The Consumer Price Index (CPI) for May 2022 data was released today and the year-over-year increase from 8.3% to 8.6%.

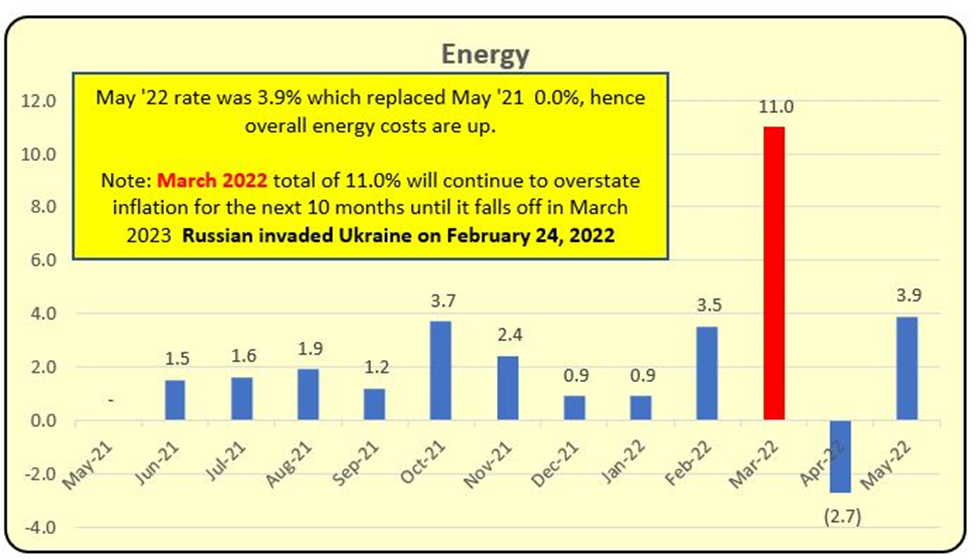

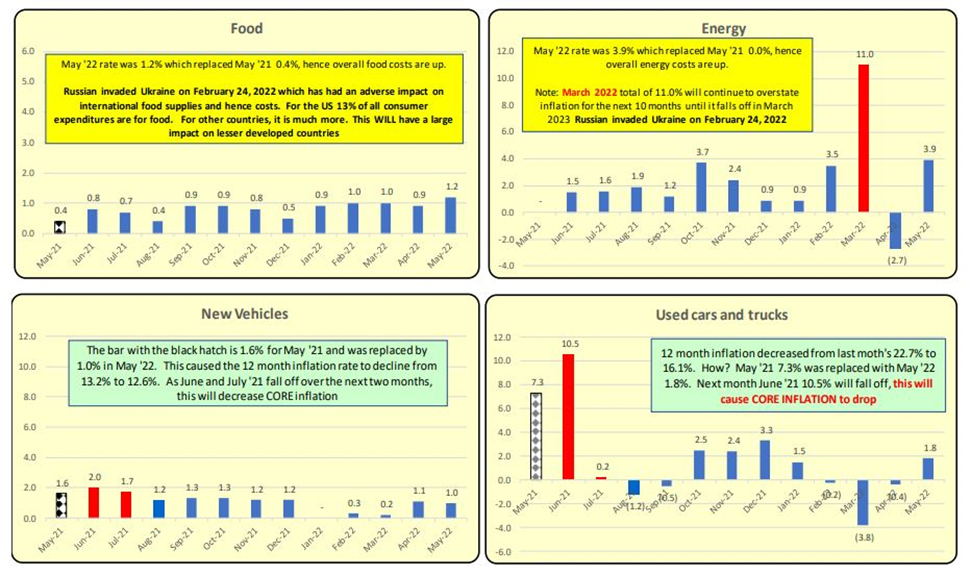

The main driver of the increase in March was due to soaring energy costs due to sanctions on Russia for their invasion of Ukraine starting on Feb 24. The one-month increase spiked 11% while the annual rate is 35%.

Gas prices were up 19% in March. For June they are up 17%. This impact will be included in the next CPI update which will include June data and is due out July 13—this WILL cause the overall CPI to rise again–maybe exceed 9.0%?

Energy Prices Soar

This 11% single-month increase will remain in the CPI calculation for the next 12 months and won’t drop off until April 2023. It will give a continuing appearance that we have a high annual inflation rate due to this single month’s spike. Given how job growth is robust and inflation is up, the Federal Reserve will likely continue with its announced future rate increases into the foreseeable future.

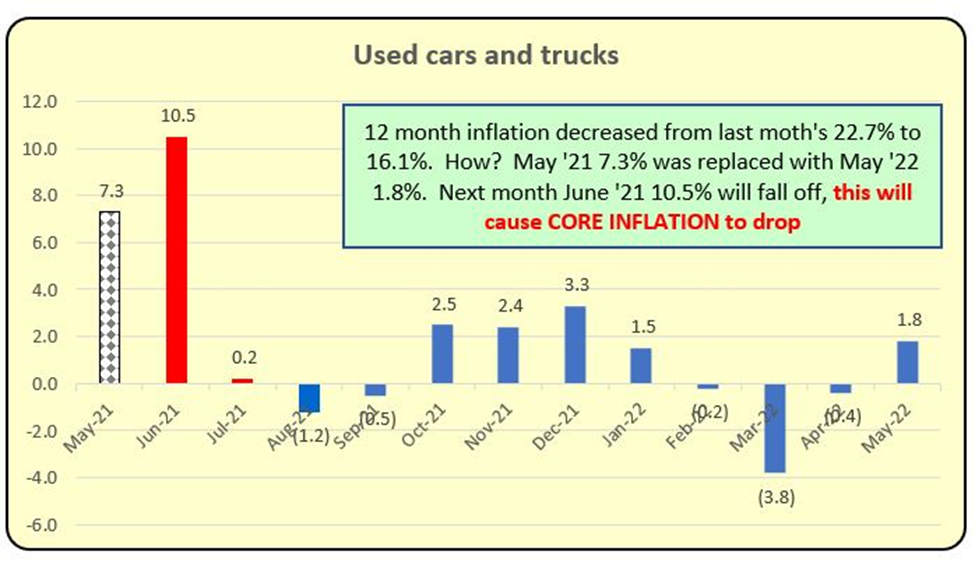

There is some good inflation news: Core inflation (less Energy and Food) annual core decreased from 6.2% to 6.0%. The major item driving the Core inflation rate is Used Car Prices which spiked for a 3-month period from April thru June 2021. The annual used car inflation rate is down from 23% to 16% as the May 2021 spike fell off when May 2022 data was published. When the June 2021 data falls off, this should lead to a further decrease in the core inflation rate.

Used Cars and Trucks Causing Spike to Core Inflation

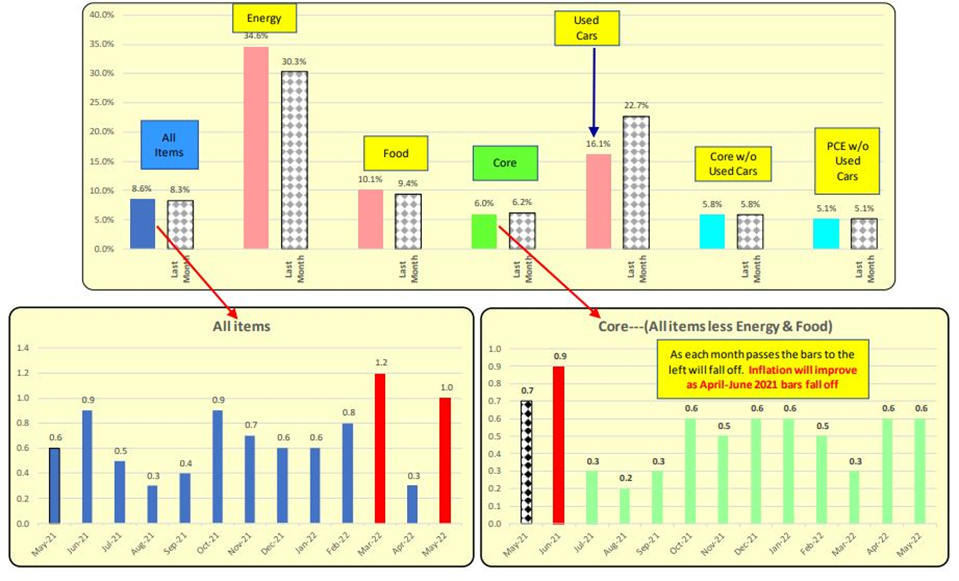

INFLATION: the 12 month CPI increased from 8.3% to 8.6% for May 2022. Energy prices were up 35%

and that is world wide AND Used Car Prices were up 16%. Exclude energy, food and Used Cars and

inflation was 5.8%. The Federal Reserve sets interest rates based on the PCE which is 5.1%.

Inflation: 12-Month Period Ending: MAY 2022

Major Causes of Inflation

INFLATION’s major causes are higher Energy and Used Car Prices. As a bar gets closer to the LEFT, it will fall off as new monthly data becomes available. The black hatched bar is the month that has recently fallen off and has been replaced by the most recent month’s data, that being May 2022. Higher interest rates will NOT solve these isolated sources of inflation.

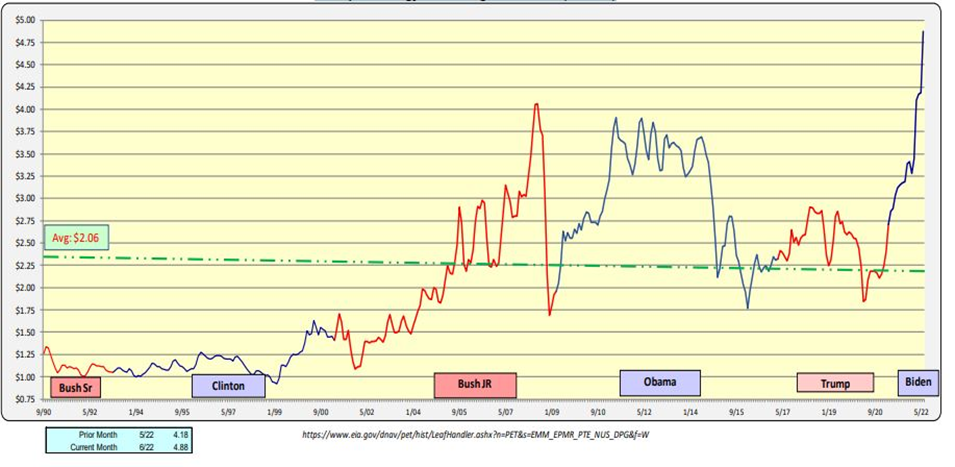

US Dept. of Energy: US Average Gas Prices (nominal)

GAS PRICES are an international item that affects all. As the war began in Ukraine on February 24th, 2022, and Biden imposed sanctions on Russian oil, gas prices rose to 19% in March. The March 2022 spike will continue to be included in the annual CPI calculation for the next 11 months. It is the gift that will keep on giving. For June gas prices are up 17% over May. This increase will show up in June’s CPI to be reported on July 13. This will be an UGLY number and will boast Energy and the CPI total.

As we move forward in 2022, as the impacts of COVID subside, the economy will come into focus. above are the publication dates of the CPI, PPI, and Net New Jobs. These items will be key factors during the Federal Reserve’s meetings.

Bill Knudson – Research Analyst for Landco ARESC