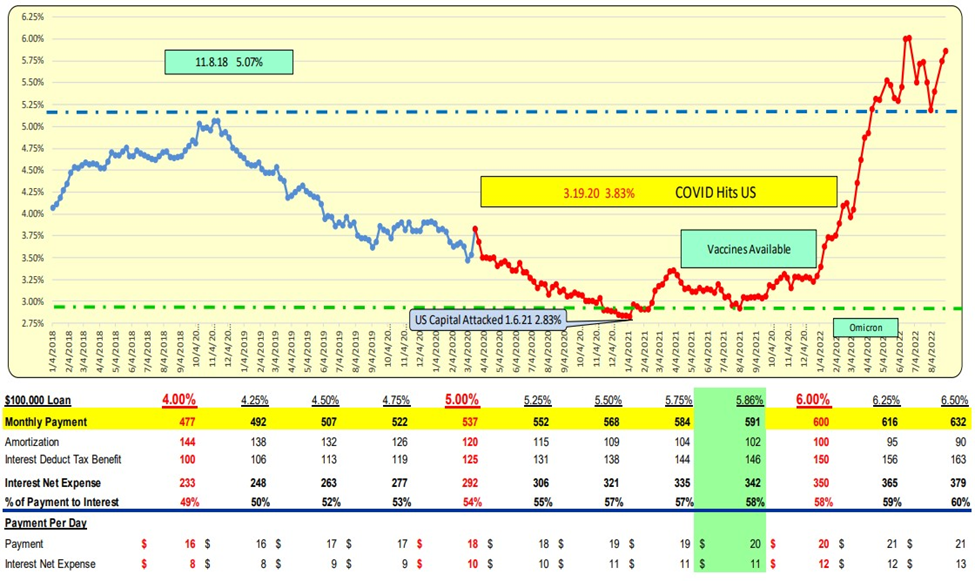

Mortgage rates INCREASE 21 bp to 6.07% for the week ending September 8th, 2022. For a $100,000 loan, the monthly payment INCREASED from $13 to $604/mo. or $0.44/day.

30-Year Mortgage Rates

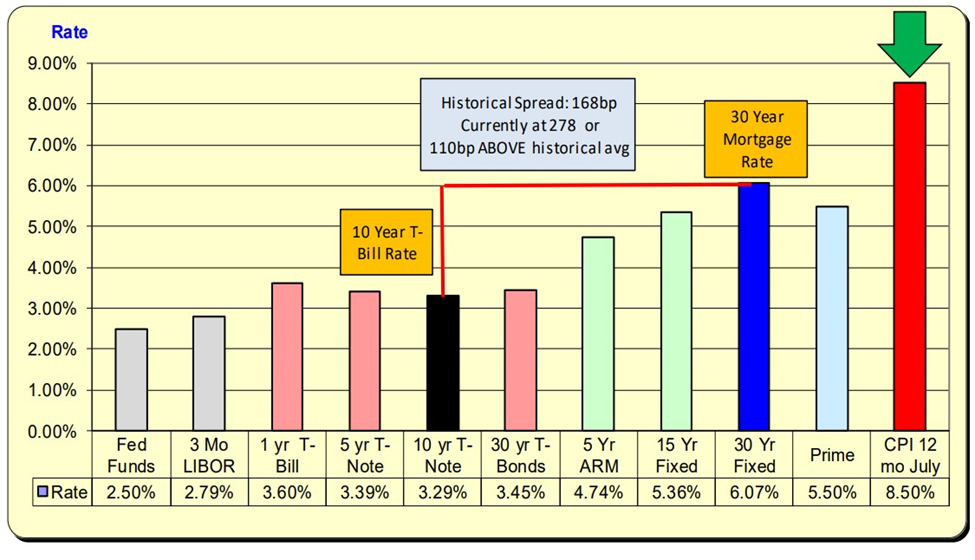

While mortgage rates INCREASED by 21 bps, 10 Year Treasury rates INCREASED by 3 bps. The net difference is an 18-bps increase in a spread of 278 bps. With the historical spread being 168 bps, there now exists a “safety cushion” of 110 bps above this historical spread.

Lending Rates and Borrowing Costs

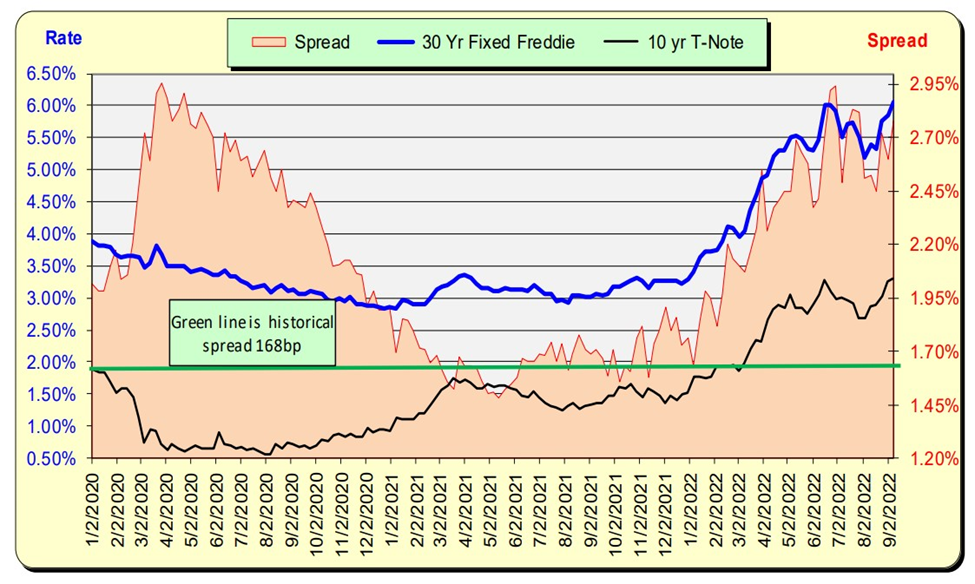

The historic spread between the 10 Year Treasury and mortgage rates is 168 bps (see the green line, right axis) and currently, there are 110 bps above the historical norm. For this spread to return to the historical norm, either mortgage rates will decrease, or 10 Year Treasury rates will increase.

The Green Line is a Historical Spread of 168 bps

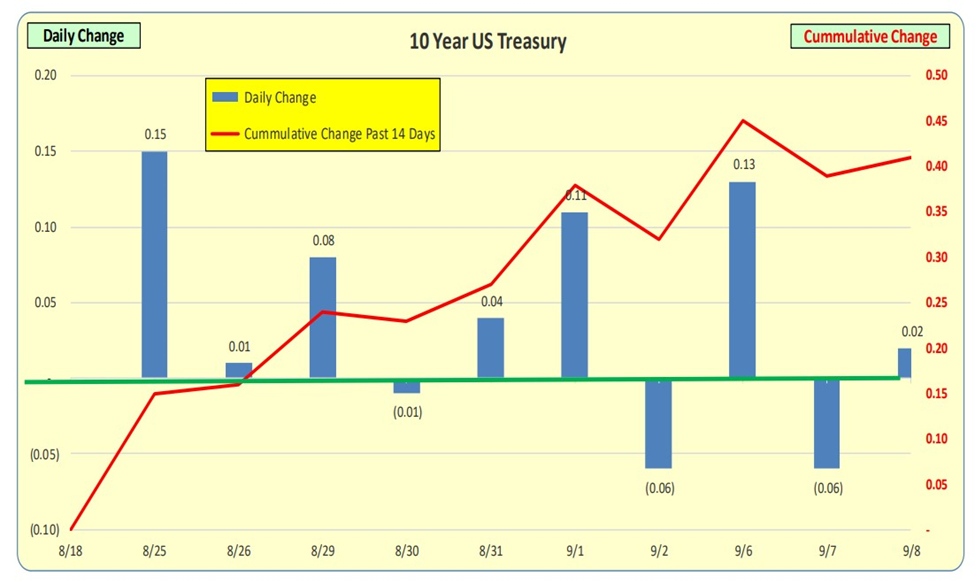

US 10-Year Treasury Rates

Daily changes in the US 10 Year Treasury rates are the blue bars while the red line is the 14-day cumulative change in rates: 41 bps cumulative INCREASE. For the blue bars, it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual.

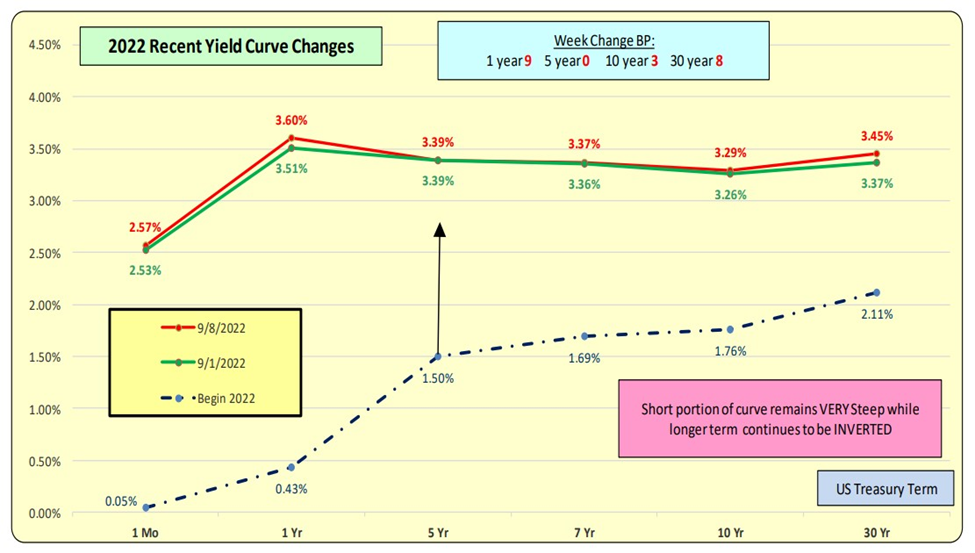

Rates for ALL terms were up this week. The Yield Curve for short terms remains steep while the longer term, (5+ years) remains INVERTED. The next CPI release is Sept 13, and the next Fed release will be Sept 21. The Fed will likely increase the Fed Funds rates by 50 bps or 75 bps.

2022 Recent Yield Curve Changes

Bill Knudson, Research Analyst Landco ARESC