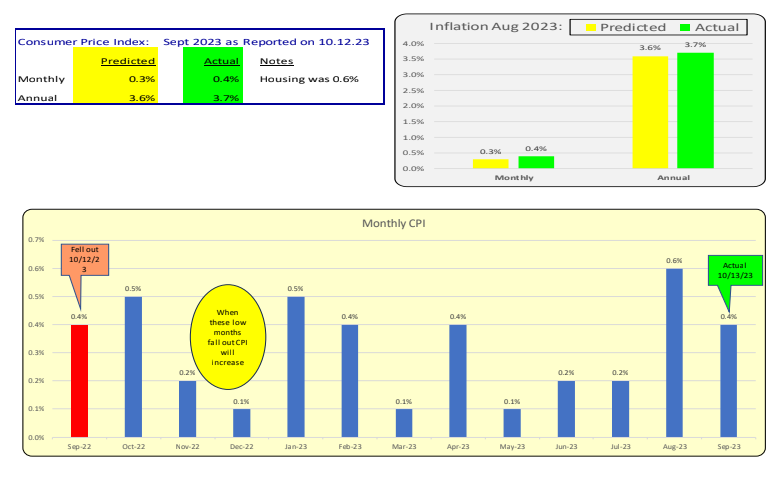

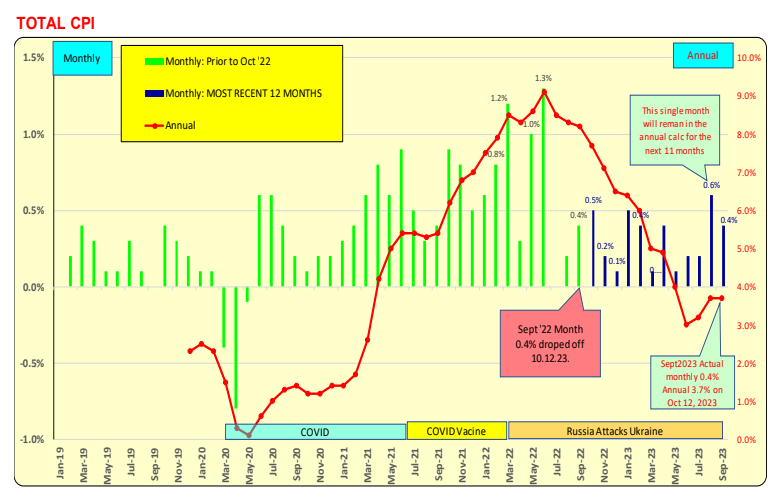

Inflation September 2023 was reported on 10.12.23, with an annual rate remaining unchanged at 3.7%.

Predicted vs. Actual and a Forward Look: On 9.13.23, the CPI for September 2023 is projected to remain stable at 0.4%, equivalent to the figure for September 2022, indicating no change in the annual CPI. The projected monthly CPI is expected to be 0.3%.

Shelter costs came in at twice the level experienced in recent prior months.

Total CPI: Projection was very close to Actual.

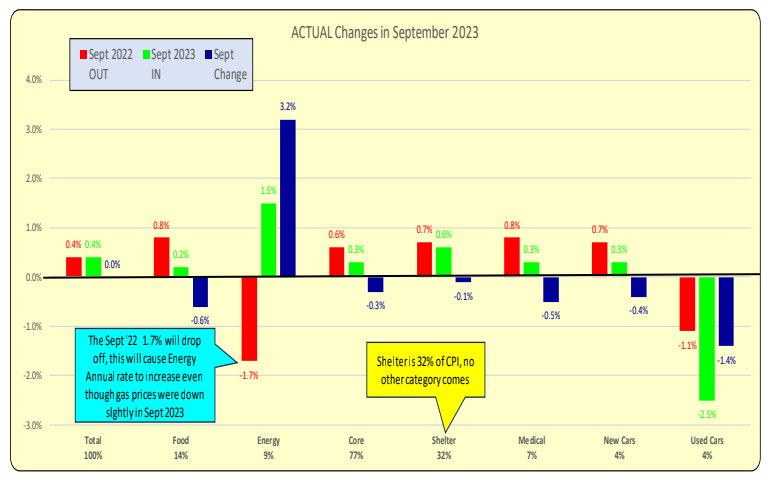

INFLATION Projection for September: September 2023 data will be reported on 10.12.23. The Total CPI is expected to decrease slightly from 3.7% to 3.6% as the September 2022 figure of 0.4% drops off. Energy prices are projected to increase as the negative impact of September 2022, which was 1.7%, drops off.

Total CPI: The annual CPI is a rolling product of 12 monthly data points. Think of it as being 12 dominoes. As a new one comes in, the oldest one falls off. In this case, the next one is September 2022’s 0.4%, which drops off and is replaced by September 2023’s 0.4%. Since they were equal, the result was no change in the annual CPI, which remains at 3.7%.

FOOD: The improvement in food-related data continues as older monthly tall bars drop off.

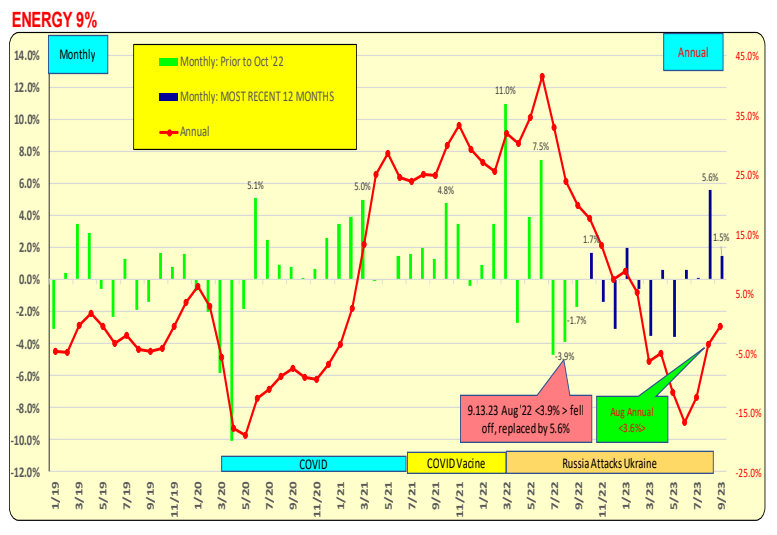

ENERGY: The annual energy figures will continue to rise as older negative bars drop off, provided there are no additional increases.

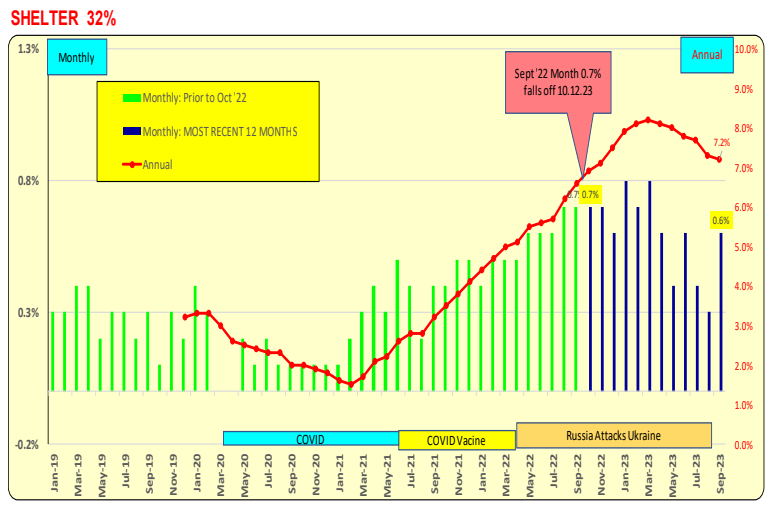

Core CPI: Core represents 77% of all CPI, with shelter being the largest component at 32% of all consumer expenditures. Core showed improvement in September as the older bar fell off. There is only one more older tall bar left to fall off. The improvement in the core will slow down once the October data is reported on November 14.

Core Shelter comprises nearly a third of the CPI. It should continue to improve as the older tall blue bars fall off. The increase in September 2023 appears to be a one-off event.

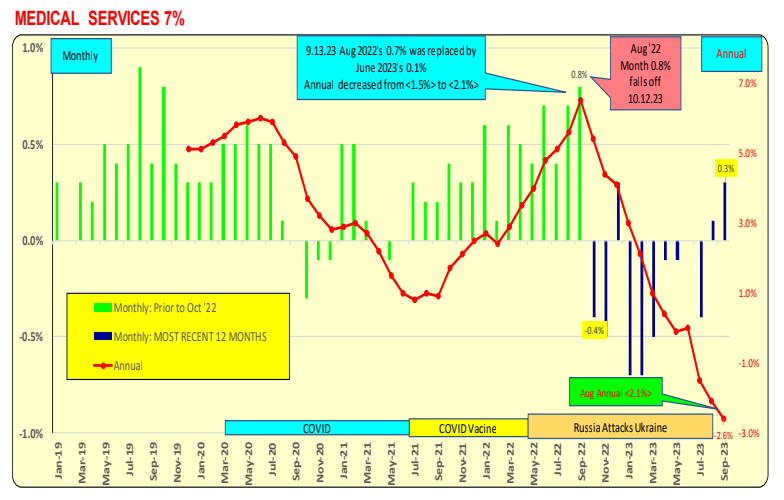

MEDICAL SERVICES: The last tall bar in core Medical Services was in September 2022. Decreases in medical service prices have been a major contributor to the overall CPI improvement, but that is going to stop in October as the negative totals from 2022 start dropping off.

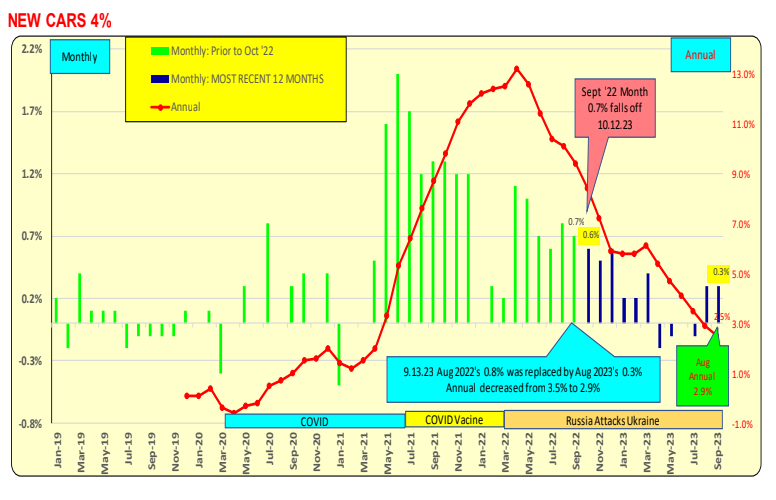

NEW CARS: The slowdown in new car prices continues to contribute to the overall CPI improvement. It has three more months to run as the older tall bars fall off. The very tall green spikes are a thing of the past. If the labor strike in this sector continues, its impact on prices remains to be seen.

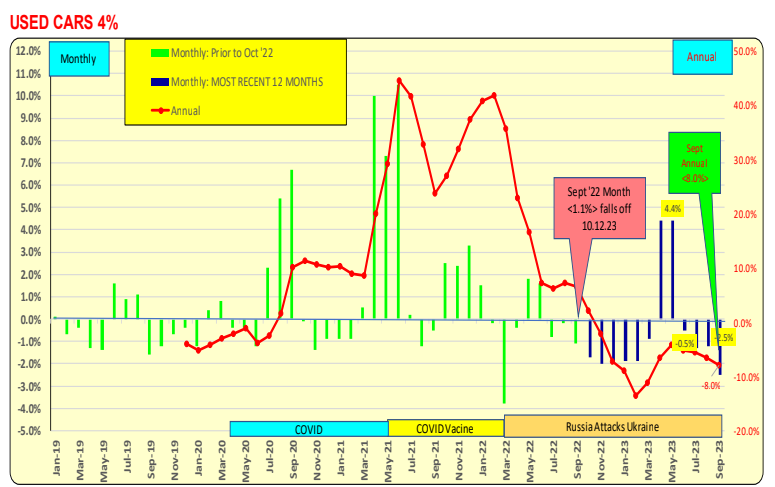

USED CARS: The improvement in the overall CPI due to decreases in used car prices will slow down as the negative figures from older months start falling off in October.

Bill Knudson, Research Analyst LANDCO ARESC