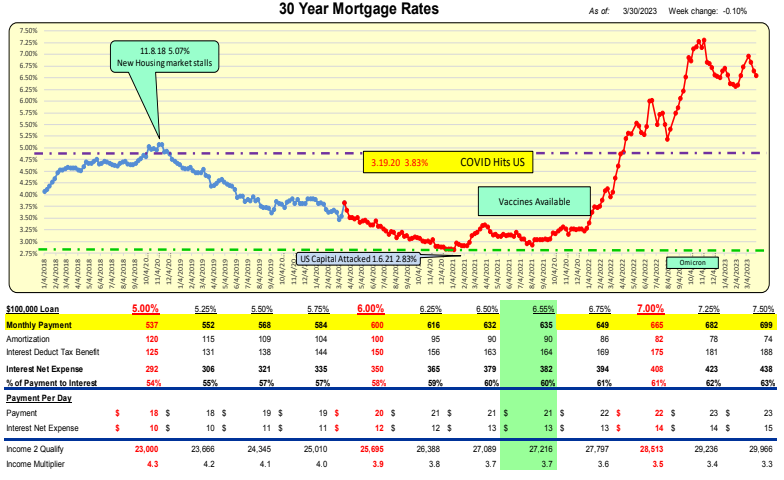

For the week ending 3.30.23, mortgage rates decreased 10bp to 6.55%. For a $100,000 loan, the monthly payment decreased by $7 to $635 per month or $0.22 per day.

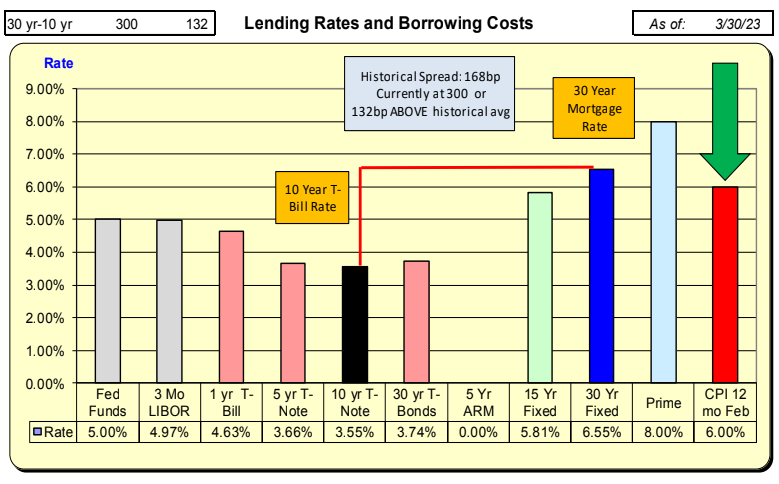

While mortgage rates decreased by 10bp, 10-year Treasury rates increased by 17bp. The net difference resulted in a decrease of 27bp in the spread to 300bp. With the historical spread being 168, there now exists a ‘safety cushion’ of 132bp above the historical spread.

The historic spread between the 10-year Treasury and mortgage rates is 168bp (see green line, right axis), and currently, there is a 132bp difference above the historical norm. For this spread to return to the historical norm, either mortgage rates will need to decrease further or 10-year Treasury rates will need to increase. The last time spreads were this large, mortgage rates decreased by 100bp over the following 12 weeks.

Bill Knudson, Research Analyst LANDCO ARESC