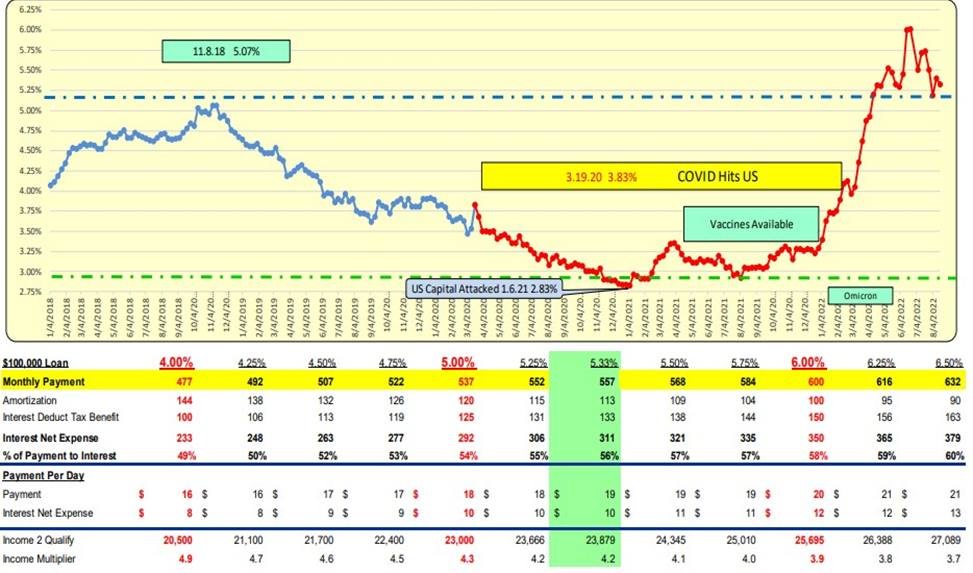

Mortgage rates DECREASE 7 bps to 5.33% for the week ending August 18th, 2022. For a $100,000 loan, the monthly payment DECREASED by $4 to $557/mo. or $0.13/day.

30-Year Mortgage Rates

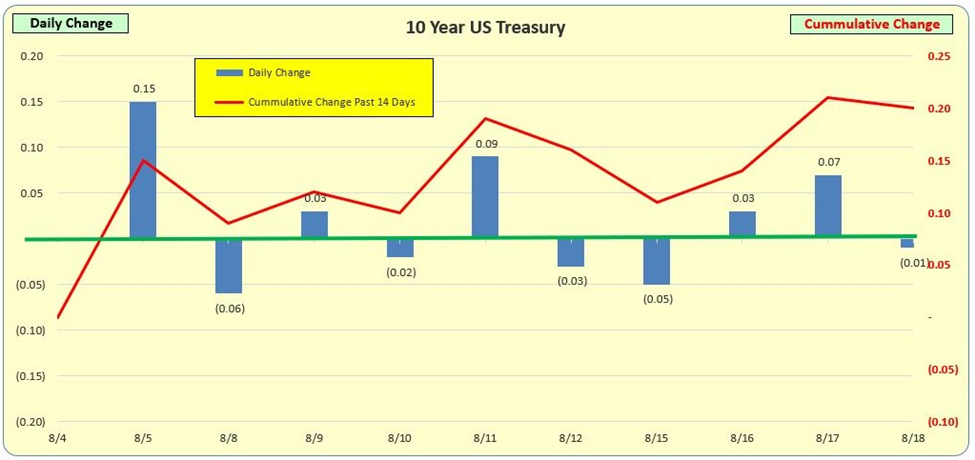

While mortgage rates DECREASED by 7 bps, 10 Year Treasury rates INCREASED by 11 bps. The net difference is an 8-bps increase in a spread of 245 bps. With the historical spread being 168 there now exists a “safety cushion” of 77 bps above this historical spread.

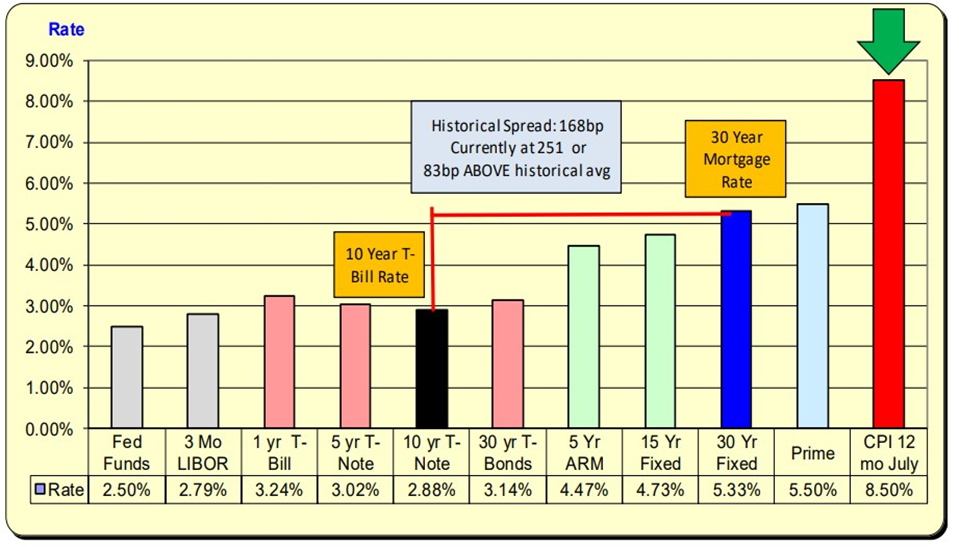

Lending Rates and Borrowing Costs

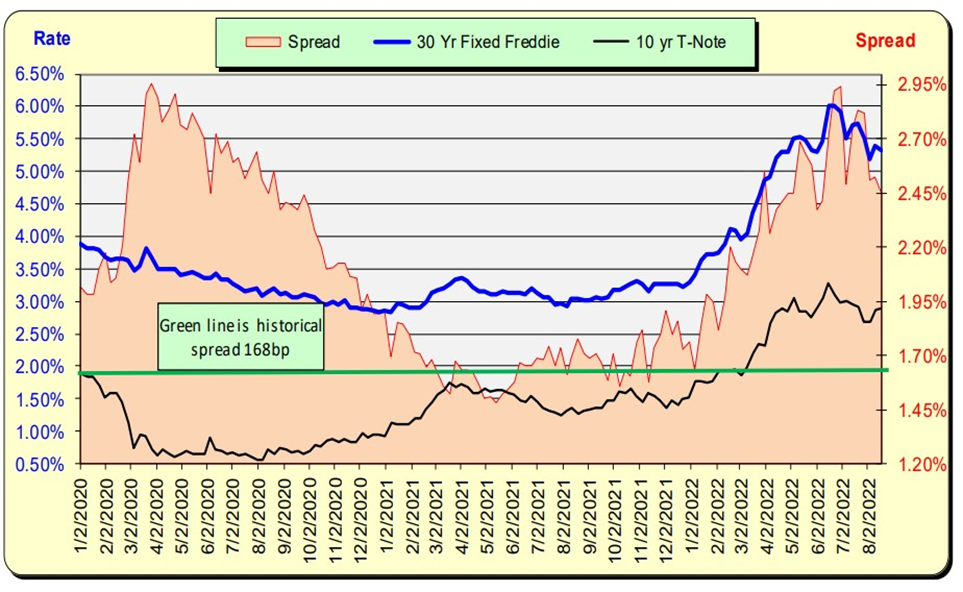

The historic spread between the 10 Year Treasury and mortgage rates is 168 bps (see the green line, right axis) and currently, there is a 77 bps above the historical norm. For this spread to return to the historical norm, either mortgage rates will decrease, or 10 Year Treasury rates will increase.

Green Line is Historical Spread

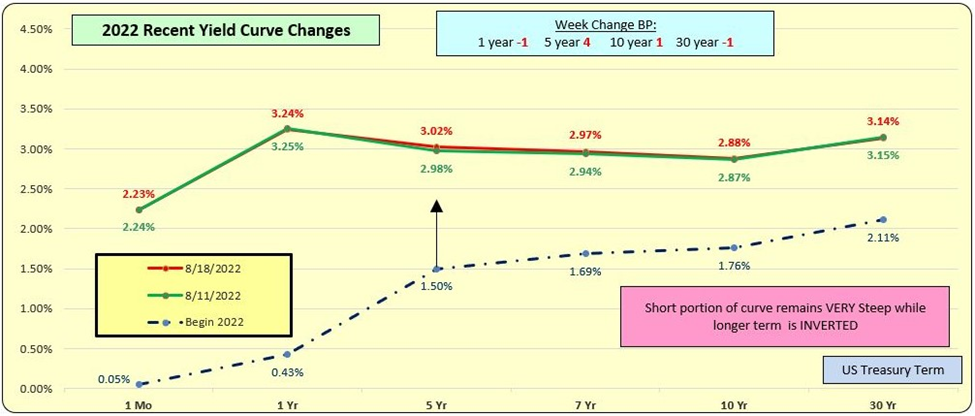

The Yield Curve Continues to be Inverted

Weekly New Unemployment filings are trending up, the Net New Jobs MONTHLY totals continue to be very solid, indicating an economy that is strong despite the Fed’s efforts to slow it down with higher interest rates. The next Fed meeting is Sept 21st.

Bill Knudson, Research Analyst Landco ARESC