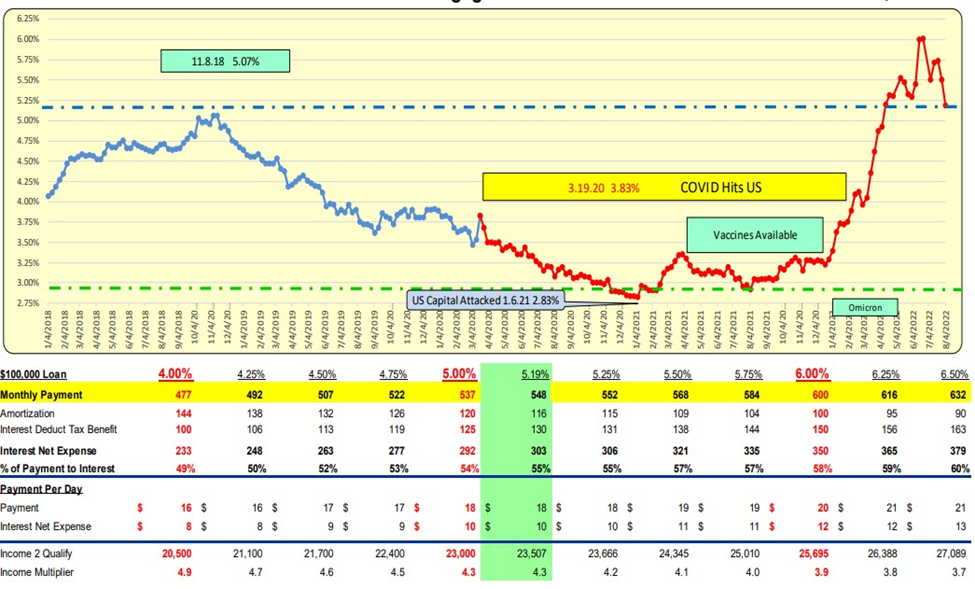

Mortgage rates decreased 31 basis points to 5.19%. For a $100,000 loan, the monthly payment decreased $19 per month to $548/mo. or $0.64/day. That is a significant savings.

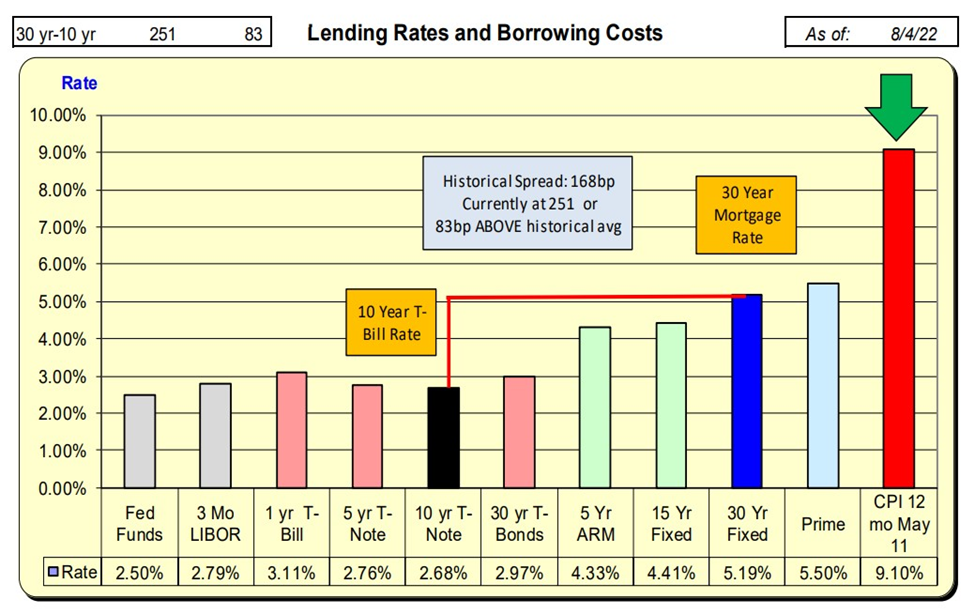

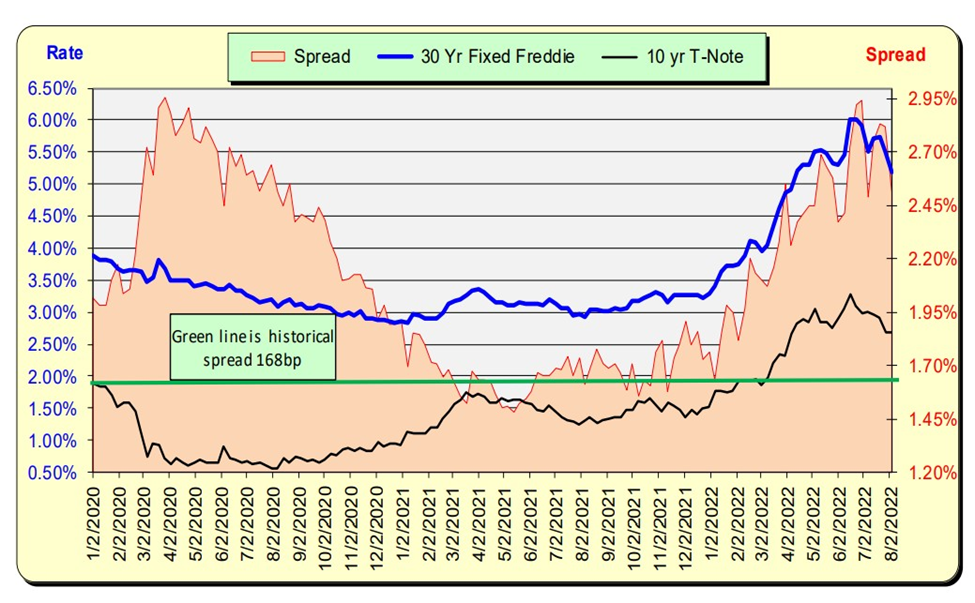

While the mortgage rates decreased 31 bp, 10 Year Treasury rates did not change. The 31 bp decrease resulted in a spread of 251 bp. With the historical spread being 168 basis points there now exists a “safety cushion” of 83 bp above this historical spread.

Lending Rates and Borrowing Costs

The historic spread between the 10 Year Treasury and mortgage rates is 168 basis points (see the green line, right axis) and currently, there is an 83bp above the historical norm. A 31 bps decrease in mortgage rates without an off-setting decrease in Treasury rates is somewhat surprising.

Bill Knudson – Research Analyst for Landco ARESC