Treasury rates were virtually unchanged for the week. Intra-week they were up 13bp. With the 23bp rise in 30-year mortgage rates, the spread between 10 Year Treasuries and Mortgage rates is 52 bps above normal spread. It appears the mortgage market is getting ahead of anticipated rate increases by the Fed.