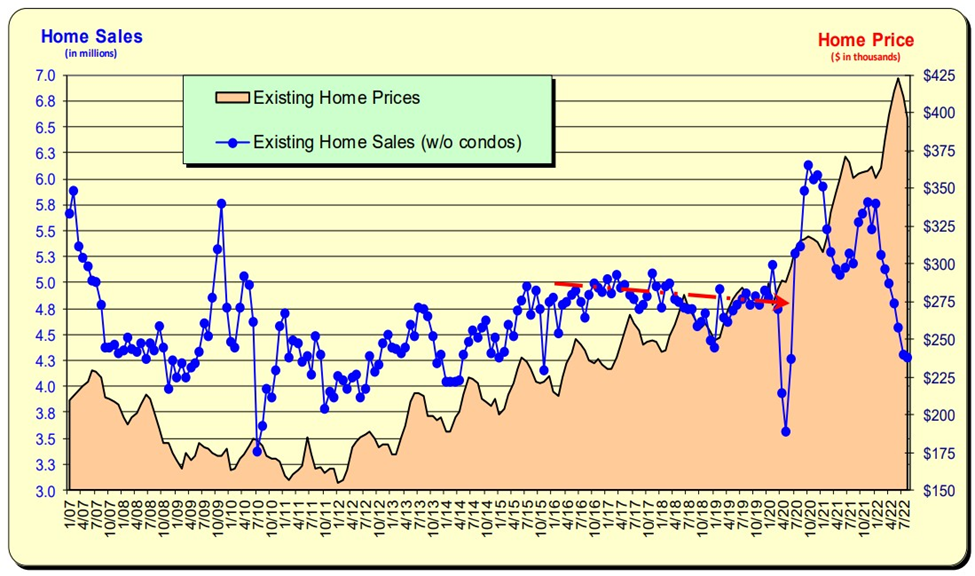

Existing Homes Sales continue to decline (see blue line) due to rising mortgage rates, higher home prices (although prices have declined slightly), and relatively few homes for sale.

August’s sales are the closing of homes that went under contract in June/July when mortgage rates were 5.35%. Mortgage rates are now headed to 7.00% as of late Sept/early Oct.

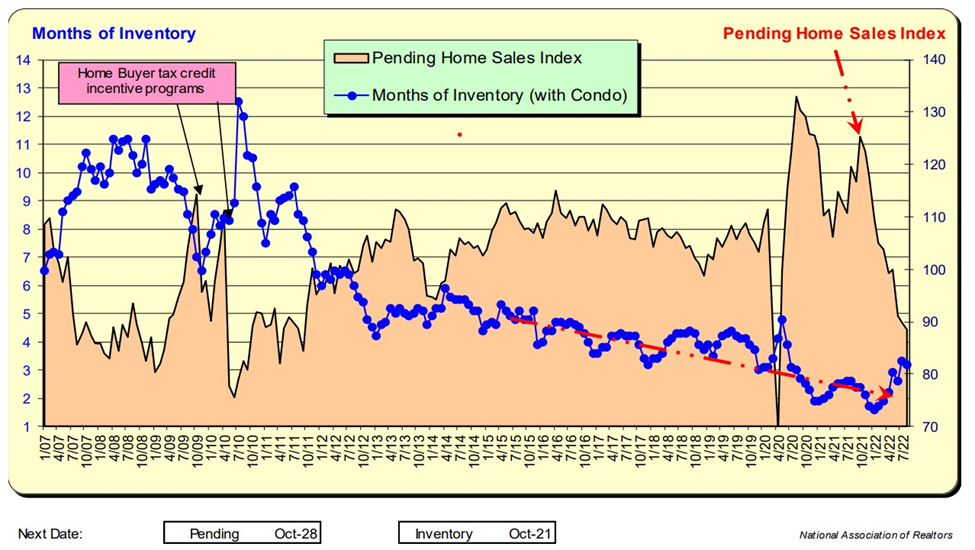

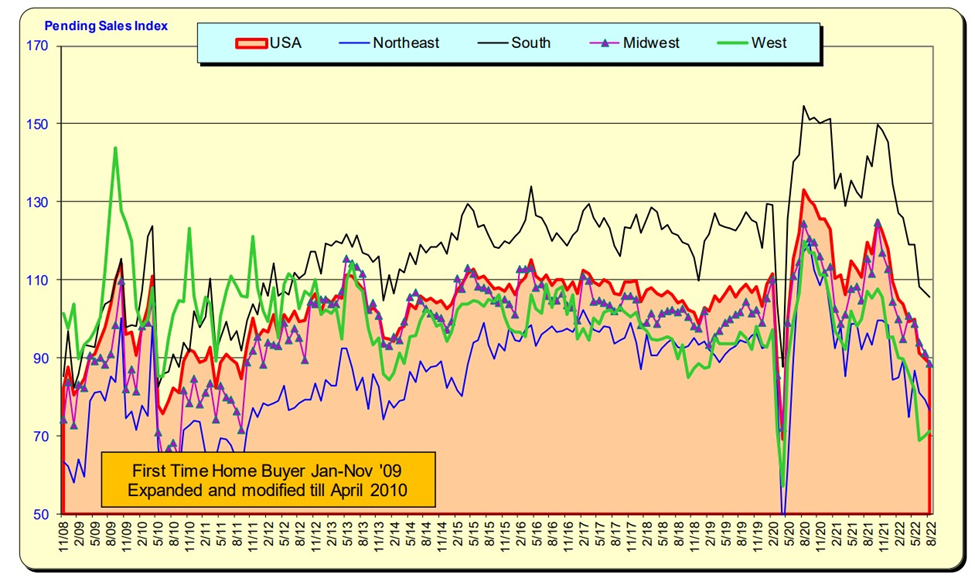

The National Association of Realtor’s Pending Sales Index has been in a free fall but now appears to be slowing. One or two months don’t make a trend, but it could be a start.

The months of inventory are increasing but remain in record low territory. This is a combination of fewer recent sales (supply constrained, rising mortgage rates, and higher home prices). These record low sales happening in July and not later in the fall season may be cause for concern.

The number of EXISTING home sales also continues to decrease as both home prices and mortgage rates increased. The inventory remains low as well as homeowners decide not to sell until the markets improve.

Existing Home Sales and Prices

Months of Inventory for existing homes remain near record lows but have started to increase. Pending Home Sales Index has materially decreased over the past 8 months—initially due to a lack of homes for sale AND now rising mortgage rates and home prices.

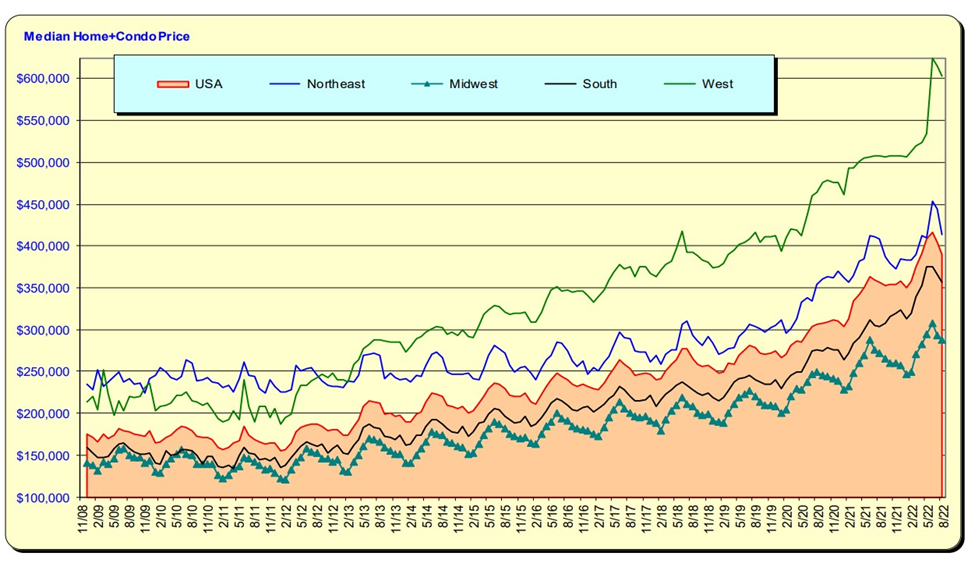

It is noted there was a decline in July and August. This is normally a strong selling month. For the West—note in the graph below, the flat monthly prices prior to the sudden recent acceleration.

Existing Homes Supply For Sale and Pending Sale Index

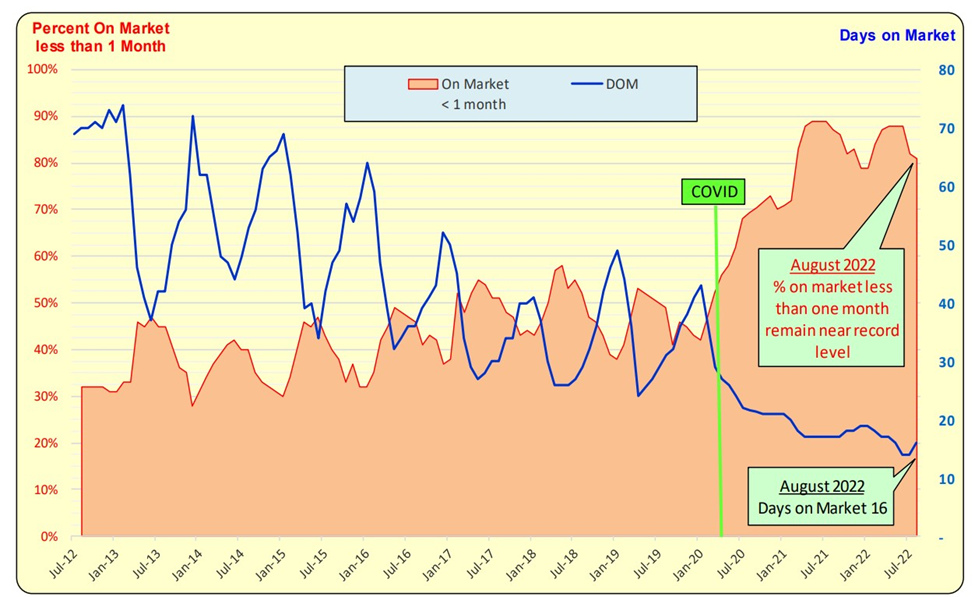

Prior to COVID-19, the Days on Market (DOM is the blue line) had been gradually decreasing. After COVID-19 the days on market reached record lows and are now 16 Days as of August 2022. 80% of all properties sell in ONE MONTH (red line). – See graph below

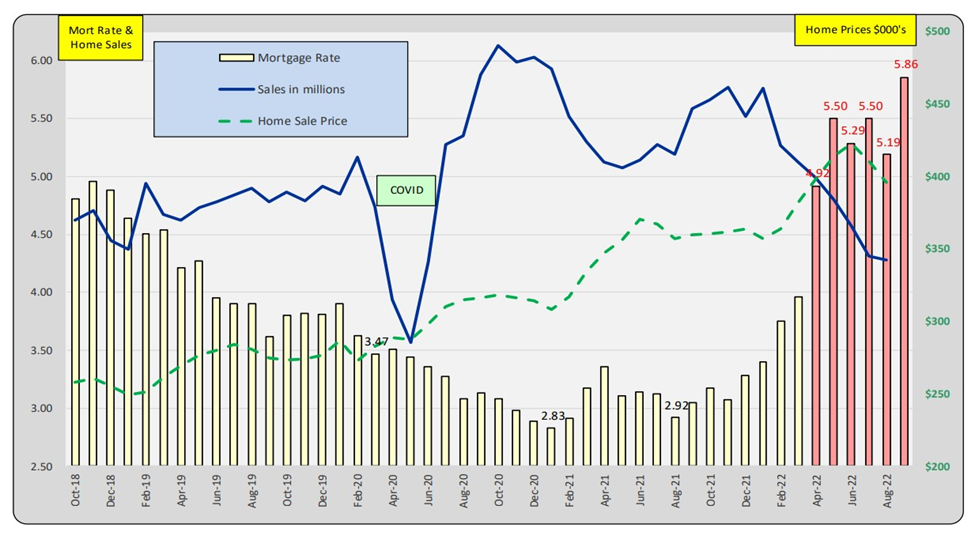

Mortgage rates are now well above 5.00% (red bars) and it is anticipated that this will have a dampening effect on home sales. (blue line). The rate increases in April-July will impact August+ closings. Home prices are the dashed green line and even with mortgage rates rising, home prices rose. This has occurred in the past when rates rose—-future near-term home buyers rushed into the market to buy before mortgage rates rose further.

Mortgage Rates and Home Sales

Median home prices for all regions accelerated in early 2022 just as mortgage rates rose. It is noted there was a decline in July and August. This is normally a strong selling month. For the West—note the flat monthly prices prior to the sudden recent acceleration.

Existing Home Prices

The National Association of Realtor’s Pending Sales Index has been declining from its record highs with substantial declines noted in the South and West regions. The declines are a combination of

1. Higher mortgage rates

2. Higher home prices

3. Relatively few homes for sale

Pending Sales Index

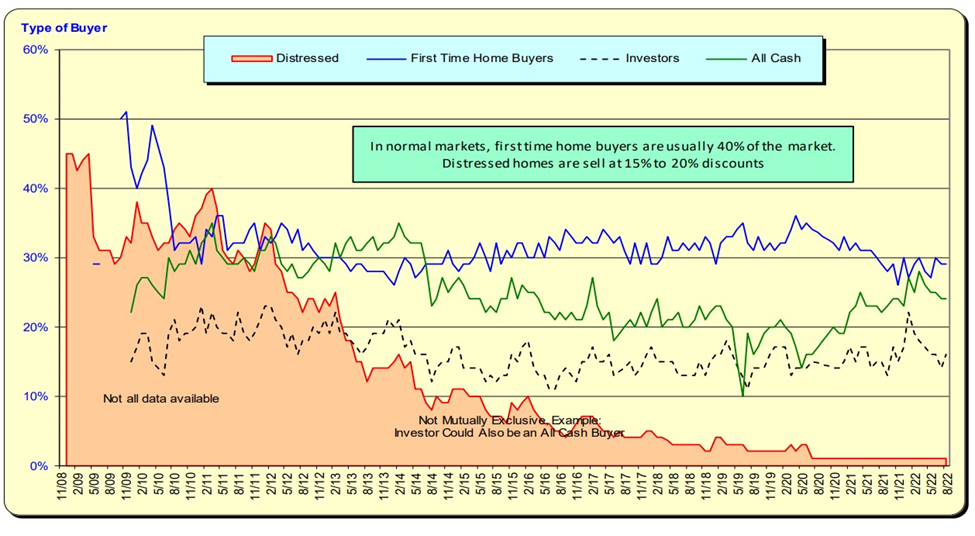

Distressed-related home sales remain at record low levels. With recent home price appreciation, distressed homeowners will be able to sell and not sustain equity losses due to foreclosures. First-time home buyers have decreased as mortgage rates and home prices have increased. Record low mortgage rates allowed 5 times income ratios; the ratio now is 3.7 based on 6.50%. All cash purchases have increased even though investor purchases have not materially increased.

Type Of Buyer

Bill Knudson, Research Analyst Landco ARESC