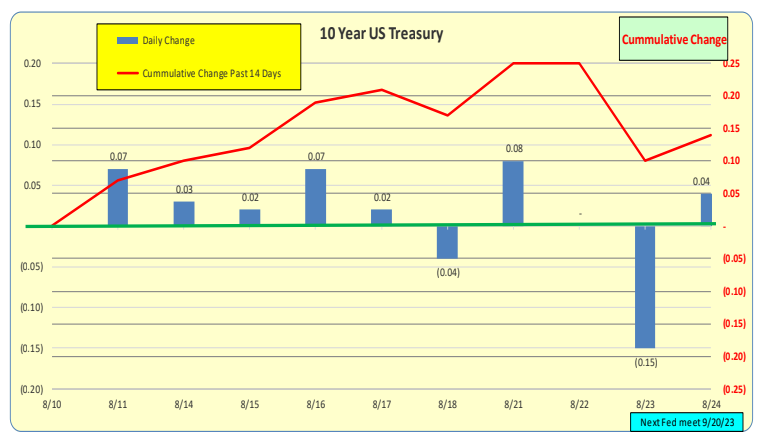

Over the past 2 weeks, 10-Year Treasury rates went up by 14 basis points. In the past week, they went down by 7 basis points.

The next Fed meeting is scheduled for 9/20/23. The Fed meetings occur twice a year, with a 6-week interval, but in the upcoming summer break, the interval will be 8 weeks. In the recent past, the market has shown a tendency to drift upward during longer breaks between Fed meetings. There will be 1 CPI announcement and 1 jobs announcement before the next Fed meeting.

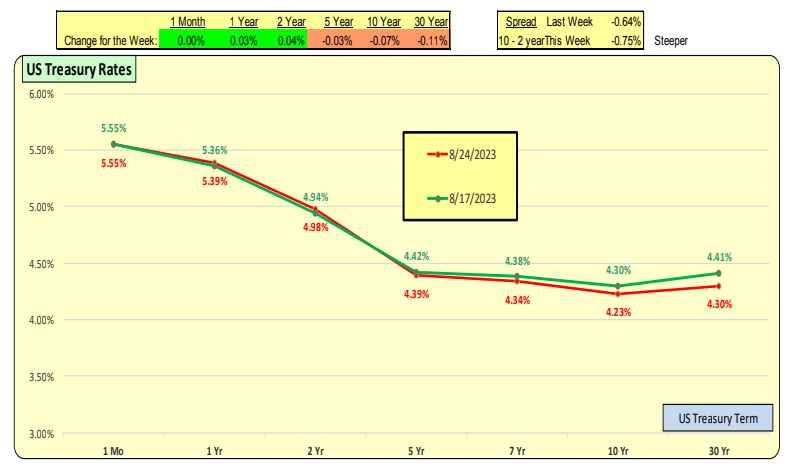

The red line represents the most current rates, while the green line represents rates from one week ago.

Longer-term rates decreased in the past week, with the 10-year rate down by 21 basis points. This change resulted in a steeper inverted yield curve. One-month rates remained unchanged.

Bill Knudson, Research Analyst LANDCO ARESC