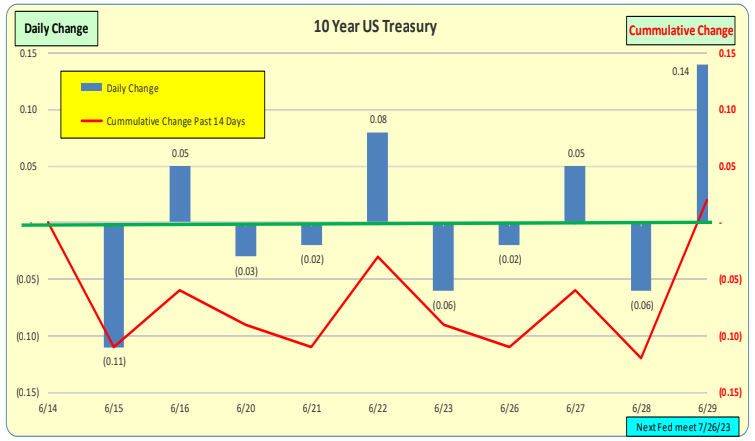

For the past 2 weeks, 10 Year Treasury rates were up 2bp. In the past week they were up 8bp. On May 3rd, 20234, the Fed made an announcement that broadly hinted that future rate increases would be in a “wait and see mode”. CPI down from 4.9% to 4.0% on 6.13..23 and 6.14.23 Fed did not increase rates, first time in 15 months.

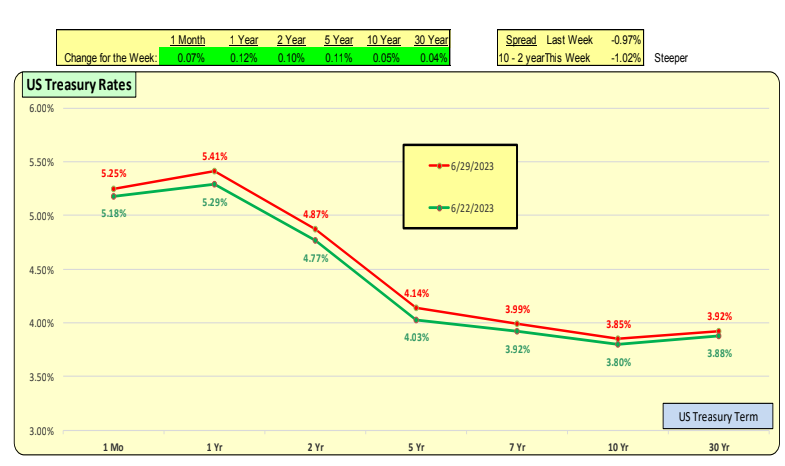

The red line represents the current rates, while the green line represents rates from one week ago. The entire yield curve for the 2 year term increased 10bp with 10 year up 5bp. This made the inverted yield curve steeper. One month rates was up 7bp.

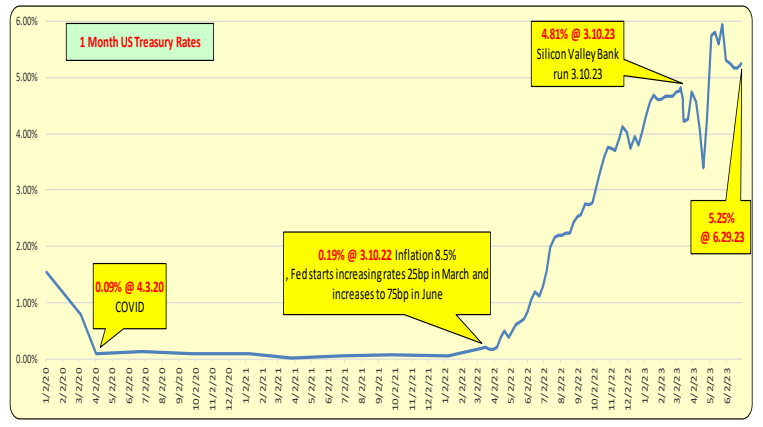

Volatility in the One Month Treasury market has diminished in the past few weeks, with the inverted yield curve. Any firm borrowing short to fund longer term assets are going to be stressed, including mortgage banking firms and bond investment firms. Note the muted reaction on the One Month rates to the news regarding the improved CPI and Fed holding rates unchanged.

Bill Knudson, Research Analyst LANDCO ARESC