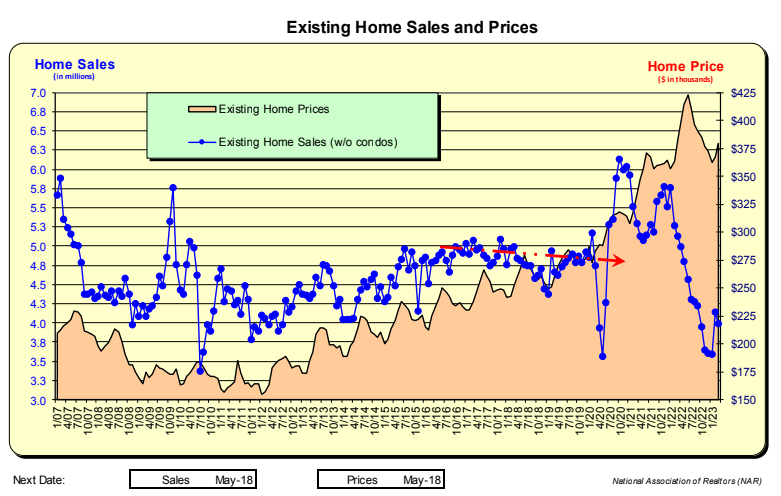

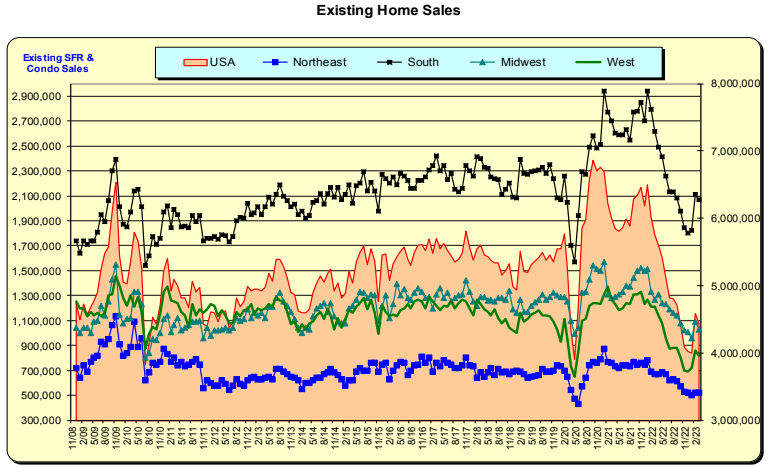

The number of existing home sales increased as mortgage rates decreased between December and February. Homes for sale continue to be very low. The home sales spike during COVID-19 and record-low mortgage rates brought forward demand. Those buyers have already purchased a home, reducing current period demand.

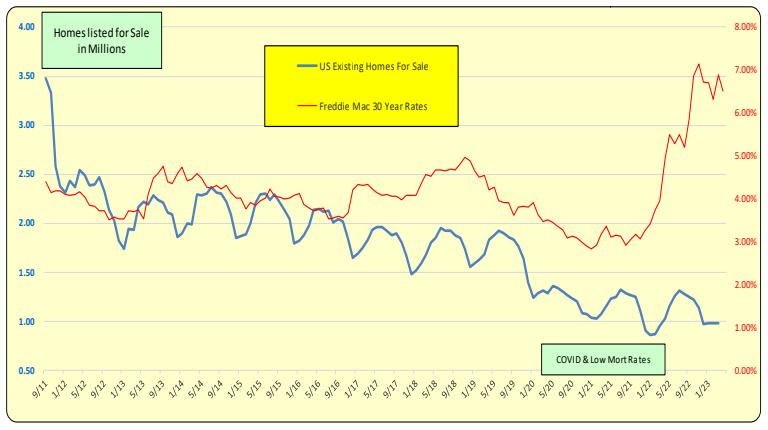

Existing homes for sale have a seasonal pattern, with December being the low point of the year. The number of homes for sale has been decreasing since 2011 and hit a low point during the COVID pandemic, when mortgage rates were at a record low. However, the Fed increased interest rates in April 2022 due to rising inflationary fears. As a result, potential sellers who have low mortgage rates want to hold onto these rates.

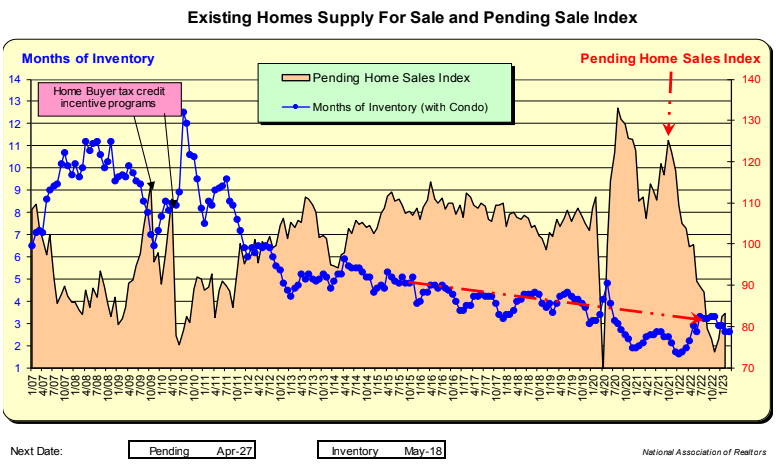

Existing homes: months of inventory remain near record lows. The Pending Home Sales Index has significantly decreased over the past 9 months, initially due to a lack of homes for sale, and now due to rising mortgage rates and home prices. However, over the last 2 months, pending home sales have picked up.

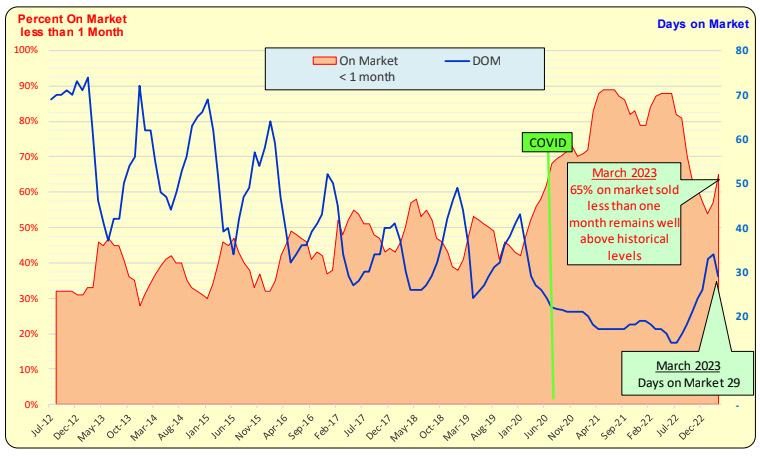

Before the COVID pandemic, the Days on Market (DOM) had been steadily decreasing. However, following the pandemic, the DOM reached record lows and is currently at 34 days as of March 2023. Additionally, 69% of all properties sell within one month, as indicated by the red line.

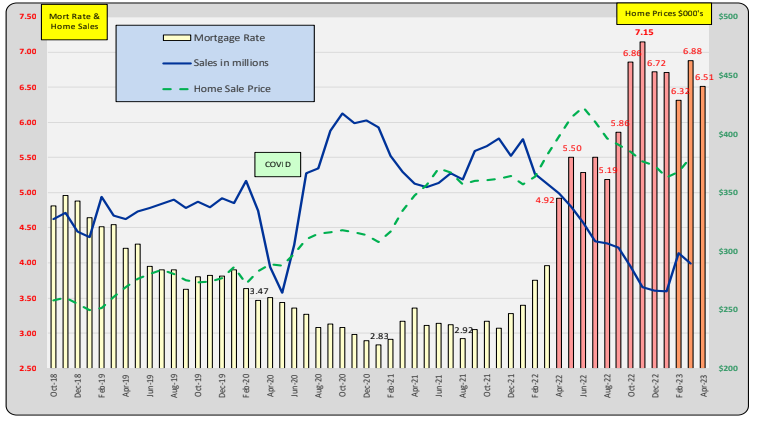

Mortgage rates are now well above 5.00% (shown as red bars). In late 2022, rates decreased slightly and home sales have picked up.

Home prices are represented by the dashed green line and, even with rising mortgage rates, they have continued to increase. This has happened in the past when rates rose as well—near-term homebuyers rushed into the market to purchase before rates increased even more. With these buyers now gone, home prices have declined, and sales of higher-end homes have moderated.

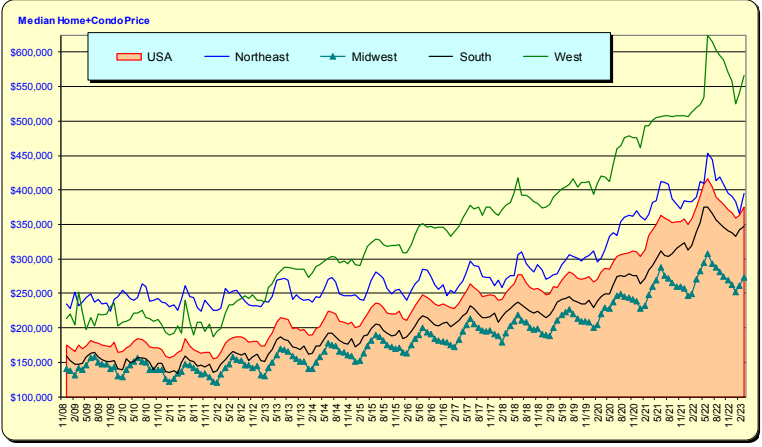

The median home price for all regions accelerated in early 2022, just as mortgage rates rose and demand surged. Although there was a decline in July and August, prices increased in February due to the modest mortgage rate decreases in late 2022. It appears that higher-priced homes are more affected by higher mortgage rates.

The National Association of Realtors’ Pending Sales Index has been declining from its record highs, with substantial declines noted in the South and West regions. These declines are a combination of three factors: 1) Higher mortgage rates (although mortgage rates decreased in late 2022 and pending sales increased), 2) Higher home prices, and 3) Relatively few homes for sale.

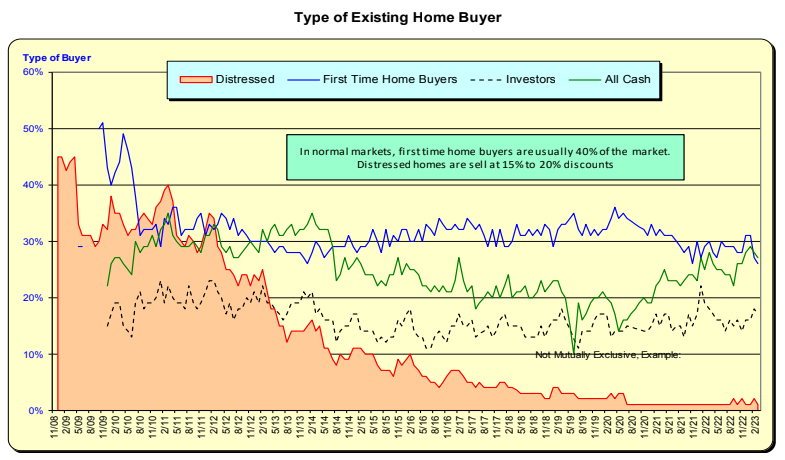

Distressed-related home sales remain at record low levels. With recent home price appreciation, distressed homeowners will be able to sell and avoid sustaining equity losses due to foreclosures.

First-time homebuyers have decreased as mortgage rates and home prices have risen. Record-low mortgage rates previously allowed for 5 times income ratios, but now the ratio has decreased to 3.6 based on a rate of 6.62%. This represents a ~25% decrease in purchasing power. All-cash purchases have increased, even though investor purchases have remained flat.