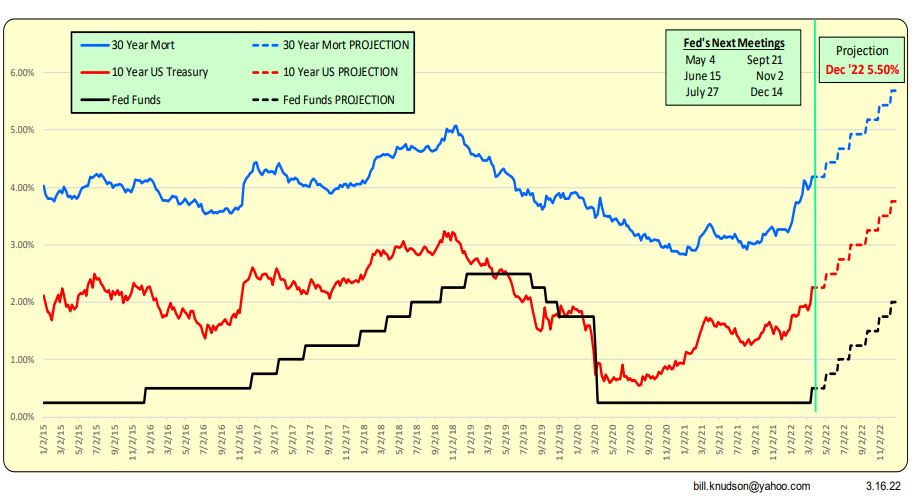

Where Are Mortgage Rates Headed? My guess is 5.00% to 5.50% by Dec 31, 2022. This is based on historical spreads and the fact that the Fed has STRONGLY singled increases in their Fed Funds rates during their next 6 meetings in 2022. In addition, they will likely stop their purchases of long-term Treasuries and Mortgage Back agency paper. (aka Taper Program) The result of this pullback will be a steeper yield curve which will also force mortgage rates even higher.

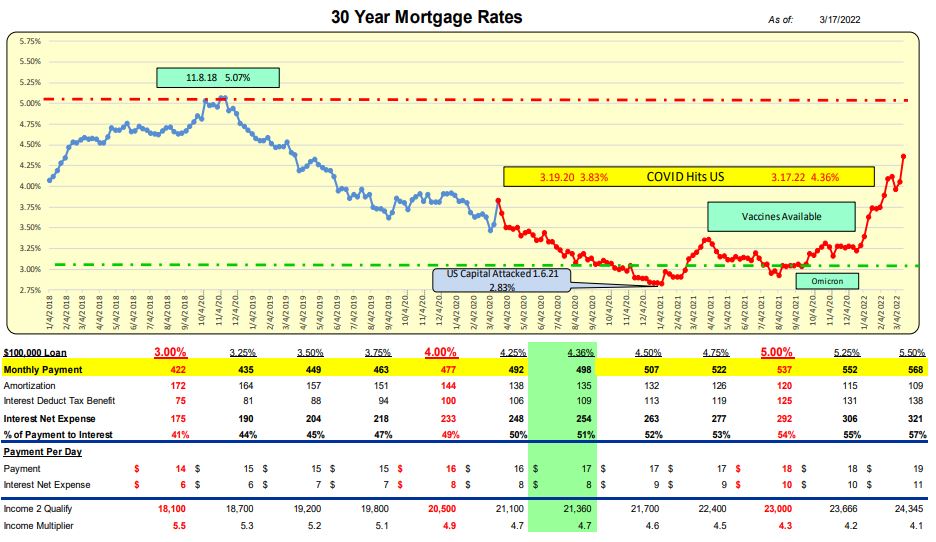

As of March 17th, 2022, a 30-year mortgage rate is 4.36%. That means for a $100,000 loan, the payment is $498. Should rates go to 5.50% the monthly payment would be $568 which is a change of $2.00 a day—-see below table. The trouble for first-time homebuyers is the income to qualify for a $100,000 loan will increase from $21,360 per year to $24,345 (i.e., the income multiplier decreases from 4.7 to 4.1).

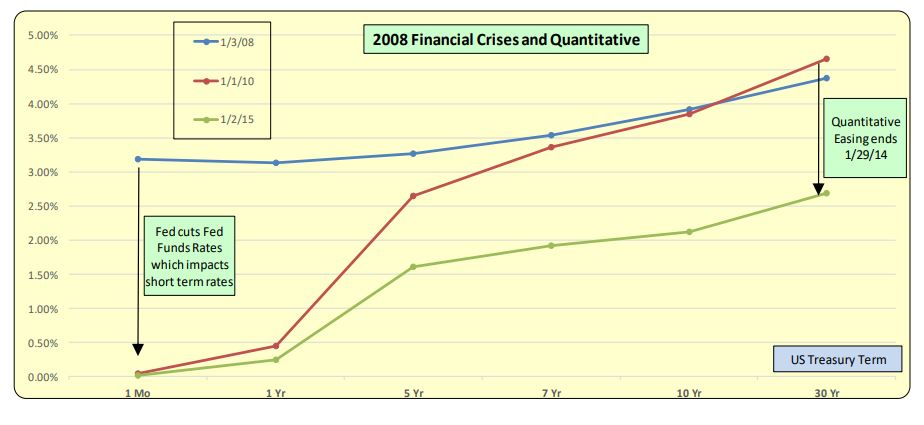

Following the 2008 Financial crisis, the Fed cut the Fed Funds rate which decreases short-term rates. Later they started their Quantitative Easing program (QE) which reduces longer-term rates. In a QE program, the Fed buys longer-term Treasuries and Agency MBS financial instruments. By being a buyer, the Fed pushes down longer-term interest rates such as the 10 Year Treasury on which both home loans and commercial real estate are priced/benchmarked.

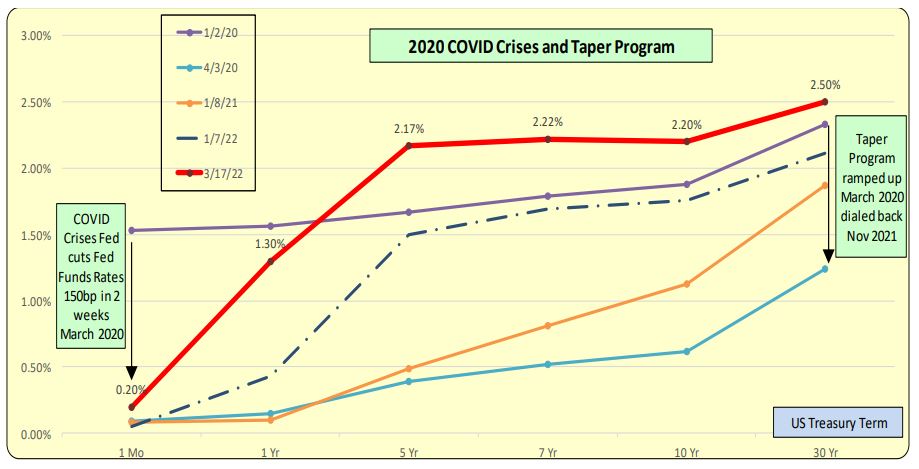

With the suddenness of the COVID-19 crises in March 2020, the Fed cut the Fed Funds rate 150 bps in 2 weeks and at the same time they started their Taper Program (very similar to their QE program from 2008) The Taper Program achieved immediate results with 10 Year US Treasury rates by 125 bps. In response, home mortgage rates feathered down to 3.00% and the housing market accelerated. With the COVID-19 crises behind us, the Fed announced in November of 2021 that the Taper Program would be wound down. As such intermediary term rates have begun to increase as well as mortgage rates.

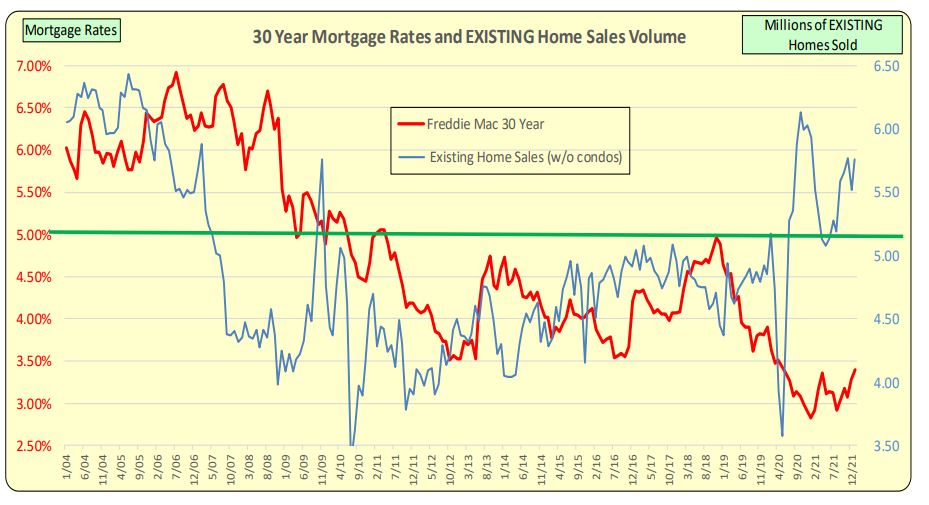

For the EXISTING home market, higher rates will slow but not tank it. We had 5.00% rates briefly in 2018 and indeed sales declined. When COVID-19 first hit in March 2020, sales totally collapsed but sharply rebounded as rates went below 3.50%. This likely brought forward a demand that was looking to buy at a later date. Millennials have not had to cope with rates higher than 5.00% and this will affect them more than “Baby Boom” vintage borrowers—who are getting smaller in numbers as they age out.

For NEW home buyers, increases in mortgage rates will likely be more impactful. Note what happened when rates hit 5.00% in Nov 2018—-sales materially pulled back. It would have been more profound had rates not decreased shortly thereafter. New home prices are 20% higher than existing and hence will have more debt.