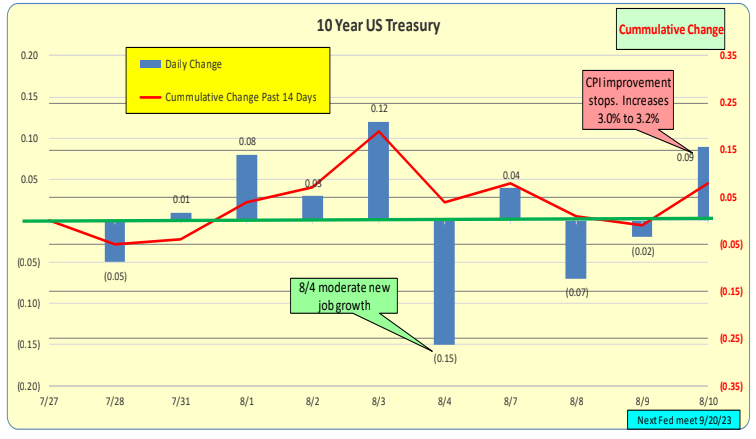

For the past 2 weeks, 10-Year Treasury rates went up by 8bp. In the past week, they went down by 11bp.

The next Fed meeting is scheduled for September 20, 2023. Twice a year, the Fed meetings are spaced 6 weeks apart; however, during this upcoming summer break, they will be spaced 8 weeks apart. Over the recent past, the market has shown a tendency to drift upward during longer breaks between Fed meetings.

There will be 1 CPI announcement and 1 jobs announcement before the next Fed meeting.

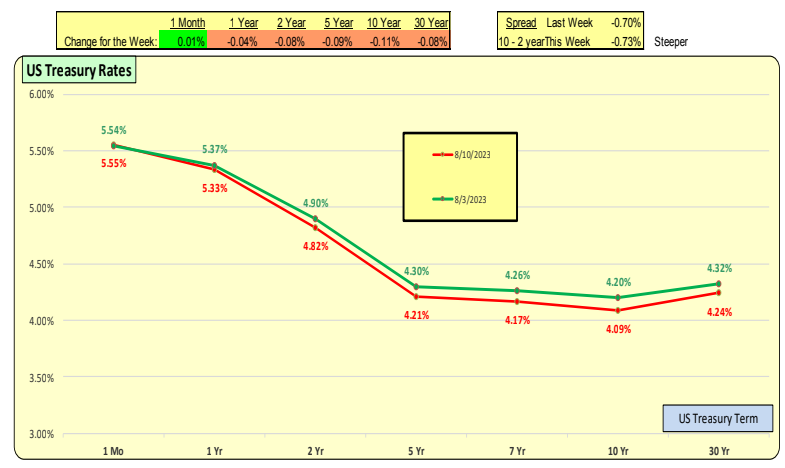

The red line represents the most current rates, while the green line represents rates from one week ago.

The entire yield curve has experienced a decrease. The 2-year term saw a decrease of 8bp, and the 10-year term decreased by 11bp. This shift has resulted in a steeper inverted yield curve. Additionally, one-month rates increased by 1bp.

Bill Knudson, Research Analyst LANDCO ARESC