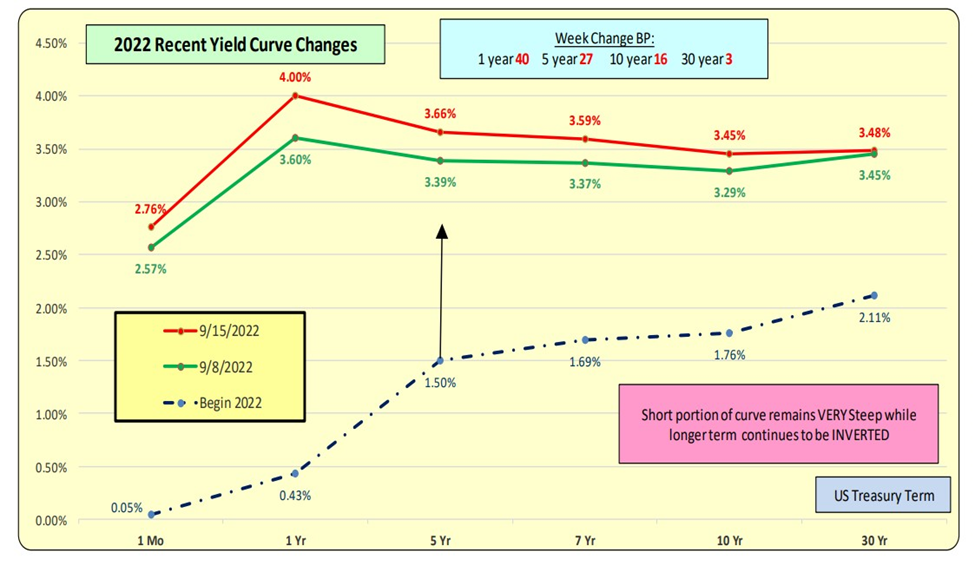

The Yield Curve inversion increased as short-term rates increased more than the longer term. NOTE 1-year was up 40bp in ONE WEEK. The 1-year yield is now 4.00% vs 3.48% for the 10 years. The last time the 1 year was this high was OCTOBER 2007.

The Fed meets today, Wednesday 9/21/2022. The Fed is likely to increase the Fed Funds rates by 50bp or 75bp. Note the short-term portion of the Yield Curve is steep, an increase in short-term rates will not necessarily result in the longer terms moving by a similar amount.

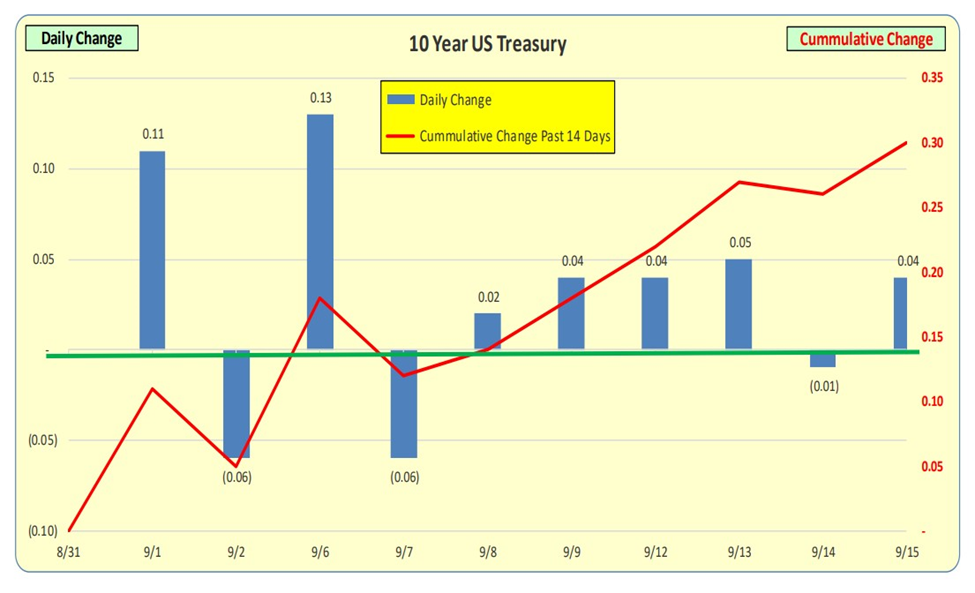

Daily changes in the US 10 Year Treasury rates are the blue bars while the red line is the 14-day cumulative change in rates: 30bp cumulative INCREASE. For the blue bars, it is unusual to have changes of greater than 0.10 in a single day and 0.20 is VERY unusual. Like a steady drumbeat, rates are increasing by about 4bp/day.

Rates for ALL terms were up this week. The Yield Curve for short terms remains steep while the longer term (5+ years) remains INVERTED.

With a 1-year rate at 4.00% and longer-term lower, the lines have converged which is indicative of an inverted yield curve.

Bill Knudson, Research Analyst Landco ARESC