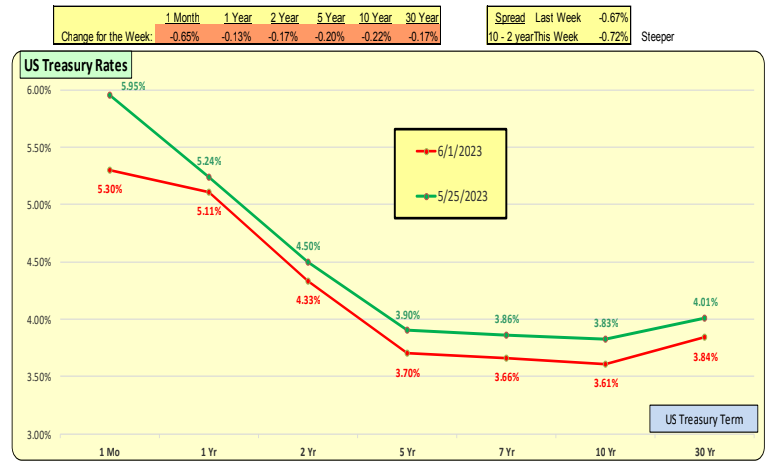

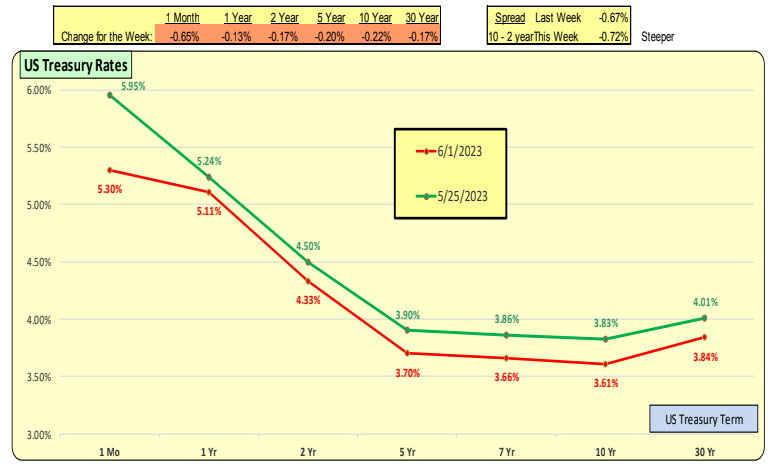

For the past 2 weeks, 10 Year Treasury rates were up 4bp. In the past week, they were down 22bp. On May 3rd, 2023, the Fed made an announcement that broadly hinted that future rate increases would be in a “wait and see mode”. The concerns over the Debt Ceiling were resolved on May 30, 2023.

The red line represents the current rates, while the green line represents rates from one week ago. The entire yield curve for the 1-2 year terms decreased 20bp while the longer term decreased more than the short term rates. This made the inverted yield curve steeper. The one month rates were down 65bp.

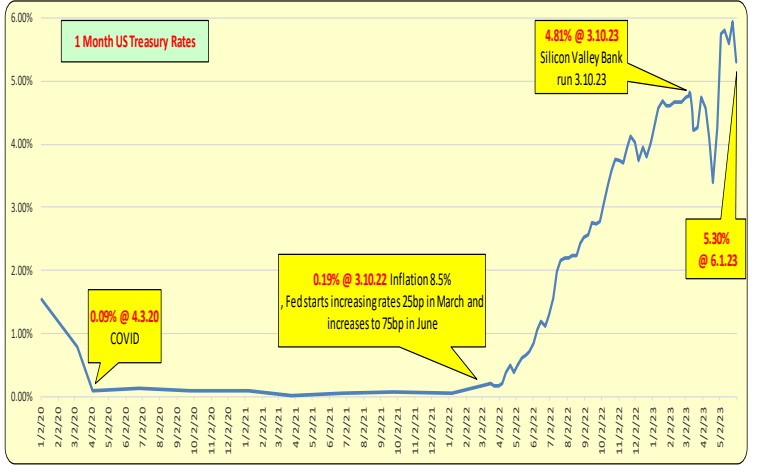

1-month US Treasury Rates while down a material 65bp this past week, note the prior increases. Any firm using short term financing for their operations is having a challenging time.

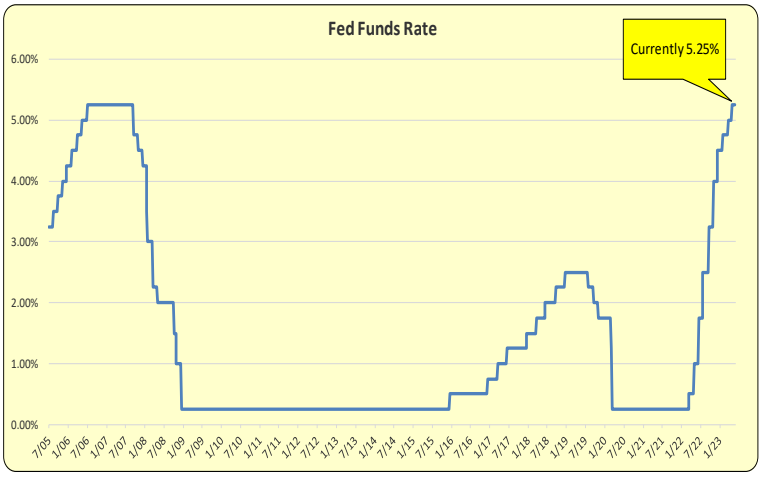

Fed meets June 14, and this may be the first FOMC meeting in over a year in which rates are not increased. CPI data for May is released on June 13, and it is expected that CPI will likely decrease from 4.9% to 4.1%.

Bill Knudson, Research Analyst LANDCO ARESC