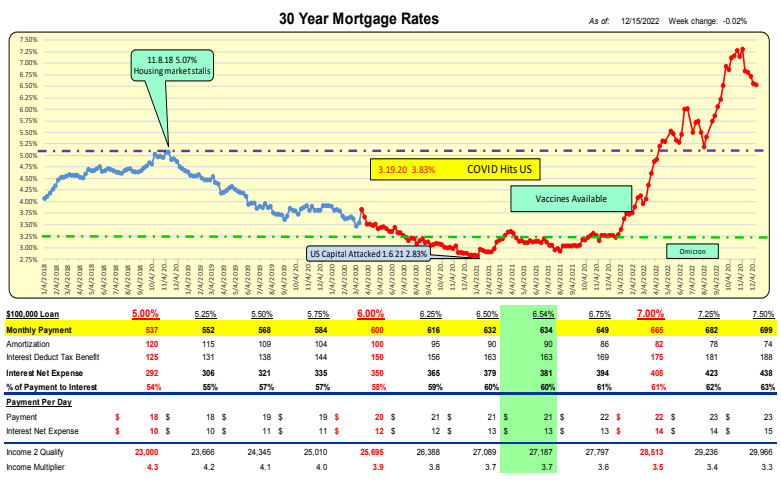

For the week ending 12.15.22 Mortgage rates DECREASED 2bp to 6.54%. For a $100,000 loan the monthly payment DECREASED $1 to $634/mo or $.04/day.

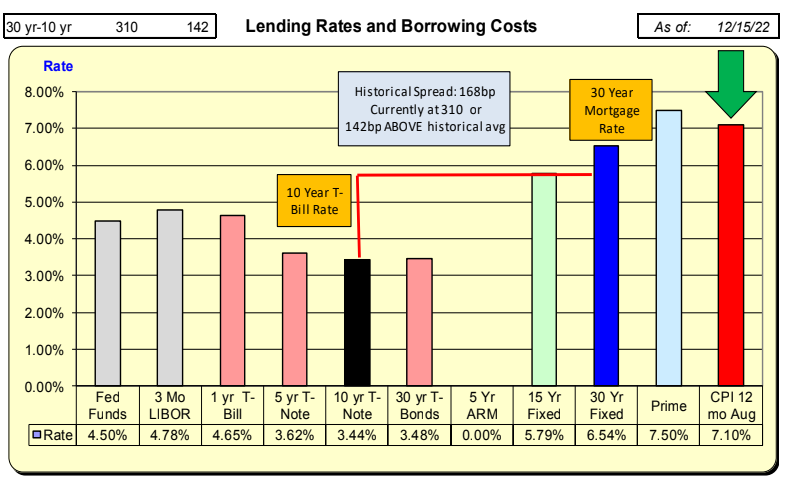

Lending Rates and Borrowing Costs

While mortgage rates DECREASED 2bp, 10 Year Treasury rates DECREASED 4bp. The net difference is a 2bp increase in a spread of 310bp. With the historical spread being 168 there now exists a “safety cushion” of 142bp above the historical spread.

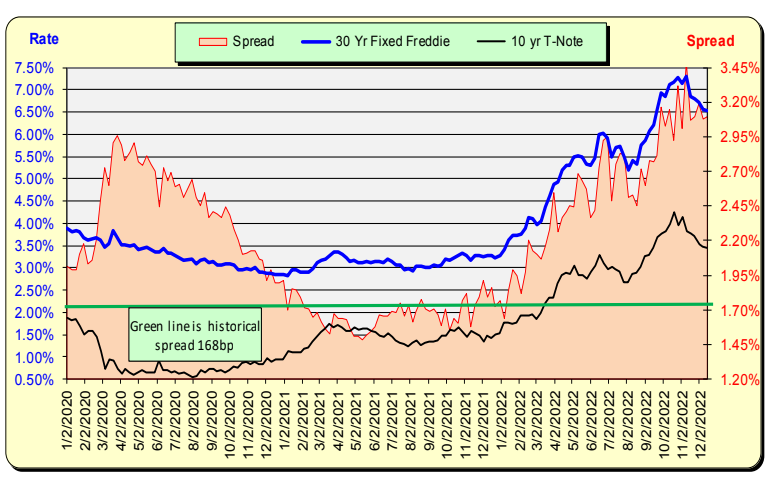

The historic spread between the 10 Year Treasury and mortgage rates is 168pb (see green line, right axis) and currently there is an 142bp above historical norm. For this spread to return to the historical norm, either mortgage rates will decrease further or 10 Year Treasury rates will increase.

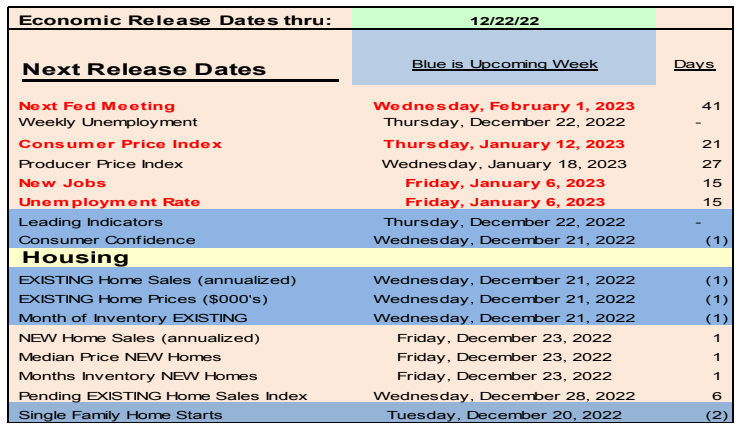

December 15 thru Dec 22, 2022—-Upcoming Week’s Data that Could Impact Treasury and Mortgage Rates.

• Monthly data updates in blue

• Weekly data on Unemployment Claims–Wednesday and Mortgage rates—Thursday

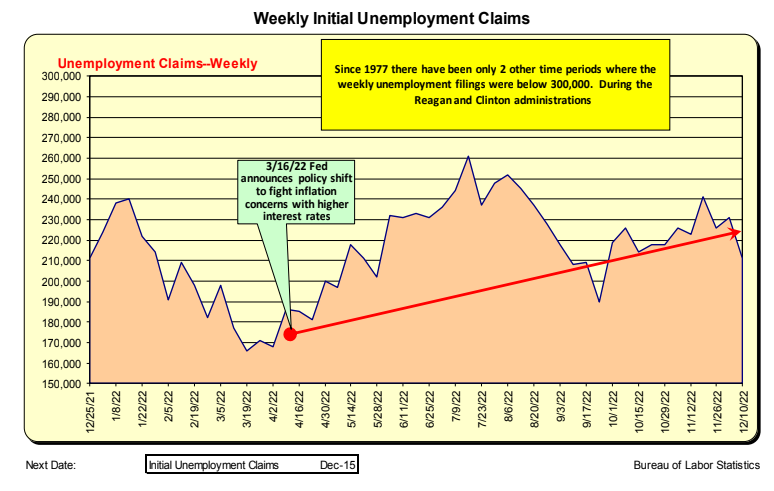

Weekly Initial Unemployment Claims

WEEKLY: Unemployment claims are available each WEDNESDAY. They have been increasing since the Fed announced their intention to increase interest rates to address inflation concerns. As the weekly claim filings increase, it will eventually slow the growth of the MONTHLY Net New Jobs total.

Bill Knudson, Research Analyst LANDCO ARESC