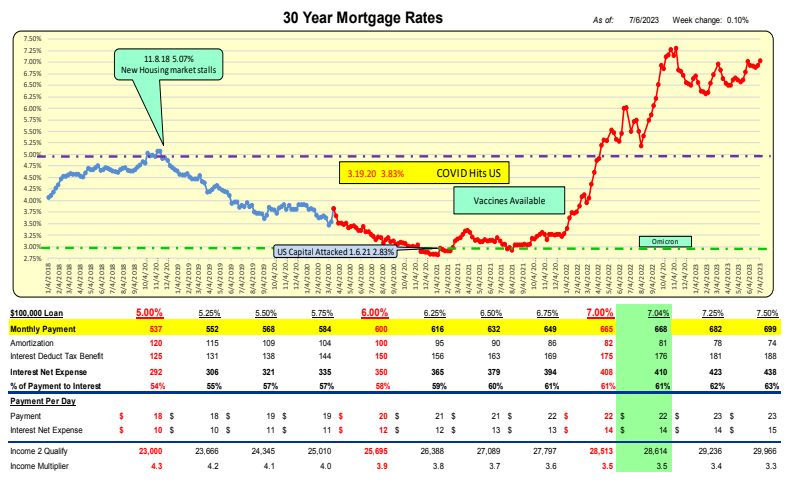

For the week ending 7/6/23 Mortgage rates increased 10bp to 7.04%. At the beginning of June, rates were 7.02% and by July 4 they were 7.04% virtually no change. For a $100,000 loan the monthly payment increased $7 to $668/mo or $0.22/day.

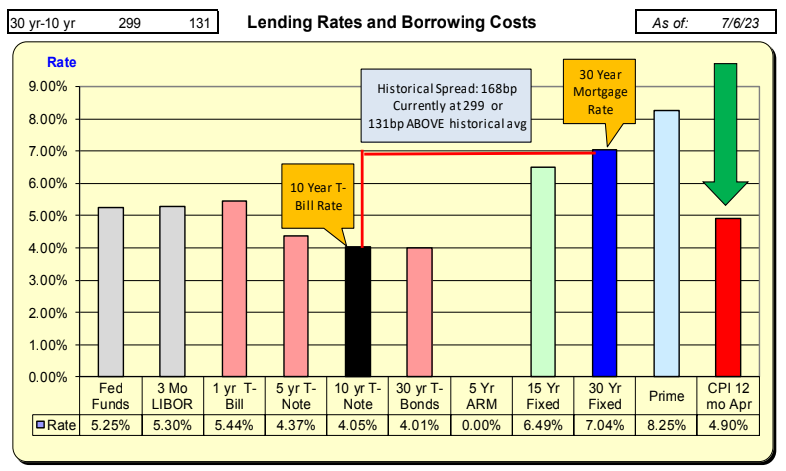

Mortgage rates increased 10bp and 10 Year Treasury rates increased 20bp for the week ended 7/6/23. The net difference resulted in a decrease of 10bp in the spread to 299bp. With the historical spread being 168, there now exists a “safety cushion” of 131bp above the historical spread.

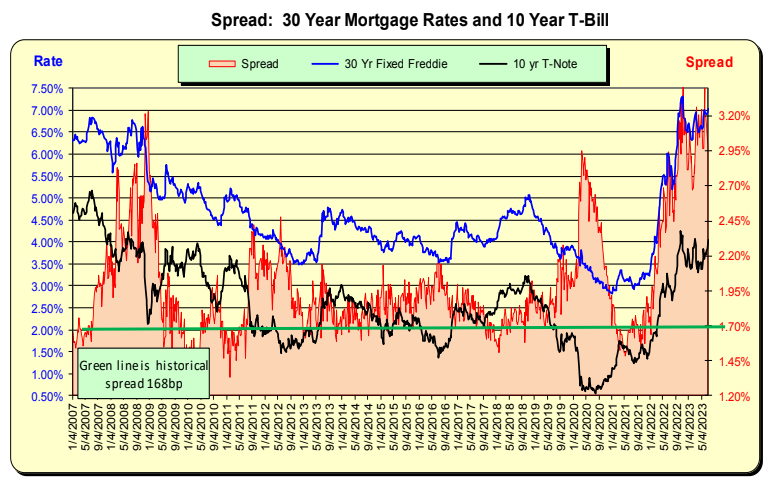

The historic spread between the 10 Year Treasury and mortgage rates is 168pb (see green line, right axis) and currently, there is a 131bp above historical norm. For this spread to return to the historical norm, either mortgage rates will decrease or 10 Year Treasury rates will increase.

Bill Knudson, Research Analyst LANDCO ARESC