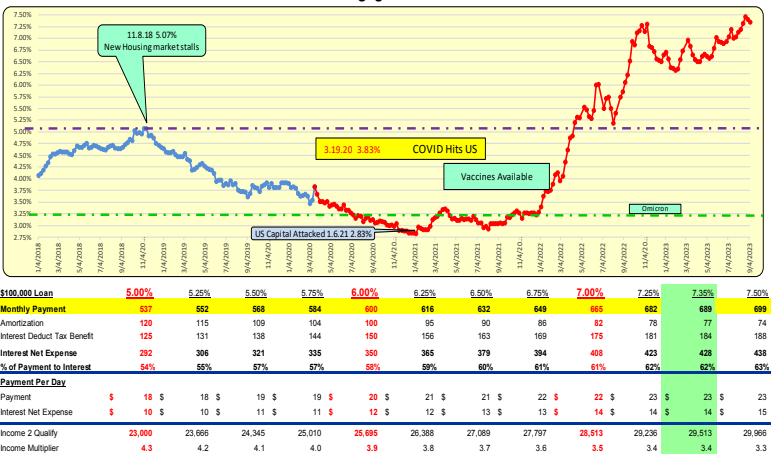

For the week ending 9/07/23, mortgage rates decreased by 6 basis points to 7.35%. For a $100,000 loan, the monthly payment decreased by $4 to $689 per month or $0.14 per day.

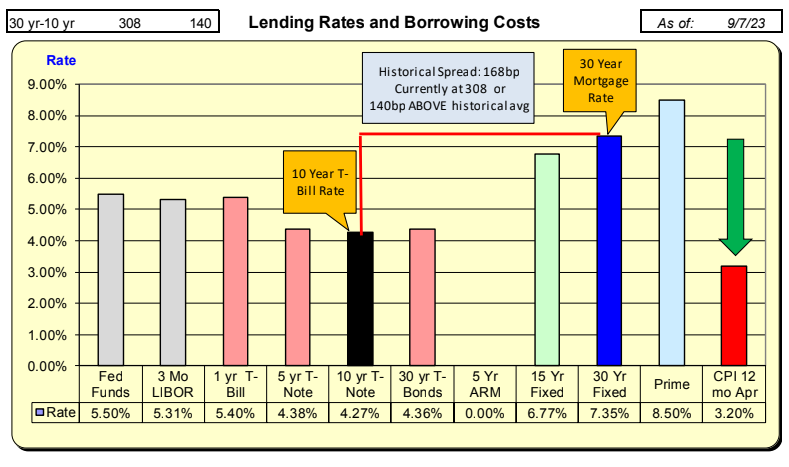

Mortgage rates decreased by 6 basis points, while the 10-year Treasury rates increased by 18 basis points for the week ending 9/7/23. The net difference resulted in a 24 basis point increase in the spread to 308 basis points. With the historical spread being 168, there now exists a ‘safety cushion’ of 140 basis points above the historical spread.

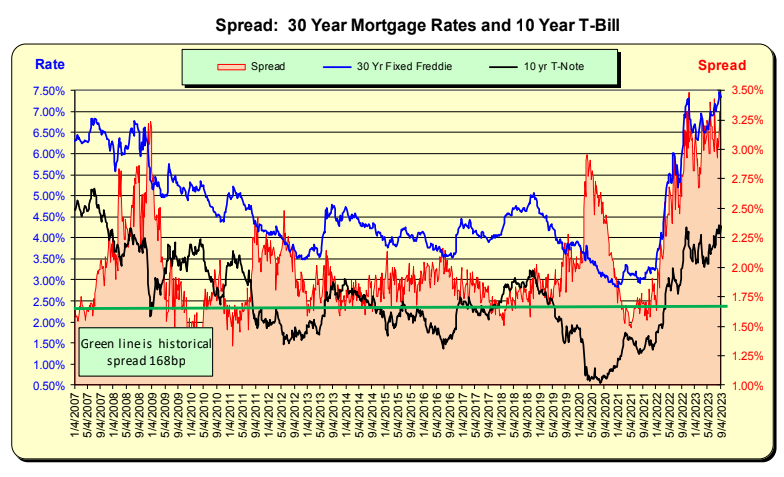

The historical spread between the 10-Year Treasury and mortgage rates is 168 basis points (see green line, right axis), and it currently stands at 140 basis points above the historical norm.

Bill Knudson, Research Analyst LANDCO ARESC