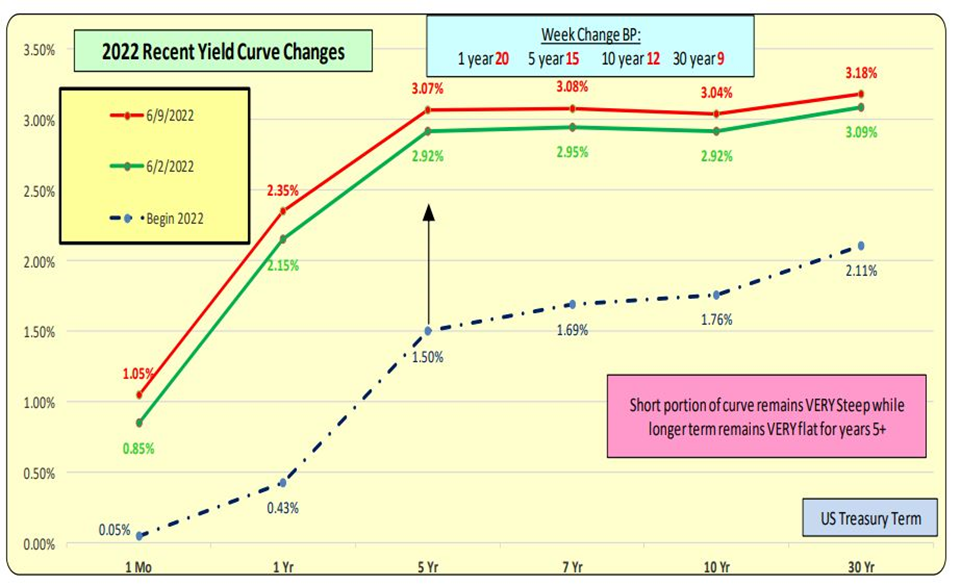

Week ending June 9, 2022: 10 Year US Treasury rates increased 12 bps which will put upward pressure on this coming week’s mortgage rates. The short-term yield curve remains steep while longer-term 5+ years is FLAT.

Lending Rates and Borrowing Costs

Daily changes in the US 10 Year Treasury rates are indicated by the blue bars while the red line shows the 14-day cumulative change in rates: 29 bps increase. RATES ROCKET UP BUT FEATHER DOWN. For the blue bars, it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

2022 Recent Yield Curve Changes

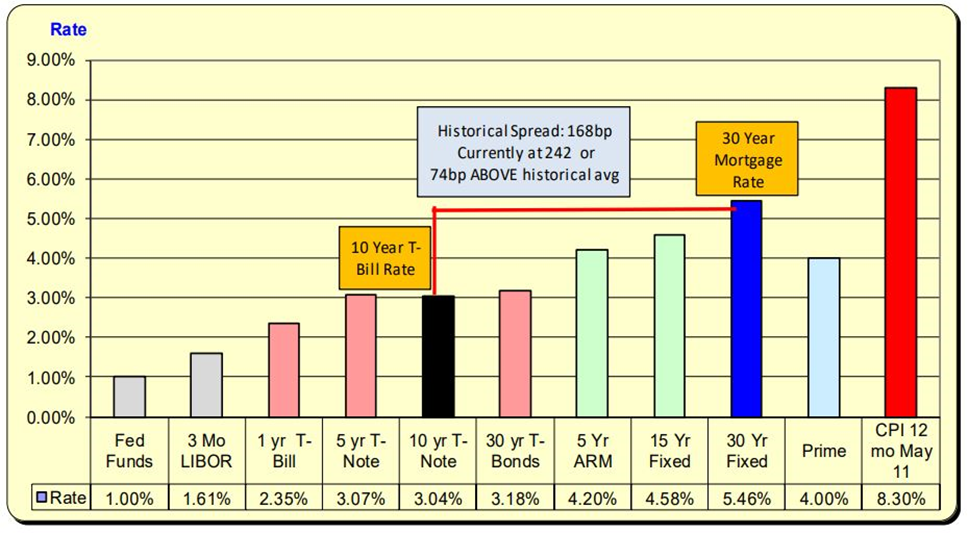

MORTGAGE RATES are now at 5.46% For the 7-day period ending June 9th, 2022, while the 10 Year Treasury rates INCREASED by 12 bps and mortgage rates increased by 17 bps. This caused the net spread to increase 5 bps to 70 bps ABOVE the normal spread of 168 bps. As I stated in my previous article “The Knudson File: How Will Surging Treasury Rates Effect Mortgage Rates?” Mortgage rates will likely increase due to the change in Treasury rates.

10 Year US Treasury

Rates rose this past week, particularly for short terms (the red line is current, and the green is last week). The Yield Curve for short terms is VERY steep while the longer-term (5+) remains virtually flat.

Bill Knudson, Research Analyst Landco ARESC