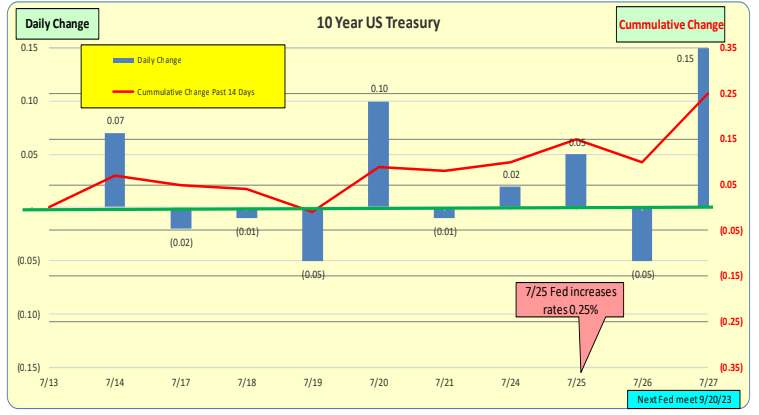

For the past 2 weeks, 10 Year Treasury rates were up 25bp. In the past week, they rose by 16bp following the Fed’s 7.26.23 meeting, where they increased their Fed Funds rate by 25bp, despite the CPI decreasing by 100bp to 3.00%.

The next Fed meeting is scheduled for 9.20.23. Twice a year, the Fed meetings are 6 weeks apart, but in this coming summer break, they are 8 weeks apart. Over the recent past, the market has tended to drift upward between longer breaks in Fed meetings.

There will be 2 CPI and 2 jobs announcements before the next Fed meeting.

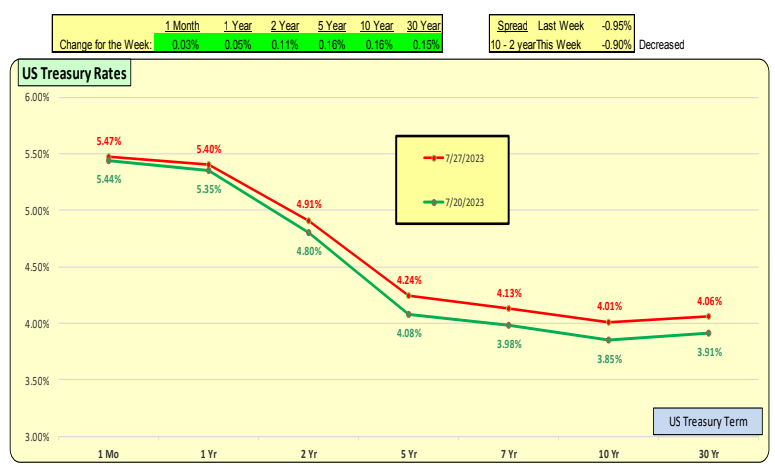

The red line represents the most current rates, while the green line represents rates from one week ago.

The entire yield curve increased, with the 2-year term rising by 11bp on top of last week’s 21bp increase, and the 10-year term going up by 16bp. This resulted in the inverted yield curve becoming less steep. Additionally, one-month rates were up by 3bp.

Bill Knudson, Research Analyst LANDCO ARESC