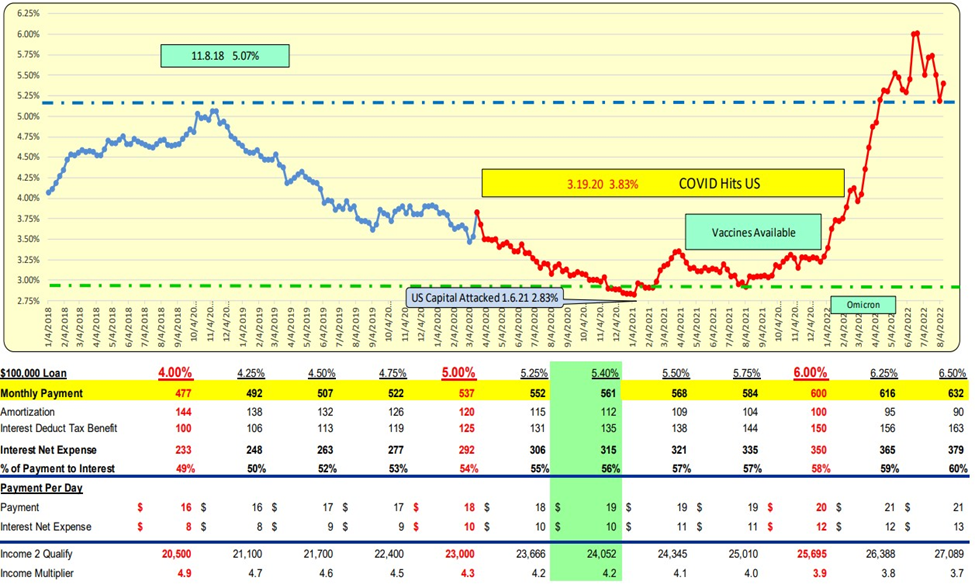

Mortgage rates INCREASE 21 basis points to 5.40%. For a $100,000 loan, the monthly payment INCREASED by $13 to $561/mo. or $0.42/day.

30-Year Mortgage Rates

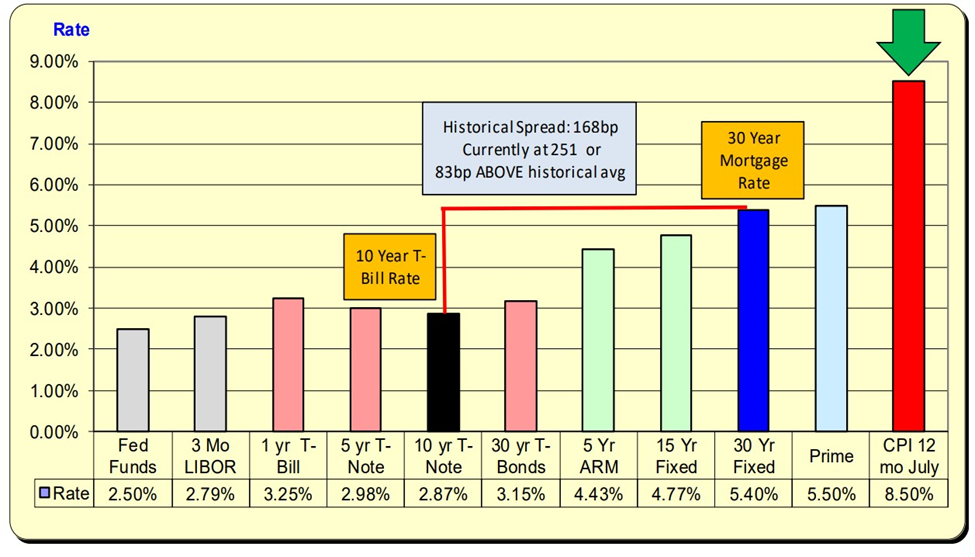

While mortgage rates INCREASED 21bp, 10 Year Treasury rates INCREASED 19bp. The net difference is a 2bp increase in a spread of 253bp. With the historical spread being 168 there now exists a “safety cushion” of 85bp above this historical spread.

Lending Rates and Borrowing Costs

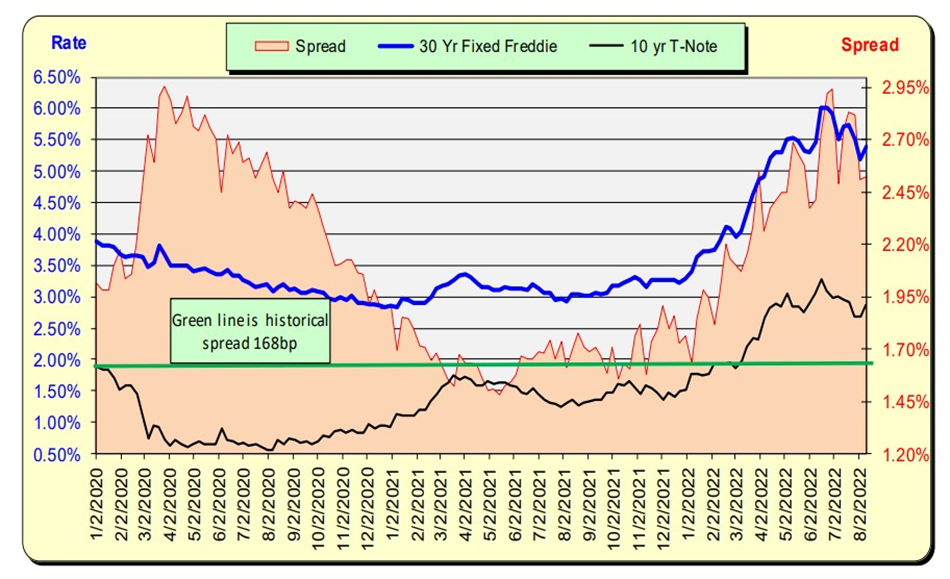

The historic spread between the 10 Year Treasury and mortgage rates is 168 bps (see the green line, right axis) and currently, there is an 85bp above the historical norm. Last week’s 31bp decrease in mortgage rates without an offsetting decrease in Treasury rates seemed odd and did NOT last long.

Spread Between 10-Year Treasury and Mortgage

Bill Knudson, Research Analyst Landco ARESC