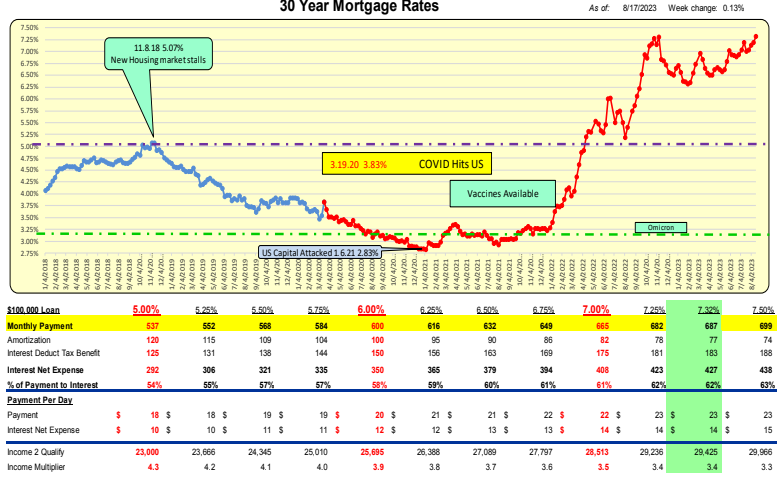

For the week ending 8.17.23, mortgage rates increased by 13bp to 7.32%.

For a $100,000 loan, the monthly payment increased by $9 to $687 per month or $0.29 per day.

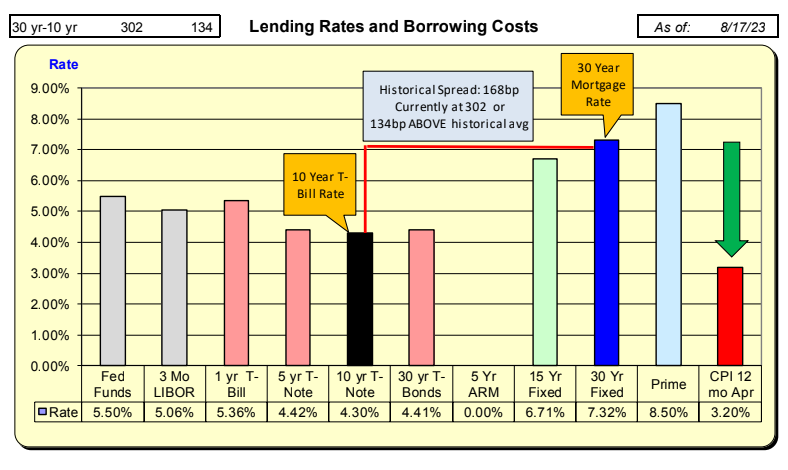

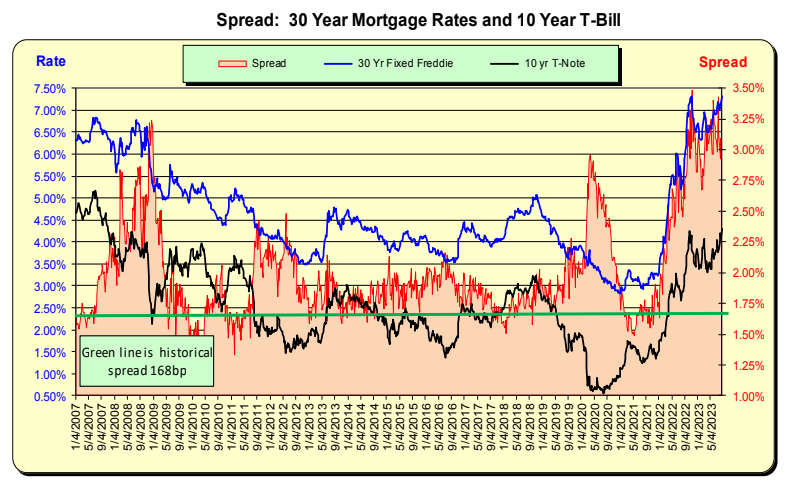

Mortgage rates increased by 13bp, and simultaneously, the 10-Year Treasury rates rose by 21bp for the week ending 8/17/23. The net difference led to an 8bp decrease in the spread, bringing it down to 302bp. With the historical spread having been 168, there is now a “safety cushion” of 134bp above the historical spread.

The historical spread between the 10-Year Treasury and mortgage rates stands at 168bp (as indicated by the green line on the right axis), and it currently remains 134bp above the historical norm.

Bill Knudson, Research Analyst LANDCO ARESC