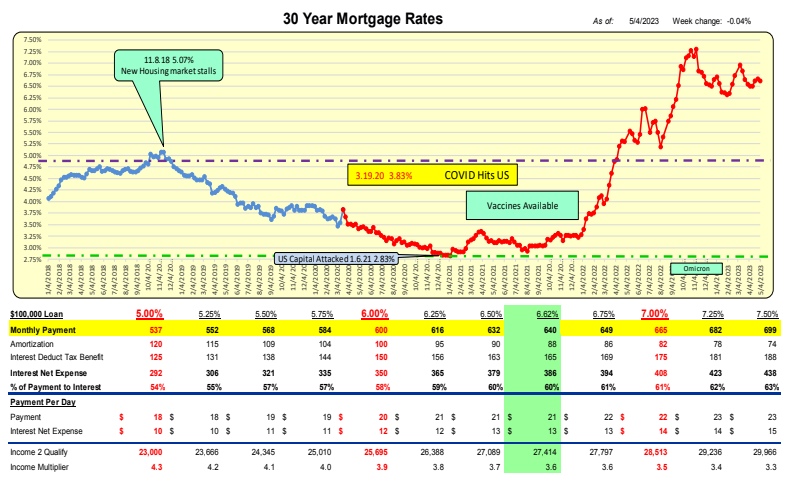

For the week ending 5.4.23 Mortgage rates DECREASED 4bp to 6.62%.

For a $100,000 loan the monthly payment DECREASED $3 to $640/month or $0.09/day.

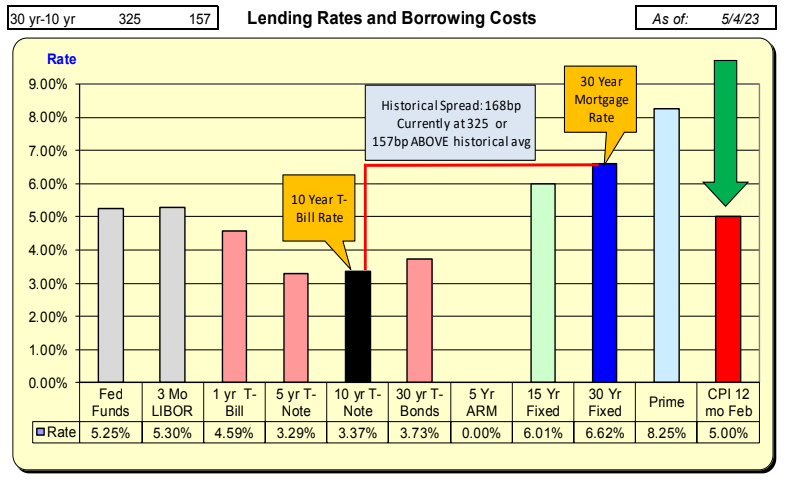

Mortgage rates decreased 4bp and 10 Year Treasury rates decreased 16bp. The net difference resulted in an increase of 12bp in the spread to 325bp. With the historical spread being 168, there now exists a “safety cushion” of 157bp above the historical spread.

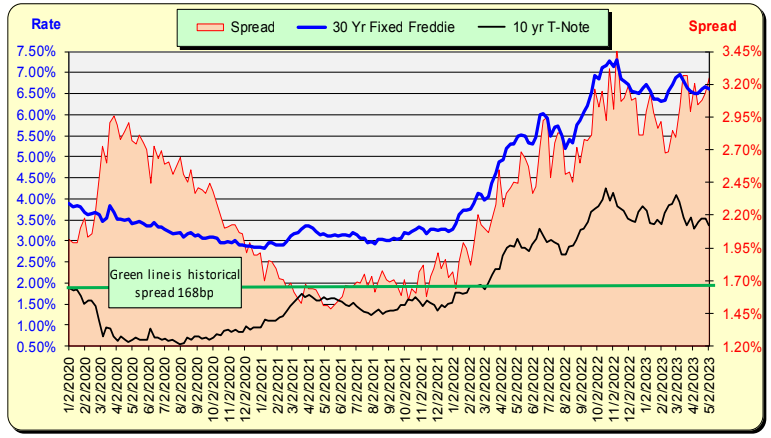

The historic spread between the 10 Year Treasury and mortgage rates is 168pb (see green line, right axis) and currently, there is a 157bp above the historical norm. For this spread to return to the historical norm, either mortgage rates will decrease or 10 Year Treasury rates will increase. The last time spreads were this large (Nov 10, 2022), mortgage rates decreased 100bp over the following 12 weeks.

Bill Knudson, Research Analyst LANDCO ARESC