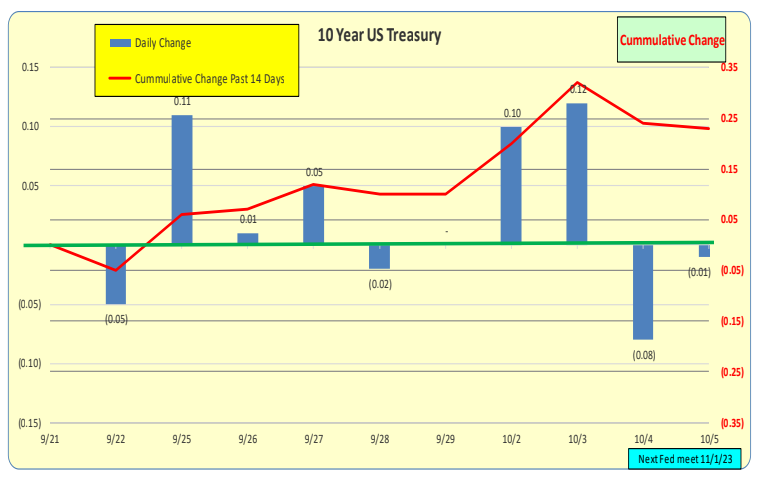

For the past 2 weeks, 10-Year Treasury rates have increased by 23bp. In the past week, they were up by 13bp.

The next Fed meeting is scheduled for 11.1.23.

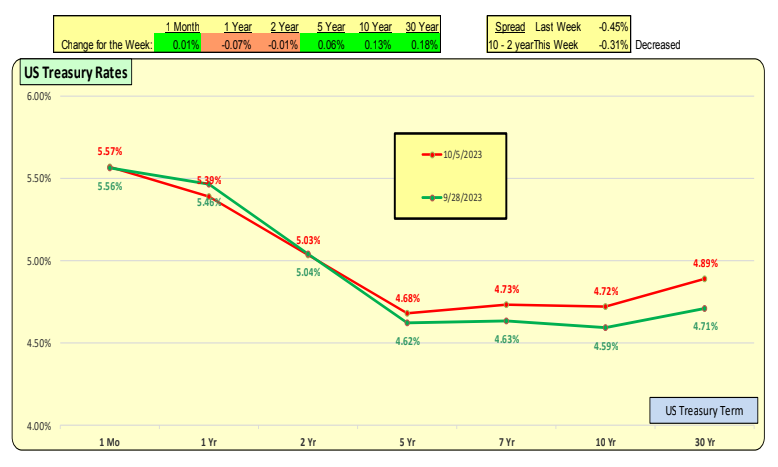

The red line represents the most current rates, while the green line represents rates from one week ago.

Longer-term rates rose relative to shorter-term rates; as a result, the inverted yield curve is less steep. For terms of 5+ years, the Yield Curve is positive. One-month rates were up slightly.

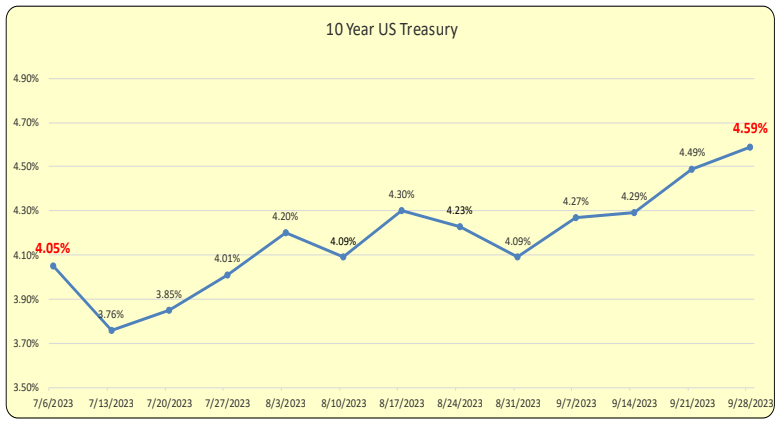

For the quarter ending September 29, 2023, the 10-Year US Treasury rates have increased. As rates rise, the value of the underlying instrument decreases. For firms that reprice their portfolio at the end of the quarter, there are going to be unwelcome returns.

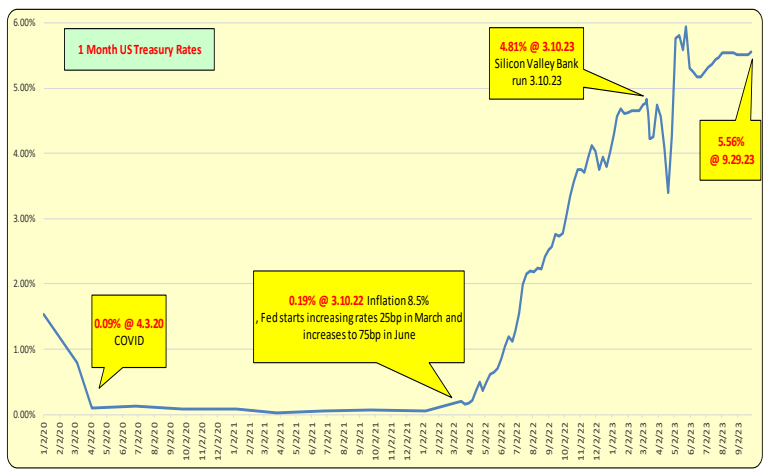

For firms that are holding longer-term instruments, the market value is likely to be less than the value they carry on their books. This is what got Silicon Valley Bank in trouble as depositor concerns expanded.

What is noted is that the volatility of the 30-day US Treasuries has been diminished.

Bill Knudson, Research Analyst LANDCO ARESC