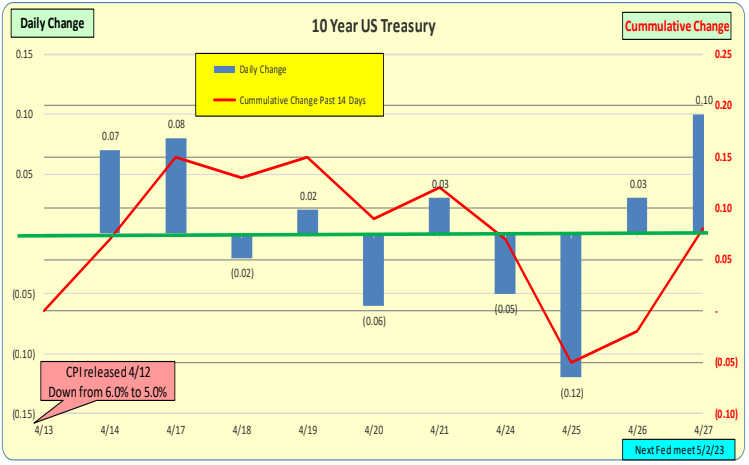

For the past 2 weeks, 10-year Treasury rates have been up 8bp. In the past week, they went down 1bp. As a result, market swings are less pronounced.

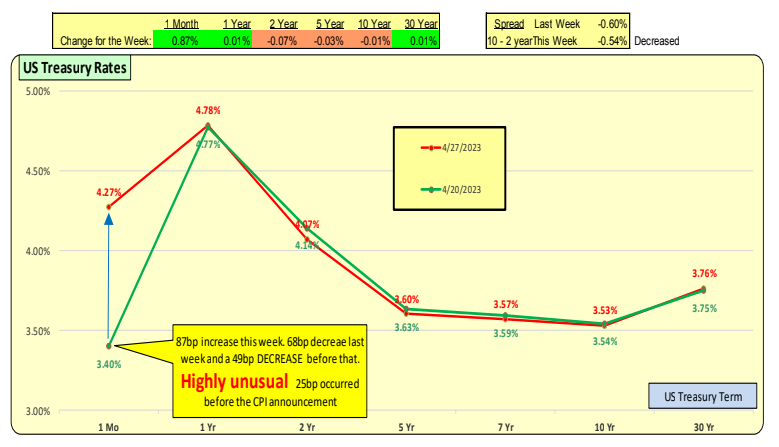

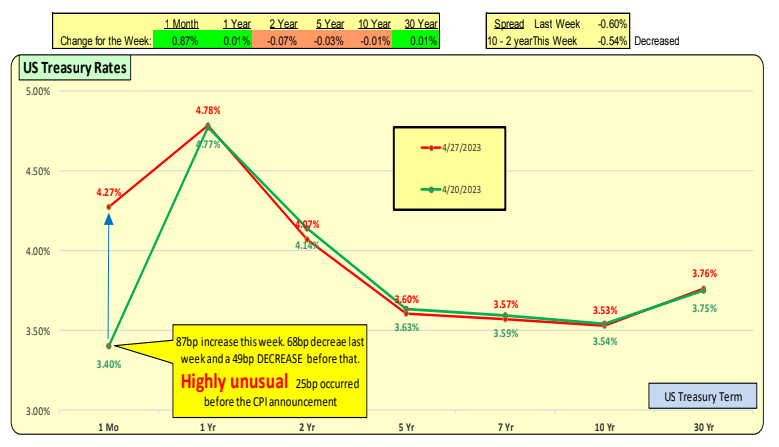

The red line represents the most current rates, while the green line represents rates from one week ago. The entire yield curve has changed very little; however, the one-month rate has increased by 87 basis points. In the prior week, it went down by 1.34%. These are very large changes, so buckle up. The yield curve inversion continues.

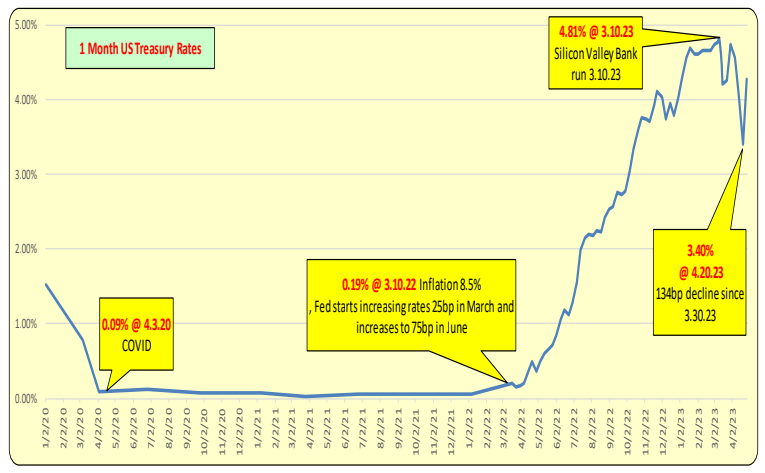

1-month US Treasuries have been extremely volatile. They went up by 87 basis points this week, but in the prior 3 weeks, they were down by 134 basis points. Something is going on. Is it a flight to safety from deposits in excess of $250,000? Are investors anticipating the Fed to curtail rate increases and maintain liquidity for an equity market rebound? Or is it related to the debt ceiling?