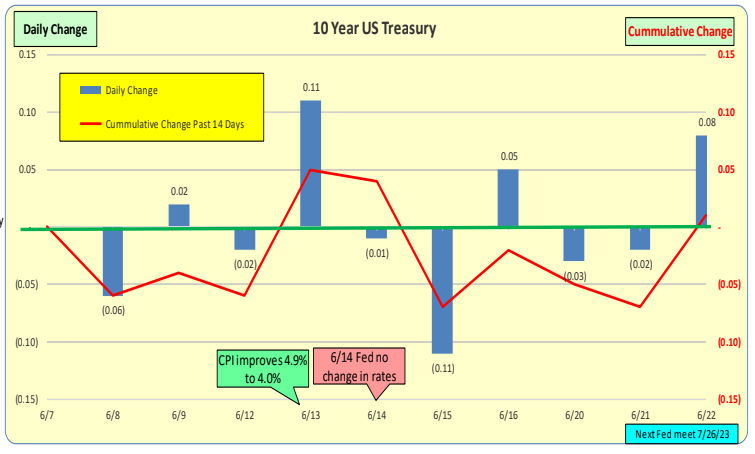

For the past 2 weeks, 10 Year Treasury rates were up 1bp. In the past week they were up 8bp. On May 3rd, 2023, the Fed made an announcement that broadly hinted that future rate increases would be in a “wait and see mode”. CPI is down from 4.9% to 4.0% on 6/3/23 and 6/14/23, for the first time in 15 months the Fed did not increase rates.

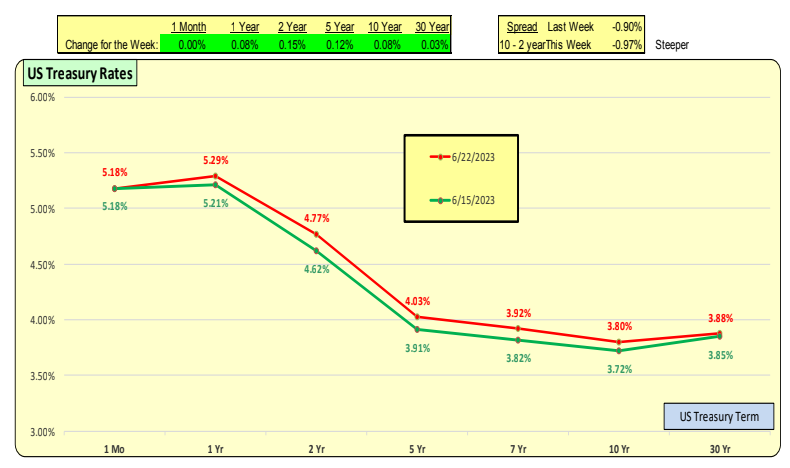

The red line represents the current rates, while the green line represents rates from one week ago. The entire yield curve for the 2 year term increased 15bp with 10 years up 8bp. This made the inverted yield curve steeper. The one month rates were unchanged.

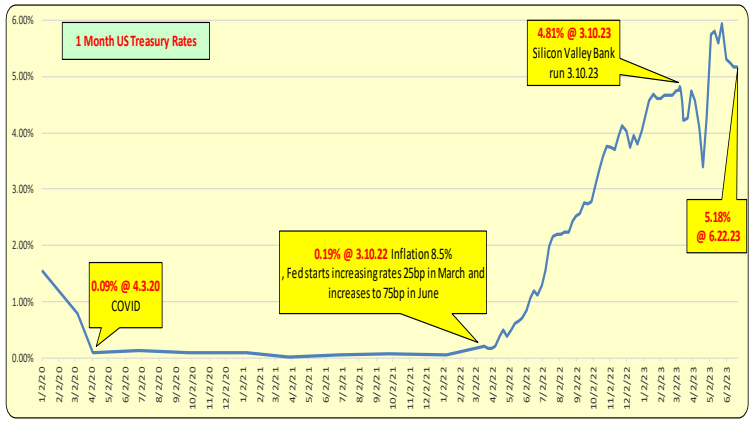

Volatility in the One Month Treasury market has diminished in the past few weeks, with the inverted yield curve. Any firm borrowing short to fund longer-term assets is going to be stressed, including mortgage banking firms and bond investment firms. Note the muted reaction of the One Month rates to the news regarding the improved CPI and the Fed holding rates unchanged.

Bill Knudson, Research Analyst LANDCO ARESC