For the past 4 quarters, all property types have incurred negative returns, with the office sector sustaining a total return of less than 14.5%. Office properties have experienced an appreciation return of 18.4% combined for the same period. This reflects changes in product demand and capitalization rate adjustments due to a higher interest rate environment. Industrial properties continue to exhibit the lowest Income Return, which is nearing its lowest level ever.

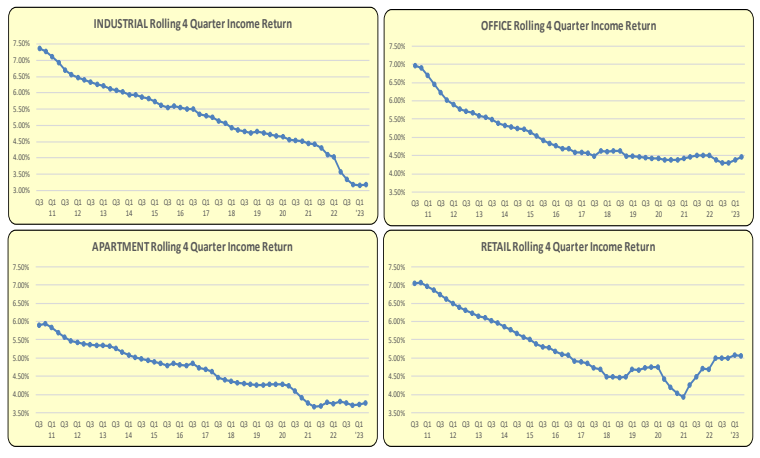

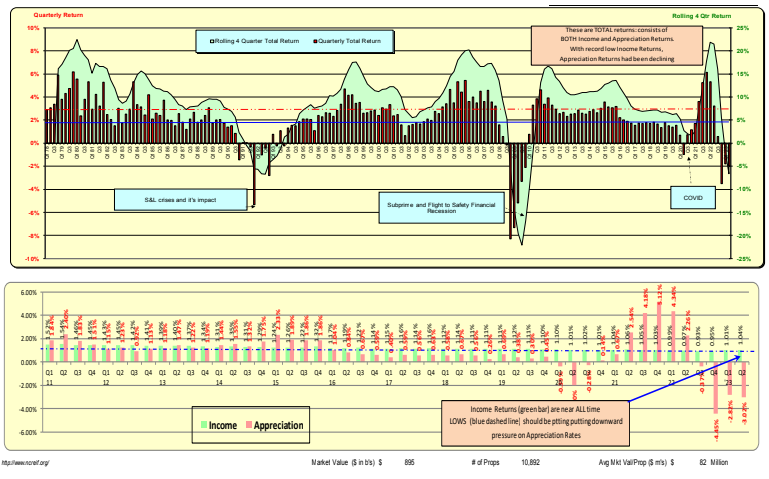

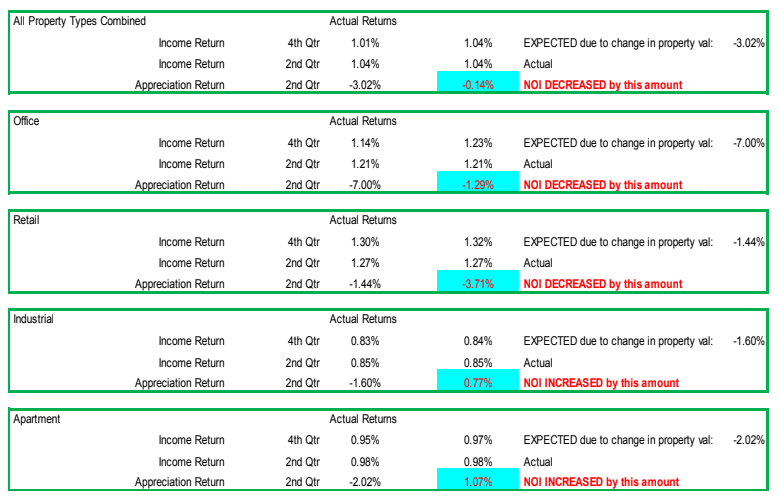

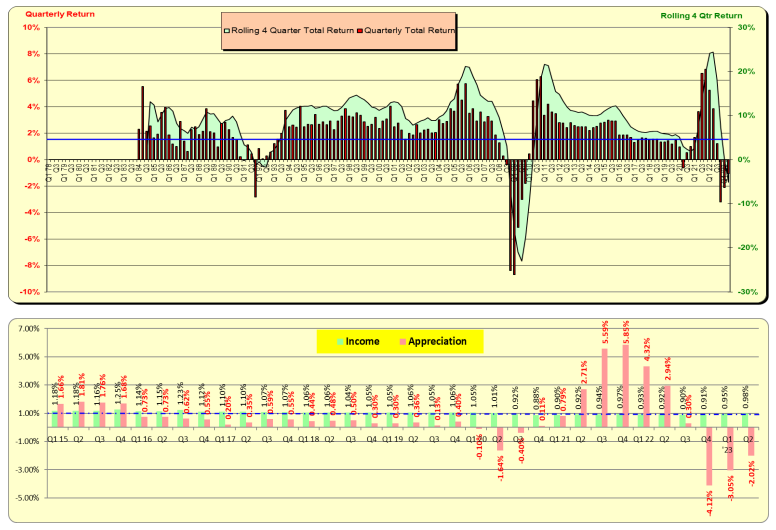

The rolling 4-quarter Income Returns for 3 out of the 4 property types are nearing record lows. This suggests that capitalization rates are also approaching record lows. Even with property value write-downs in the 2nd quarter, income returns did not change materially. The central question is whether the Net Operating Income (NOI) returns are influenced by property write-downs or actual increases in NOI.

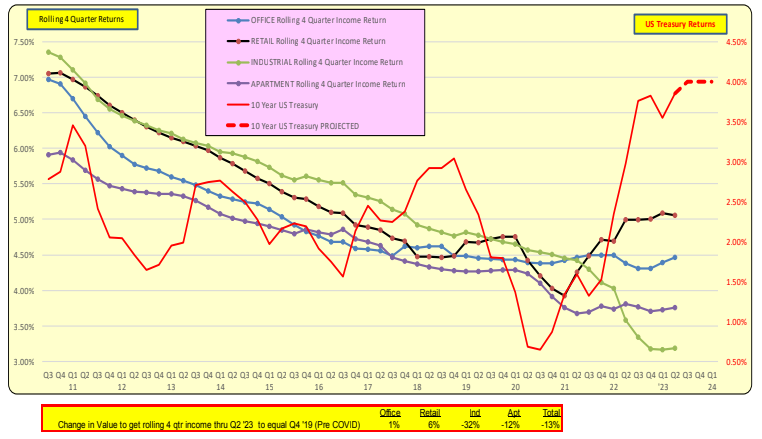

There is a strong correlation between the US 10-Year Treasury Rate and the rolling 4-Quarter Income Returns. Property returns are fundamentally risk-based in relation to the US Treasury 10-year rates, which experienced a significant increase beginning in Q2 2022. The dashed red line represents the projected rates leading into Q4 2024, based on the latest Federal Reserve ‘dot plot’ and the spread of the inverted yield curve’s 10-Year Treasury. This is expected to exert a materially adverse impact on both income and appreciation returns moving forward.

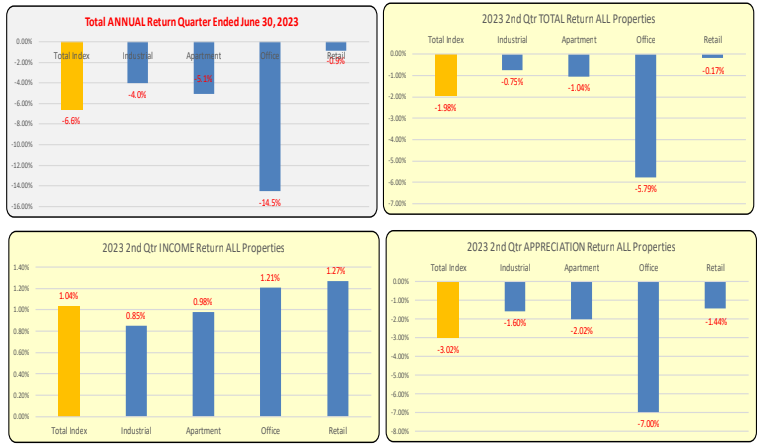

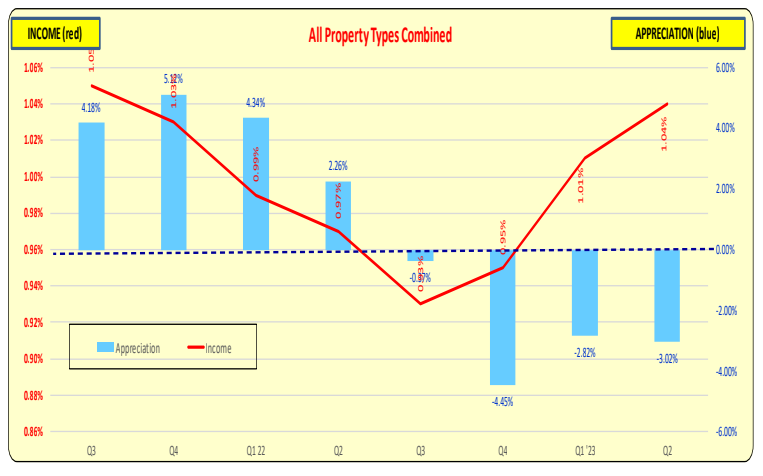

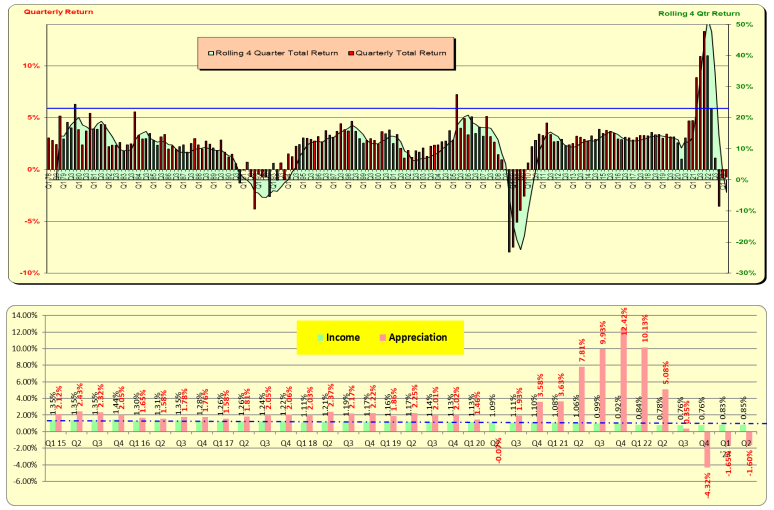

Combined Performance Across All Property Types: Income returns saw a marginal 3bp increase in Q2, primarily due to negative property appreciation. The persistently low income returns raise concerns, especially considering the growing competition from benchmark asset classes. Appreciation returns, on the other hand, remained in the negative territory throughout Q2 and declined further to 3.02% by Q2 2023.

Combined Performance Across All Properties: The annual return turned negative in Q4 and will continue to decline into the future as prior quarters with high returns drop off. Total returns were propelled by industrial properties, yet even this property type’s returns have become negative in Q4. Please observe in the lower graphic that quarterly income returns persist near record lows.

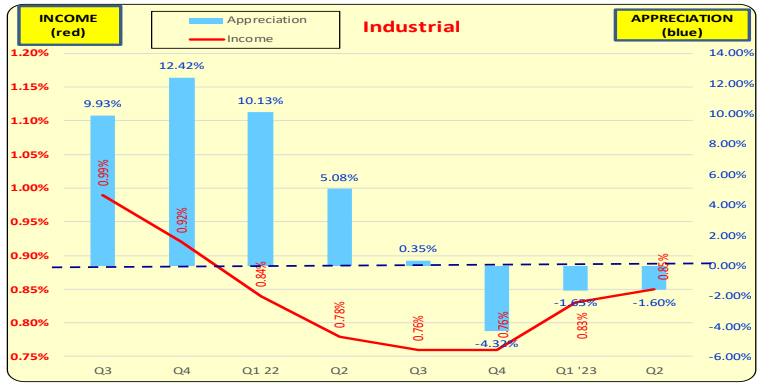

NOI Growth from Property Devaluation vs. NOI Increase: Notably, NOI increased for both industrial and apartment property types. Despite a 1.60% decrease in property value for industrial properties, the NOI return increased by 1 basis point (bp) in 2Q.

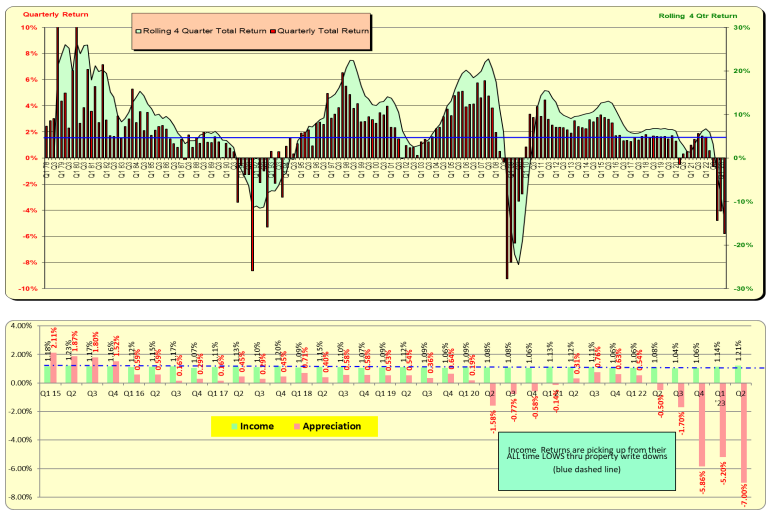

Industrial: Total returns have been driven by record-shattering Appreciation returns. Meanwhile, Income returns have been decreasing, indicating anticipation of future income increases or declines in cap rates.

Considering the rise in 10-Year Treasury rates, there is room for debate about whether the lower cap rates can be sustained. While it is true that demand for Industrial property surged during the 2020-2022 COVID outbreak as people stayed home and engaged in more online shopping, the persistence of this trend at high levels remains uncertain with COVID becoming less of a public policy concern.

Industrial: The era of record returns has come to an end. Income returns have reached record lows (the lowest of any property type that I can recall), and appreciation is declining rapidly, which will consequently drag down the total returns.

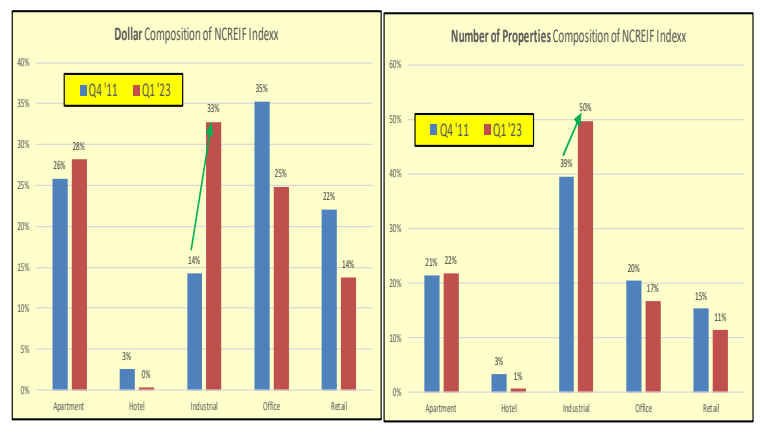

Industrial Properties as a Percentage of NCREIF: The composition of NCREIF gradually changes over time by property type. Below are the changes observed during the 12-year period from Q4 2011 to Q1 2023. Notably, there has been a substantial increase in Industrial Properties. This change in composition has contributed to a higher Total NCREIF return, attributed to the remarkable performance of industrial properties. However, caution is advised concerning the record-low income returns of Industrial Properties.

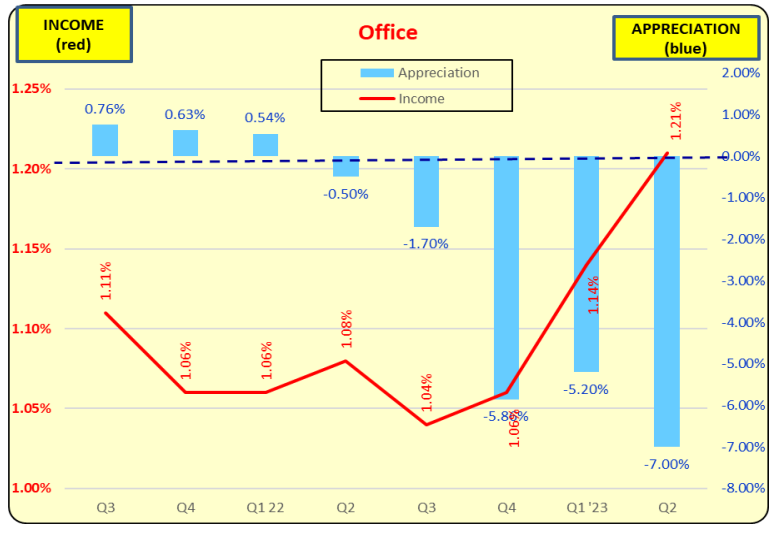

Office: Income returns increased in Q2, propelled by the negative appreciation of 18% over the past 3 quarters.

Office: With a drop in demand induced by COVID, alongside rising 10-year Treasury rates and a looming recession, the outlook for the office sector appears unfavorable. While income returns are no longer near all-time lows due to property write-downs, challenges persist.

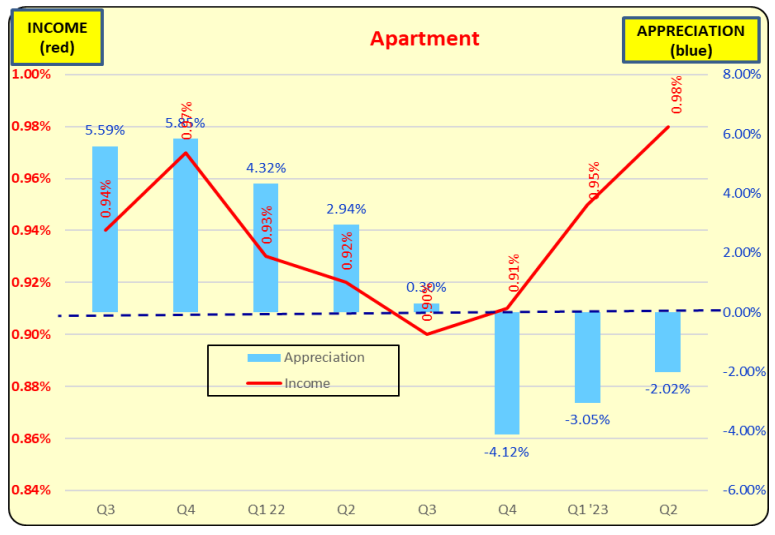

Apartment: Income returns have increased due to a 9% decrease in property values over the past 3 qtrs.

Apartment: Total annual returns will decline rapidly as the previously high quarterly returns are not being sustained.

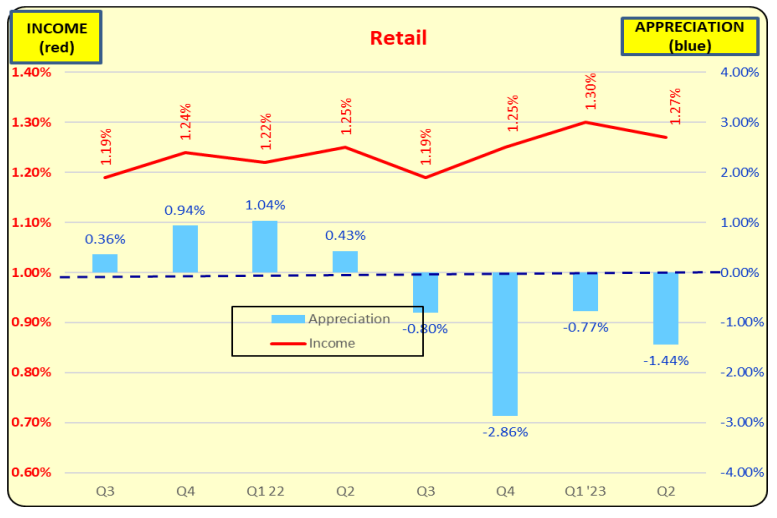

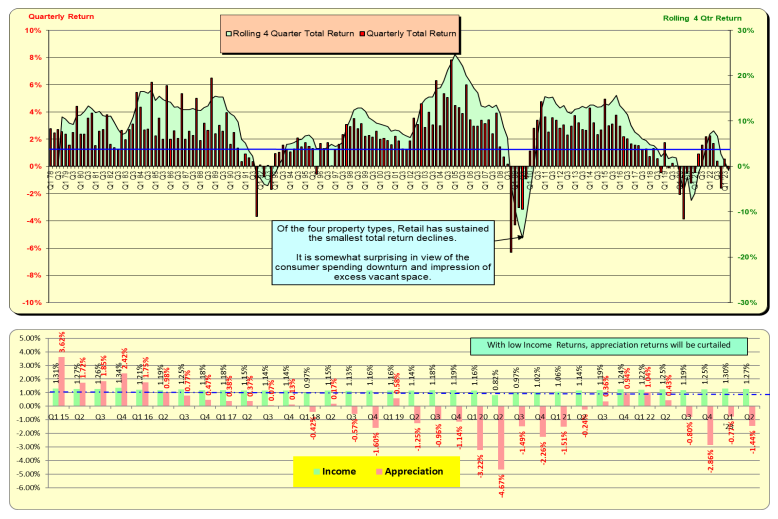

Retail: Despite recent negative appreciation returns, income returns, which had been gradually increasing, decreased in Q2.

Retail: Retail was adversely affected by COVID and is currently undergoing a sluggish recovery. Unlike some other property types, retail properties did not experience valuation spikes leading up to or during the COVID time periods.

Bill Knudson, Research Analyst LANDCO ARESC