The upcoming week’s data reveals a few things that could impact Treasury and Mortgage rates. These things include consumer confidence, new home sales, prices, and months of inventory, the existing home pending sales index, and the Federal Reserve FOMC Meeting which is coming up on Wednesday, July 27th..

Key economic items in the upcoming week that will impact Treasury and Mortgage Rates are highlighted in BLUE. Graphics on each of these items are attached. This will provide you with historical changes and trends for each blue item.

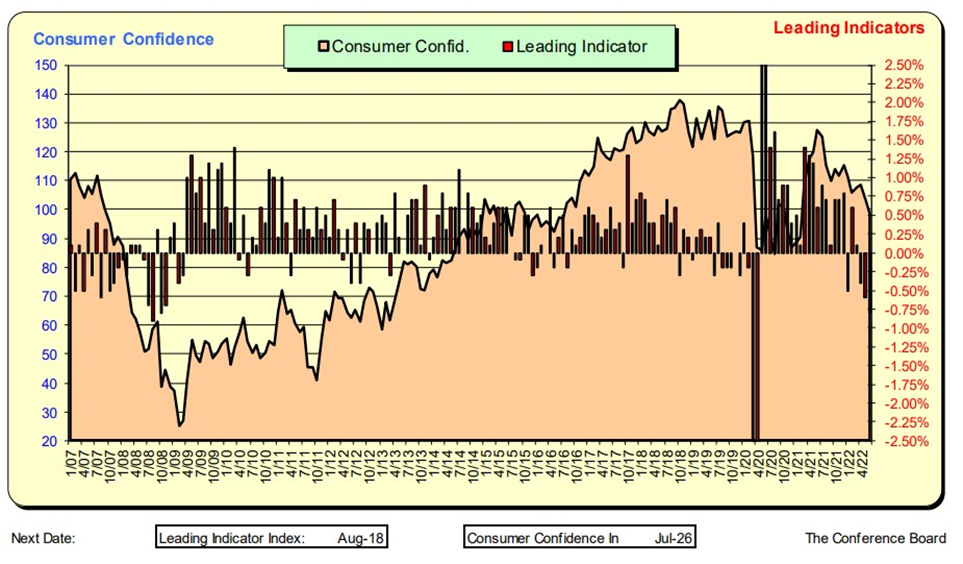

Leading Business Indicators and Consumer Confidence

Consumer Confidence is the shaded area, and it has been trending down as well as Business Leading Indicators which are clearly showing a downward trend.

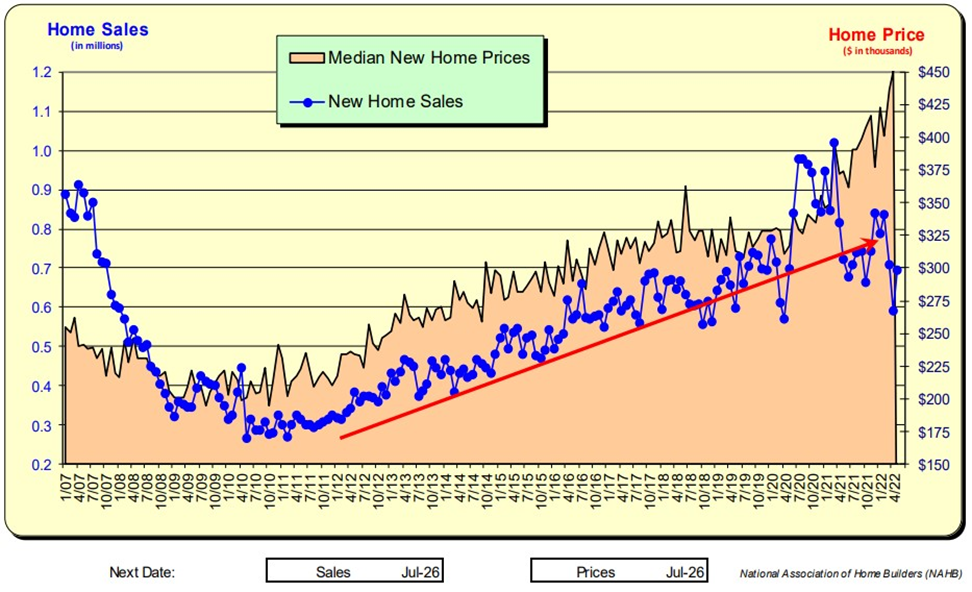

New Home Sales and Prices

NEW home sales have pulled back from their COVID/3% mortgage levels. New Home Sales have been adversely impacted by mortgage rates higher than 5.00%. NEW home prices have continued to rise.

New Homes Supply For Sale and New Home Starts

It is important to note the large increase in Months of Inventory that occurred in November 2018. That is when Mortgage rates hit 5.00% and sales slumped. On April 14, 2022, rates exceeded 5.00% NEW home months of inventory spiked when mortgage rates exceeded 5.00% This appears to be a KEY price point for buyers who are Millennials (blue line).

Existing Homes Supply For Sale and Pending Sale Index

Pending EXISTING Home Sales (shaded area) have been trending downward as mortgage rates increase, record-high selling prices continue, and the number of homes for sale has decreased due to people choosing to stay in their homes. This decrease however was not enough to stall the increase in selling prices with median home prices climbing to 13.4%. This is the 23rd straight month of double-digit annual price gains; the longest run since the late 1970s.

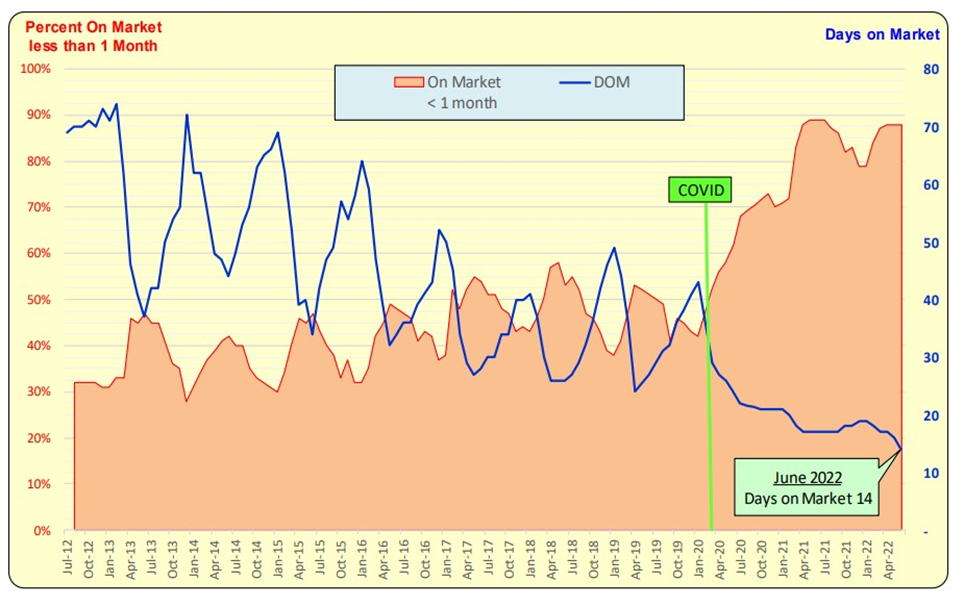

Days on the Market

Prior to COVID, the Days on Market (DOM) had been gradually decreasing. After COVID the days on market reached record lows and are now 14 Days as of June 2022. 70% of all properties sell in ONE MONTH.

Mortgage Rates and Home Sales

Mortgage rates are now above 5.00% (red bars) and it is anticipated that this will have a dampening effect on home sales. (blue line). The rate increases in April-June will impact July+ closings. Home prices are the dashed green line and even with mortgage rates rising, home prices rose. This has occurred in the past when rates rose—-future near-term home buyers rushed into the market to buy before mortgage rates rose further.

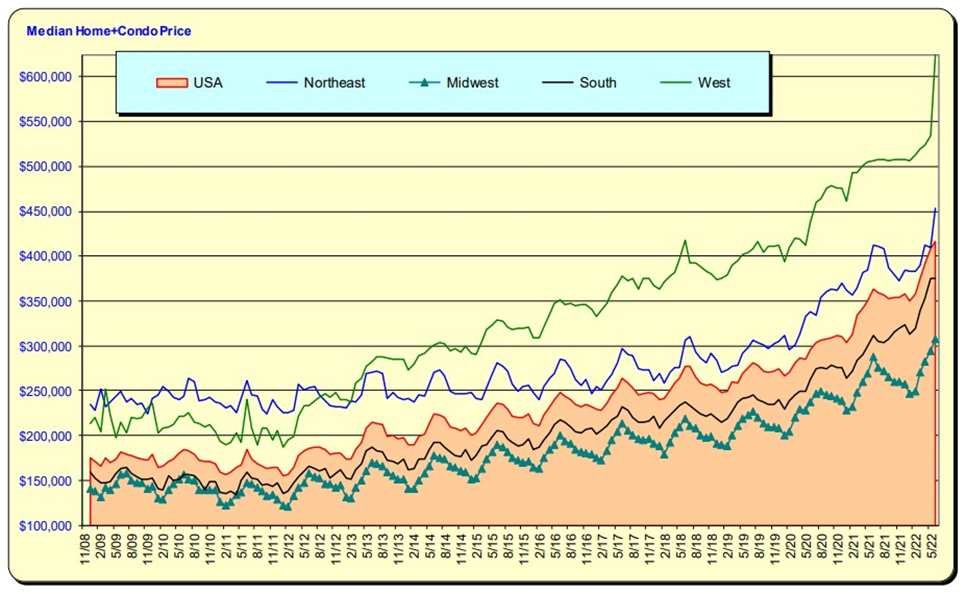

Median Home and Condo Prices

The median home prices for all regions of the United States accelerated in early 2022 just as mortgage rates rose. For the West—note the flat monthly prices prior to the sudden recent acceleration.

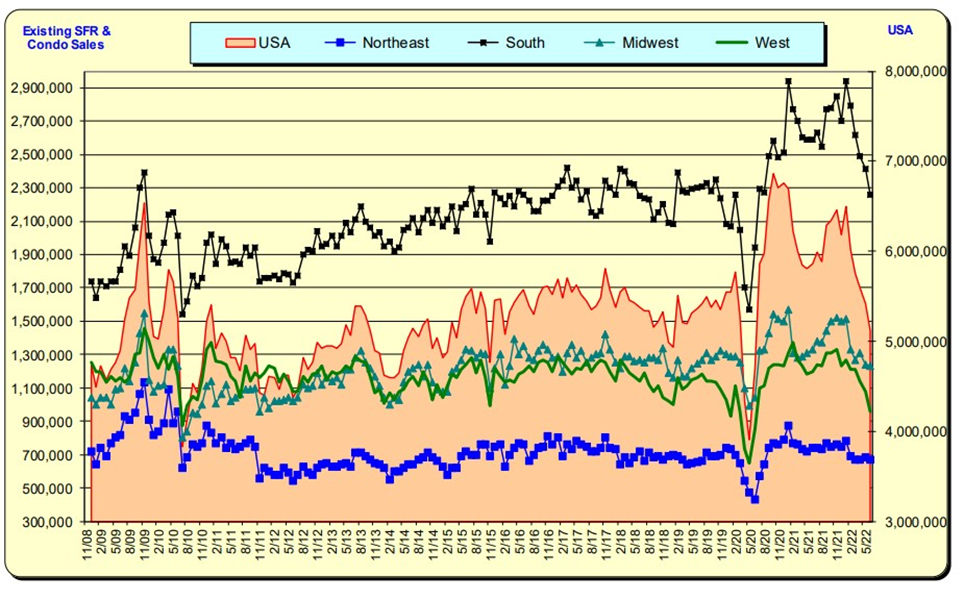

Existing SFR & Condo Sales in the USA

Sales have been declining from their record highs with substantial declines noted in the South and West regions.

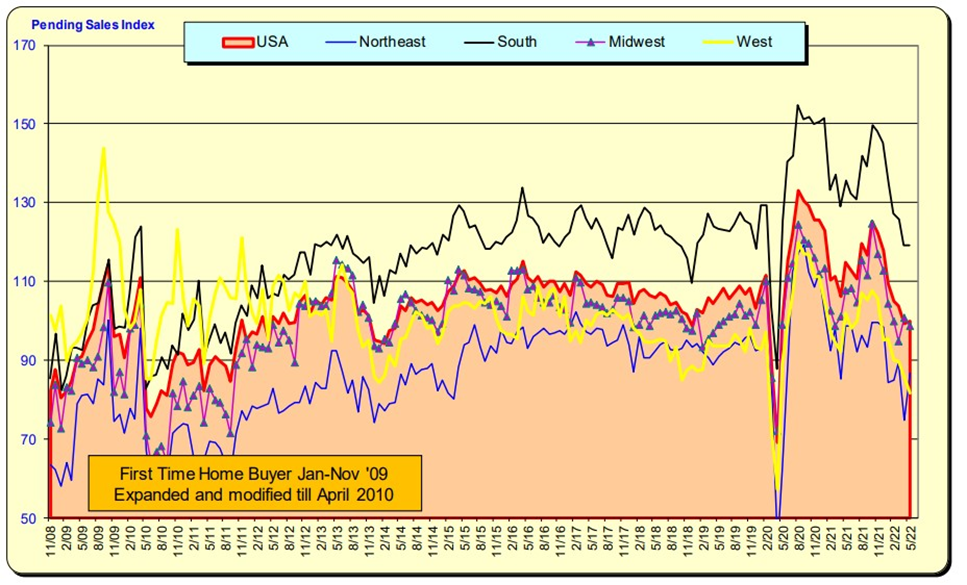

Pending Sales Index

The National Association of Realtor’s Pending Sales Index continues to decline as a mix of higher mortgage rates, higher home prices, and relatively low homes for sale. Declines are occurring in all regions. We are coming off record high PSI levels due to low mortgage rates. PSI levels going forward will likely continue to decline as households who have purchased in the recent past will not need to move again. In essence, then future demand was brought forward with low mortgage rates, and we are now seeing lower levels of demand.

Type of Buyer

Distressed-related home sales remain at record low levels. With recent home price appreciation, distressed homeowners will be able to sell and not sustain equity losses due to foreclosures. First-time home buyers have decreased as mortgage rates and home prices have increased. Record low mortgage rates allowed 5 times income ratios; the ratio now is 4.0 based on 5.74%. All cash purchases have increased even though investor purchases have not materially increased.

Bill Knudson – Research Analyst for Landco ARESC