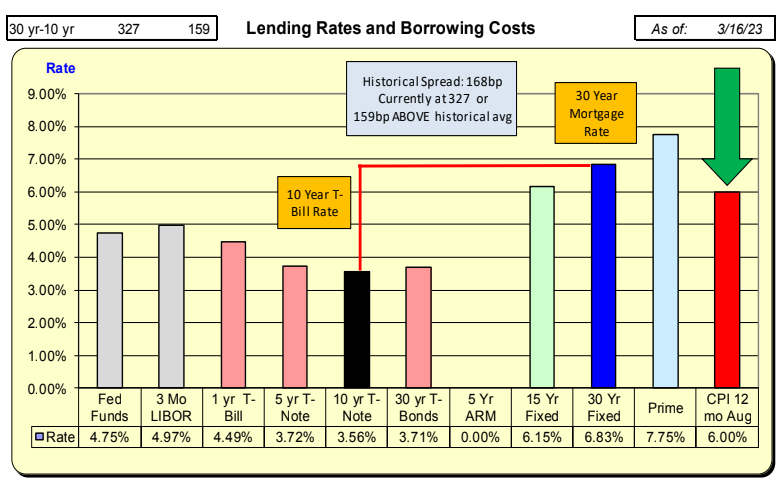

For the week ending 3.16.23, mortgage rates decreased by 13bp to 6.83%. For a $100,000 loan, the monthly payment decreased by $9 to $654/month or $0.29/day.

While mortgage rates decreased by 13bp, 10-year Treasury rates decreased by 37bp. The net difference resulted in an increase of 24bp in the spread, to 327bp. With the historical spread being 168, there now exists a “safety cushion” of 159bp above the historical spread.

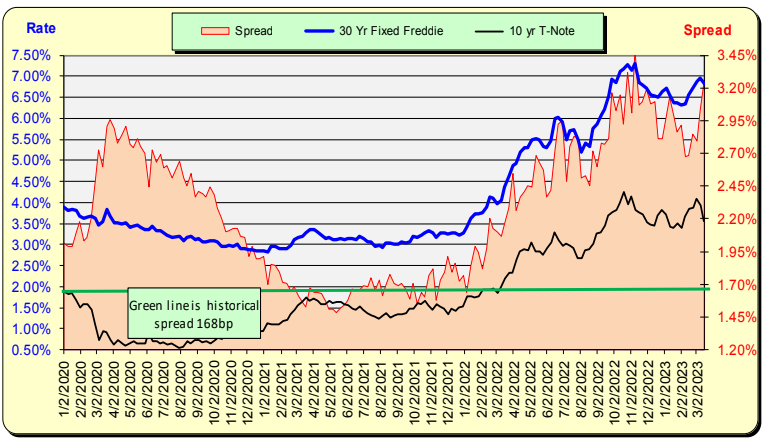

The historic spread between the 10 Year Treasury and mortgage rates is 168bp (see green line, right axis), and currently, there is a 159bp difference above the historical norm. For this spread to return to the historical norm, either mortgage rates will need to decrease further, or 10-year Treasury rates will need to increase. The last time spreads were this large, mortgage rates decreased by 100bp over the following 12 weeks.

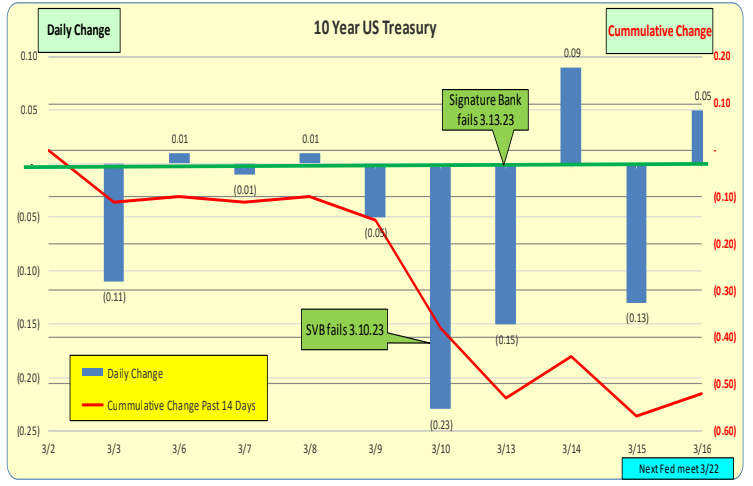

10 Year Treasury Rates DECREASED 52bp for the Two Week Ending 3.16.23

For the past two weeks, 10-year Treasury rates have been down by 52bp.

The red line represents the most current rates, while the green line represents rates from one week ago. Short-term rates decreased by 76bp, while longer-term rates were down by 37bp for the week. The yield curve inversion decreased.

Bill Knudson, Research Analyst LANDCO ARESC