The new jobs report was announced this morning with 311,000 new jobs added to the labor market this quarter, (pre-COVID was 180k-200k) which is strong despite the unemployment rate increasing from 3.5% to 3.7%. Interest rates will likely increase as the Fed continues to fight inflation.

CPI’s next release is Sept 13th, 2022

Fed’s next meeting is Sept 21st ,2022

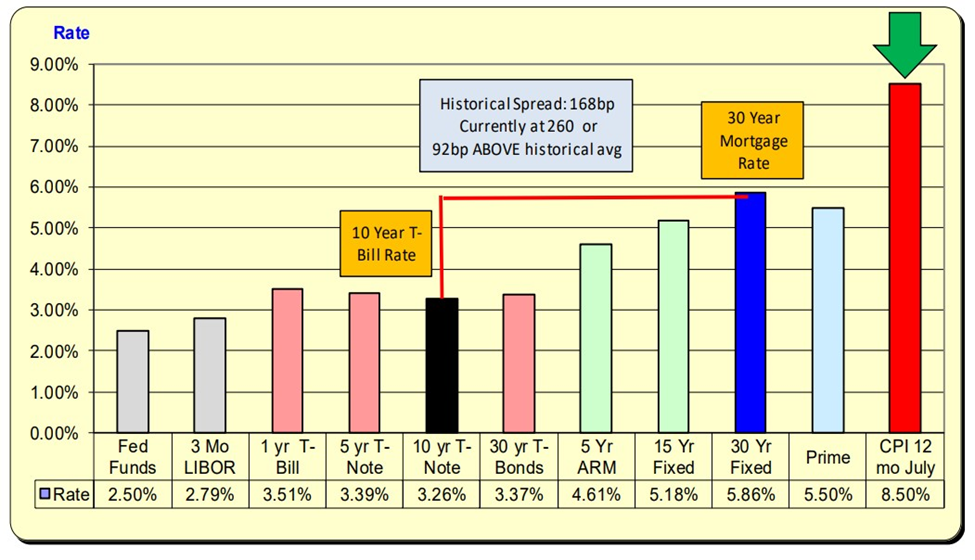

Attention will turn to whether the Fed will boast the Fed Funds rate to either 50 basis points or 75 basis points. With the historic cushion now at 92 bps, we are going to get mortgage rates above 6.00% in the next week or two. They did exceed the 6.00% level in mid-June for longer than 2 weeks.

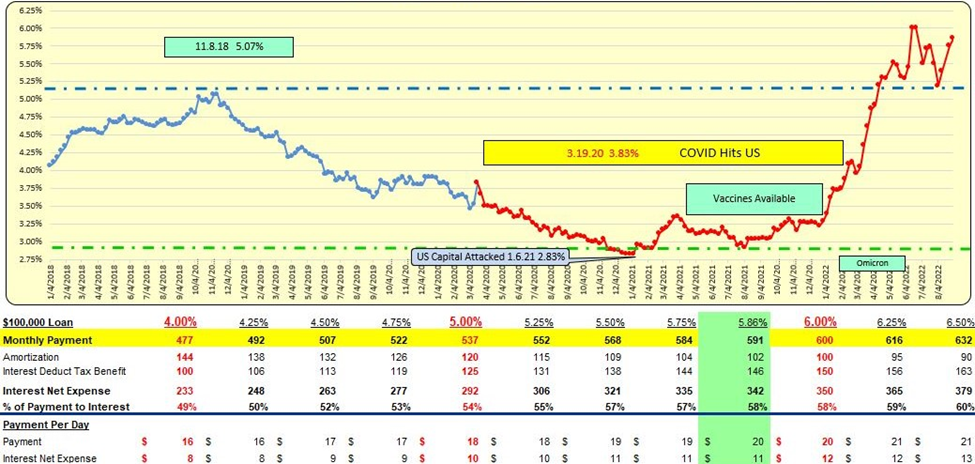

Mortgage rates did INCREASE 11 bps to 5.86% for the week ending September 1st, 2022. That means, for a $100,000 loan the monthly payment INCREASED by $7 to $591/mo. or $0.23/day.

30 Year Mortgage Rates

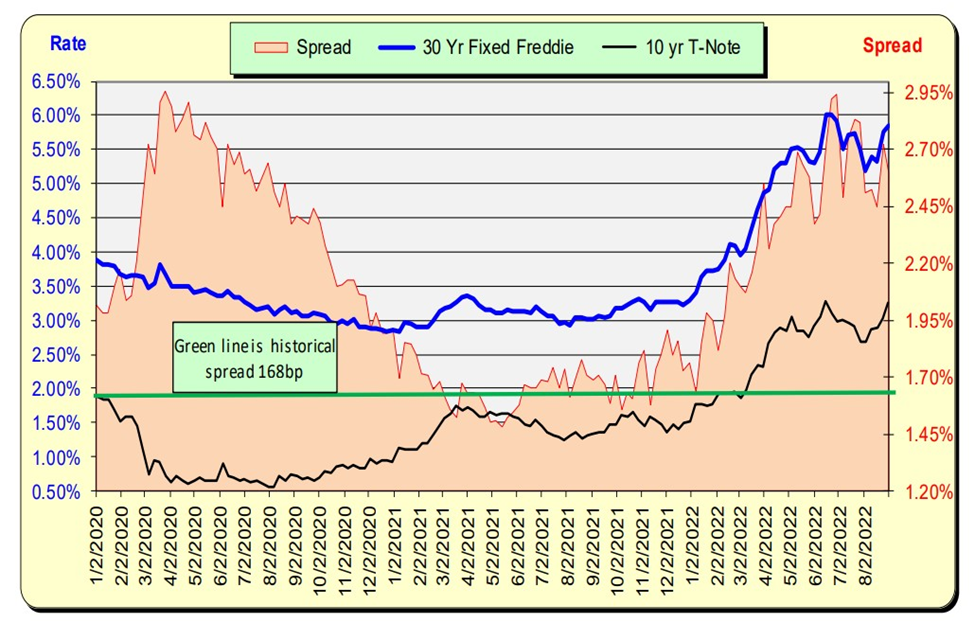

While mortgage rates increased, the 10 Year Treasury rates also INCREASED by 23 bps. The net difference is a 12-bps increase in a spread of 260 bps. With the historical spread being 168 bps, there now exists a “safety cushion” of 92 bps above this historical spread.

Lending Rates and Borrowing Costs

The historic spread between the 10 Year Treasury and mortgage rates is 168 bps (see the green line, right axis) and currently, there are 92 bps above the historical norm. For this spread to return to the historical norm, either mortgage rates will decrease, or 10 Year Treasury rates will increase.

Green Line – Historical Spread

Bill Knudson, Research Analyst Landco ARESC