Sunday–March 12, 2023 joint statement from:

Treasury Department Secretary Janet Yellen

Federal Reserve Chair Jerome Powell

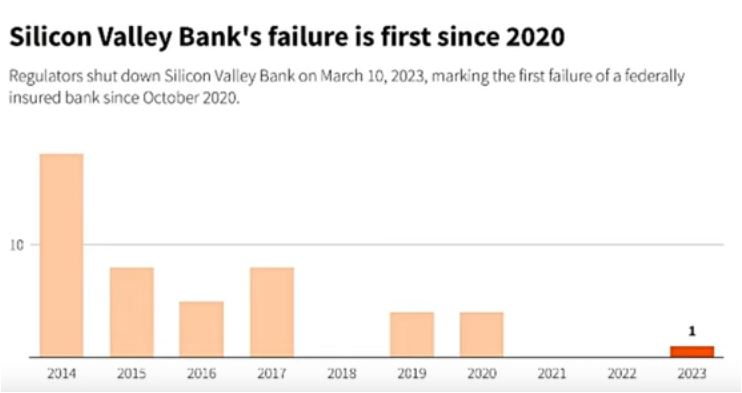

FDIC Chair Martin Gruenberg, who cited a “systemic risk exemption” that is also being applied to all Silicon Valley Bank deposit holders will get their money back.

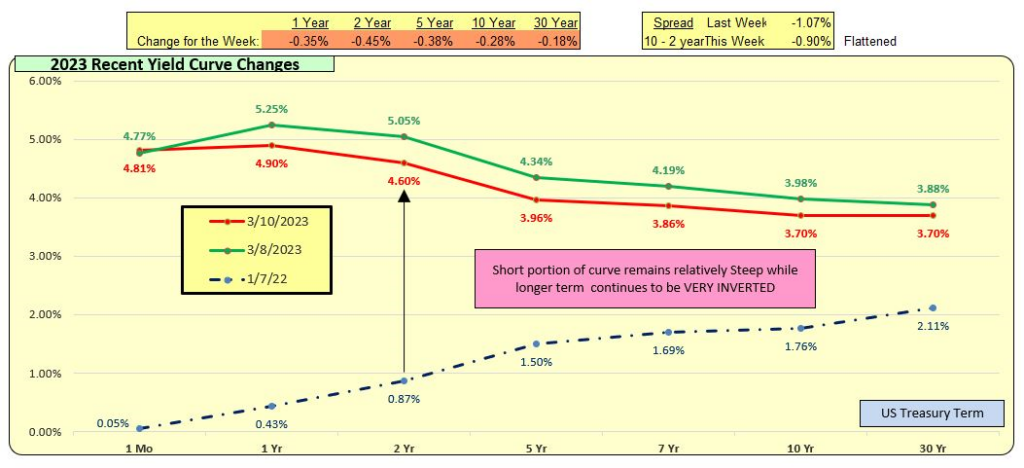

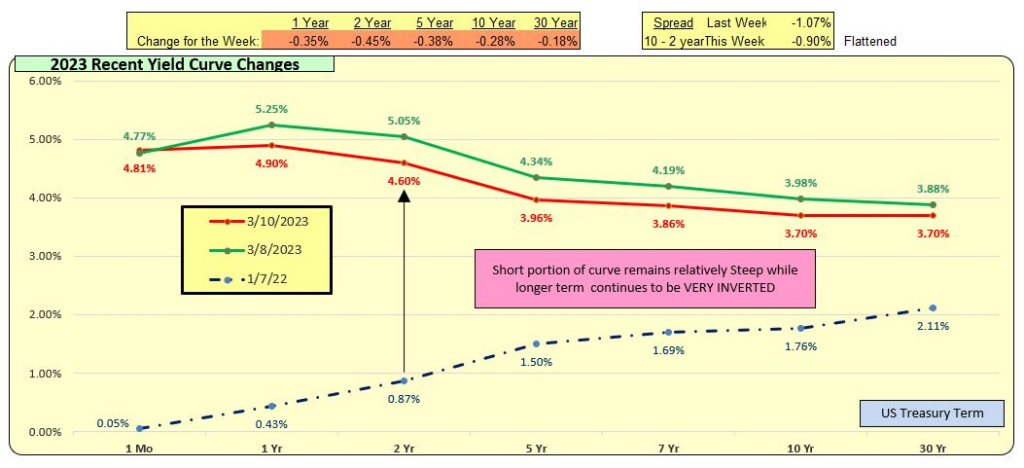

Below is the change in US Treasury yield curve in TWO DAYS: Wednesday 3.8.23 (Green Line) vs Friday 3.10.23 (Red Line).

Silicon Valley Bank was taken over on Friday 3.10.23. NYC’s Signature Bank failure on 3.12.23 occurred afterwards and its impact is not yet reflected in these yield curve changes.

Flight to safety vs. Fed actively buying Treasuries Good news, holders of Treasuries just saw a gain with these rate movements.

CPI data release of Feb data is 3.14.23 It will be good news but will likely not get much reporting given the bank failures coverage. Next Fed meeting is 3.22.23. With improved CPI data, Fed will have some air cover to act on changing Fed Fund rate expectations downward. The talk of a 50bp FF increase is now off the table. The Fed may walk back the 25bp increase expectation by pointing to CPI improvement. They will want to take action but will not want to set off undo concerns. The Fed does have its Discount Window to meet individual bank’s liquidity needs.

If I were a bank, I’d be monitoring my commercial lines of credit for draw downs. In times of uncertainty, folks will go for liquidity—get the cash while it is available. Although Treasuries are down, mortgage rates may not immediately follow–and then there are lender liquidity concerns.

Bill Knudson, Research Analyst LANDCO ARESC