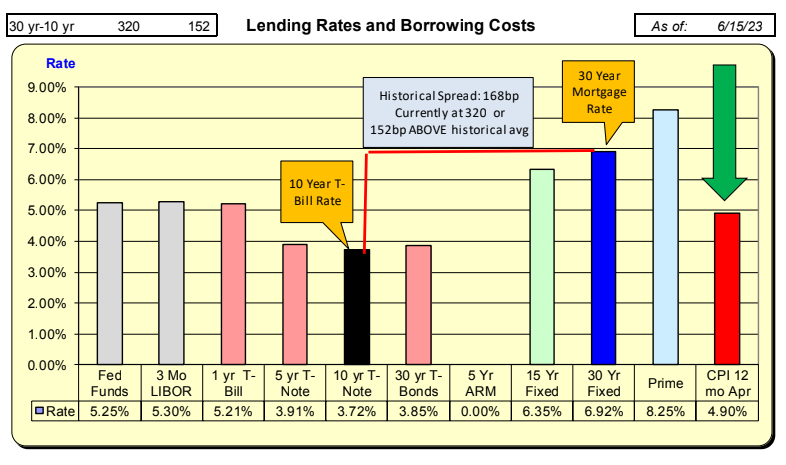

For the week ending 6.15.23 Mortgage rates decreased 2bp to 6.92%. Since the middle of March, mortgage rates had been in a tight range between 6.50% to 6.65%. SVB bank went under March 10. For a $100,000 loan the monthly payment decreased $2 to $660/mo or $0.04/day.

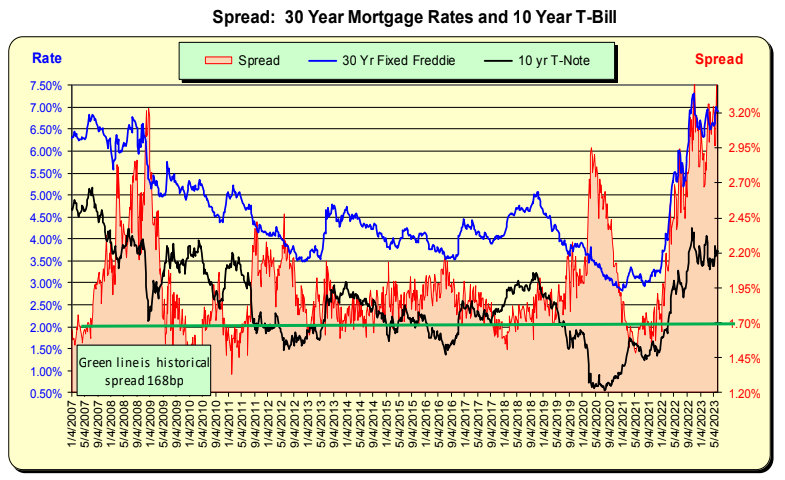

Mortgage rates decreased 2bp and 10 Year Treasury rates decreased 1bp for the week ended 6/15/23. The net difference resulted in a decrease of 1bp in the spread to 320bp. With the historical spread being 168, there now exists a “safety cushion” of 152bp above the historical spread.

The historic spread between the 10 Year Treasury and mortgage rates is 168pb (see green line, right axis) and currently, there is a 152bp above the historical norm. For this spread to return to the historical norm, either mortgage rates will decrease or the 10 Year Treasury rates will increase.

Bill Knudson, Research Analyst LANDCO ARESC