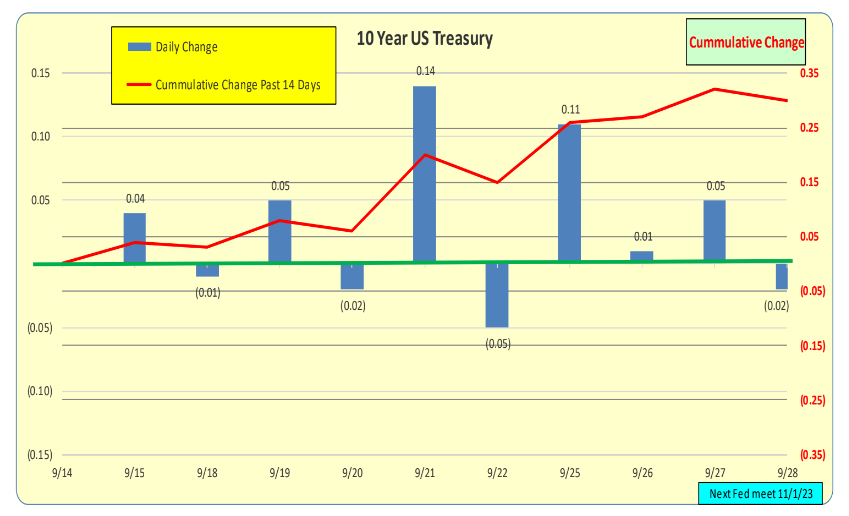

For the past 2 weeks, 10 Year Treasury rates were up 30bp. Past week: up 10bp.

Fed 9/20/23 meeting – no rate change, reaction to potential Fed future rate increases.

Red line is the most current rates, while the green line represents rates from one week ago.

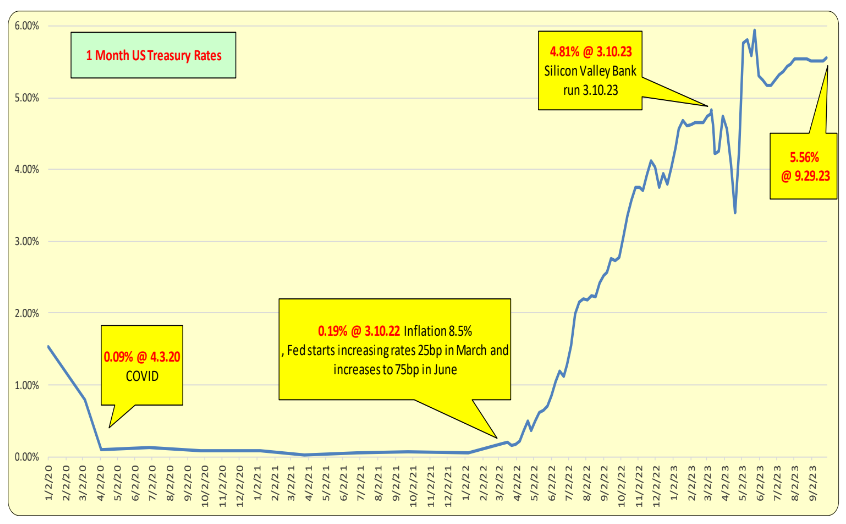

Longer-term rates rose relative to shorter-term rates, making the inverted yield curve less steep. One-month rates were up slightly.

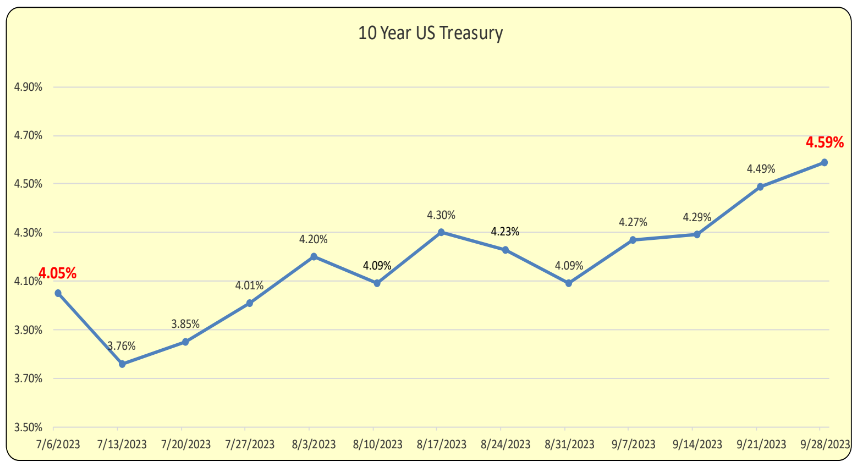

For the quarter ending September 29, 2023, the 10-Year US Treasury rates have increased. As rates rise, the value of the underlying instrument decreases. For firms that reprice their portfolio at the end of the quarter, there are going to be unwelcome returns.

For firms that are holding longer-term instruments, the market value is likely to be less than the value they carry on their books. This is what got Silicon Valley Bank in trouble as depositor concerns expanded.

What is noted is the volatility of the 30-day US Treasuries has been diminished.

Bill Knudson, Research Analyst LANDCO ARESC